If anyone reading this owned an NBA team over the past 2 decades, we tip our hat to you.

The average price of an NBA franchise jumped by +1,057% between 2002 and 2021, per CNBC.

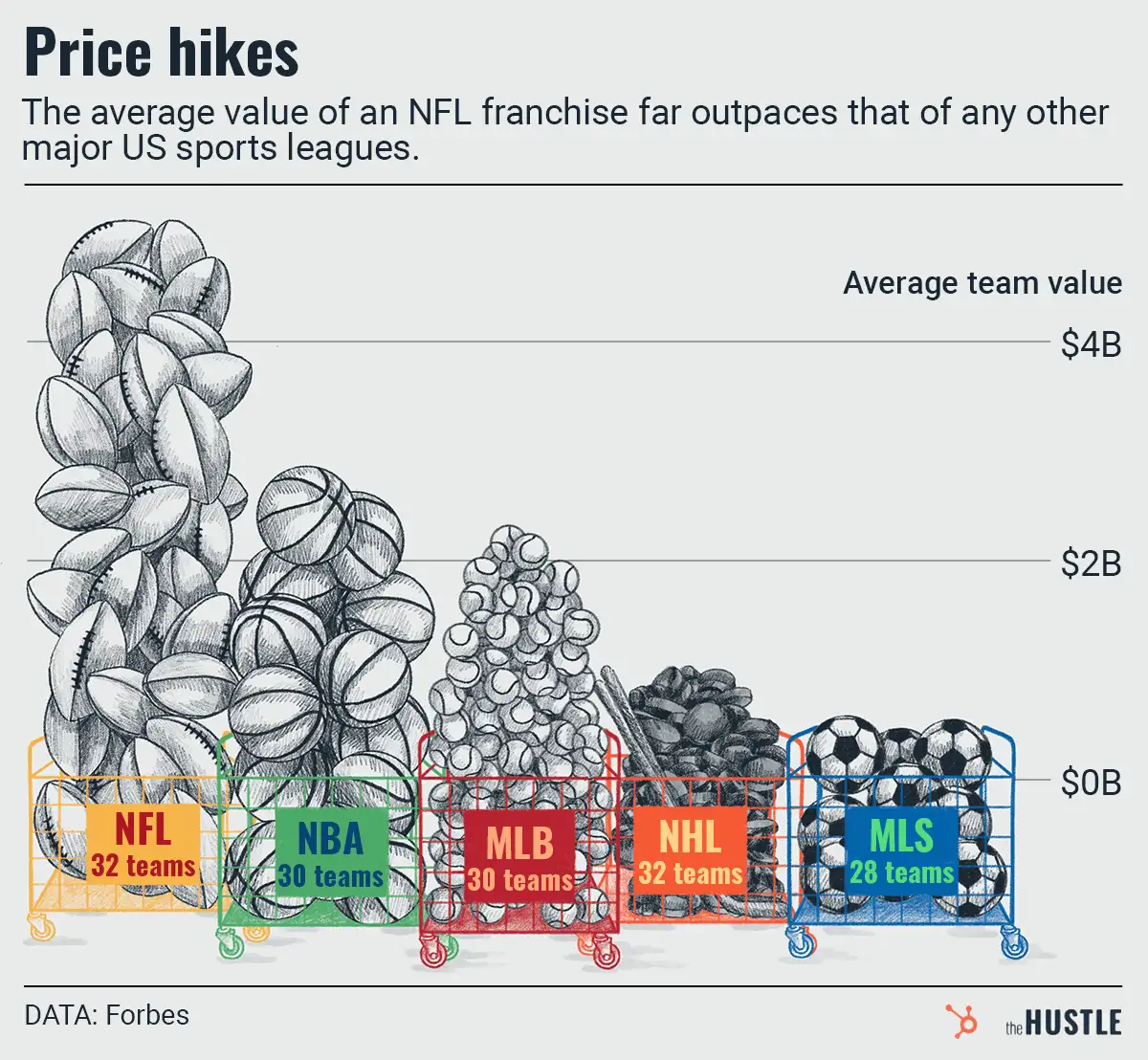

The return compares favorably to other sports leagues — MLB (+669%) and NHL (+467%) — as well as the S&P 500 (+458%) over that span.

Private equity (PE) firms have taken notice…

… and established funds to purchase stakes in professional sports teams.

Three NBA teams — Golden State Warriors, San Antonio Spurs, and Sacramento Kings — sold minority shares to PE firms in 2021 (a single PE fund is capped to 20% max ownership).

Rising team valuations are being driven in large part by lucrative media rights. NBA owners can also use a “roster depreciation allowance” to defer tax payments on sports-related revenue.

Why is the NBA so hot?

While sports like golf and tennis are considered “global,” the NBA has significant international expansion plans, per CNBC:

- Africa: Last May, the league launched a Basketball Africa League to develop talent and build arenas. It’s valued at $1B.

- China: In 2019, the Chinese government boycotted the NBA over comments from an NBA GM regarding Hong Kong. But games are still being broadcast, and NBA China is worth $5B.

- India: The NBA is slowly expanding into the country of 1B+ citizens.

Back in America, the WNBA — a women’s league owned by the NBA — just raised money for the 1st time ever at a $1B valuation.

With all the money rolling around, this Vancouver-based writer has one question: When are we getting an NBA team again?