Don’t let Apple’s squeaky-clean packaging fool you: The company isn’t afraid to mix it up.

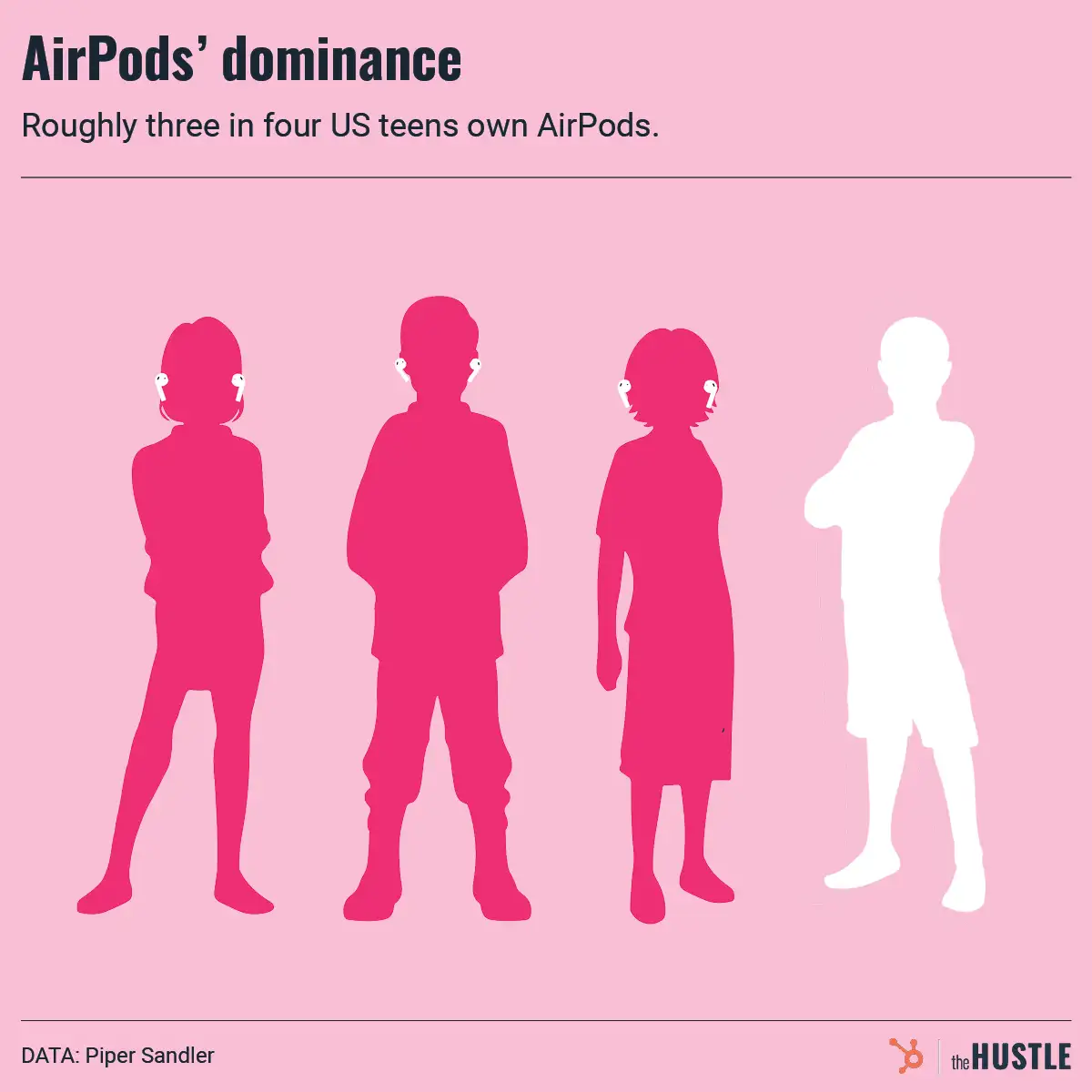

With 1B+ installed iPhones, Apple is the gateway to the mobile world’s most valuable customers.

And the $2T tech giant is about to roll out a new user-tracking policy that could cost Google and Facebook ~$25B in ad revenue.

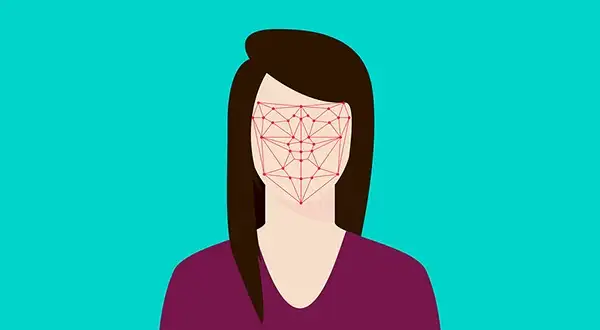

What is changing?

As reported by The Wall Street Journal, Apple is updating its iPhone software and letting users decide if they want to be tracked for targeted ads.

The current default allows such tracking. But in weeks to come, there will be a pop-up that requires an opt-in to be tracked.

The expectation is for many users to opt-out, which will severely disrupt the $400B digital advertising industry…one that depends heavily on data tracking.

How are companies coping?

The WSJ breaks down how various industry players are preparing for the change:

- Facebook initially protested the change but recently stated that it could be stronger in the long run as it improves its in-app retail options (separately, FB will have its own phone pop-ups explaining the benefits of user tracking for targeted ads).

- Google will comply with Apple’s changes but warns that metrics looking at how ads drive app usage and sales will be less useful (it does plan to create new performance-tracking tools not dependent on individual user data).

- Big Chinese tech firms (Tencent, ByteDance) tested a workaround tracking method that Apple says it would reject from its app store.

Smaller apps may adapt by switching from free to paid.

Meanwhile, the WSJ says the tracking changes could really hurt gaming apps, which depends on targeting to find big-spending users.

Apple’s privacy angle is a winning hand…

… with consumers. However, other tech players in the ecosystem see it as Apple flexing its monopolistic might.

These changes come as Epic Games and Facebook wage corporate war against Apple’s ironclad control of the Apple App Store.

Further, a number of US states have (so far unsuccessfully) introduced legislation to change the App Store policies around installations and revenue take.

Right now, Apple’s beautiful aesthetic won’t stop people from saying it has dirty tactics.