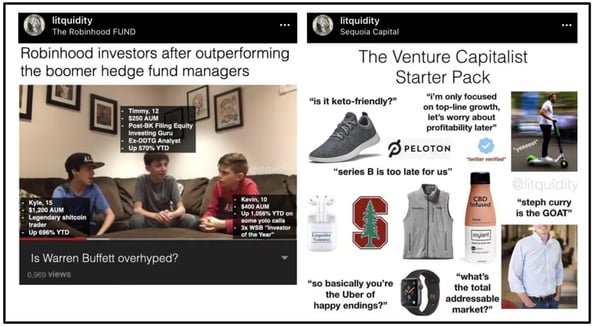

Some legendary Litquidity memes (Source: Litquidity)

Epitomized by the rise and fall of GameStop, Reddit-fuelled meme stocks are having a serious moment.

At the height of the $GME madness, Litquidity — one of the most popular finance-related meme accounts (500k+ Instagram followers) — released the Exec Sum newsletter to help people make sense of the market madness.

The Hustle recently spoke with Litquidity to find out more:

Litquidity is run by an anonymous Wall Street banker

The Instagram account launched in March 2017 and quickly picked up a following among the finance crowd.

“My close friends know I run the account,” Litquidity tells us. “But my co-workers have no idea, and they’ll often send me my own memes.”

The memes really took off during quarantine

And, with the Litquidity brand blowing up, he saw there was a big appetite for market education and decided to launch the newsletter.

It already has sponsors and will serve as a stream of revenue to complement a (hilarious) merchandise and advertising business.

What’s after GameStop?

Litquidity thinks these 3 ticker have “meme stock” potential (obviously, not investment advice):

- Virgin Galactic ($SPCE): “The ‘to the moon stuff’ meme works perfect with Virgin.”

- Blackberry ($BB): “This is already a meme stock with the Reddit crowd, but there’s actually an interesting cybersecurity business supporting the story.”

- DraftKings ($DKNG): “The whole sports betting industry is a meme factory in itself. There is also real momentum in the industry with so many states moving to legalize gambling to fill budget shortfalls exacerbated by COVID-19.”