Extended stay hotels are a surefire investment

Extended stay hotels aren’t as glamorous as luxury chateaus, but they are a good investment.

Published:

Updated:

Related Articles

-

-

Adam Neumann’s apartment startup is here

-

Private jets have a pilot problem

-

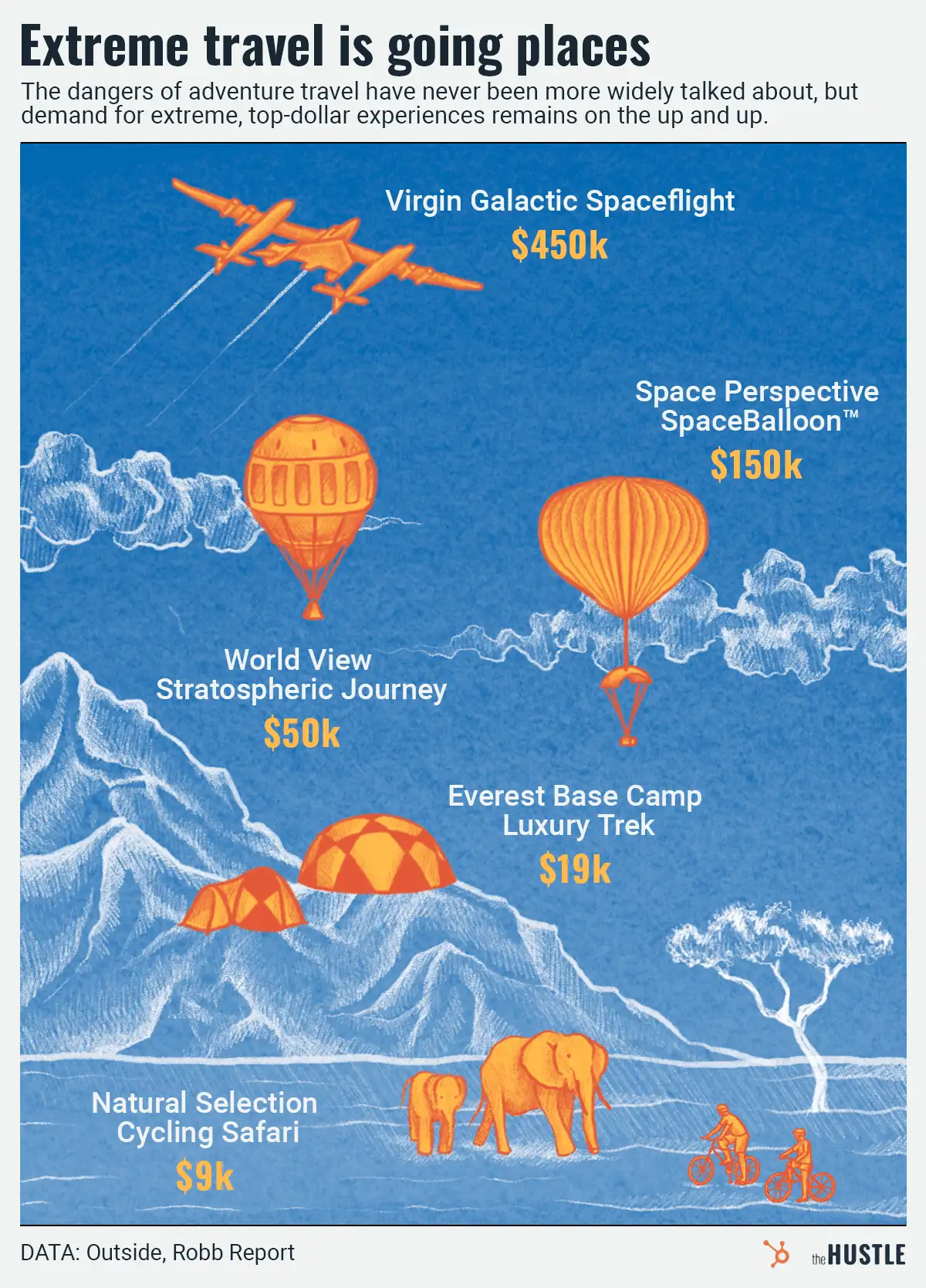

Months after the sub tragedy, extreme tourism is… more popular than ever?

-

What the heck is going on with Airbnb in NYC?

-

The next big travel destination might be the airport itself

-

Why tech workers are sleeping in expensive boxes

-

Ready for a trip? Psychedelic retreats are going mainstream

-

Branded residences aren’t just for hotels anymore

-

Check into the future: Hotels are getting an upgrade