Everyone thought Toast was toast. Now it’s planning an IPO.

When COVID hit the restaurant industry, Toast was in trouble. But things have turned around and now it’s prepping an IPO.

Published:

Updated:

Related Articles

-

-

Why, though? A beverage you can chew

-

The $5m lawsuit over a missing jack-o’-lantern face

-

Hungover? Burger King’s facial recognition tech has a deal for you

-

A latte to think about: Coffee is coming home in 2024

-

Food brands are cooking up new offerings to pair with weight loss drugs

-

A sci-fi McDonald’s appears in Illinois

-

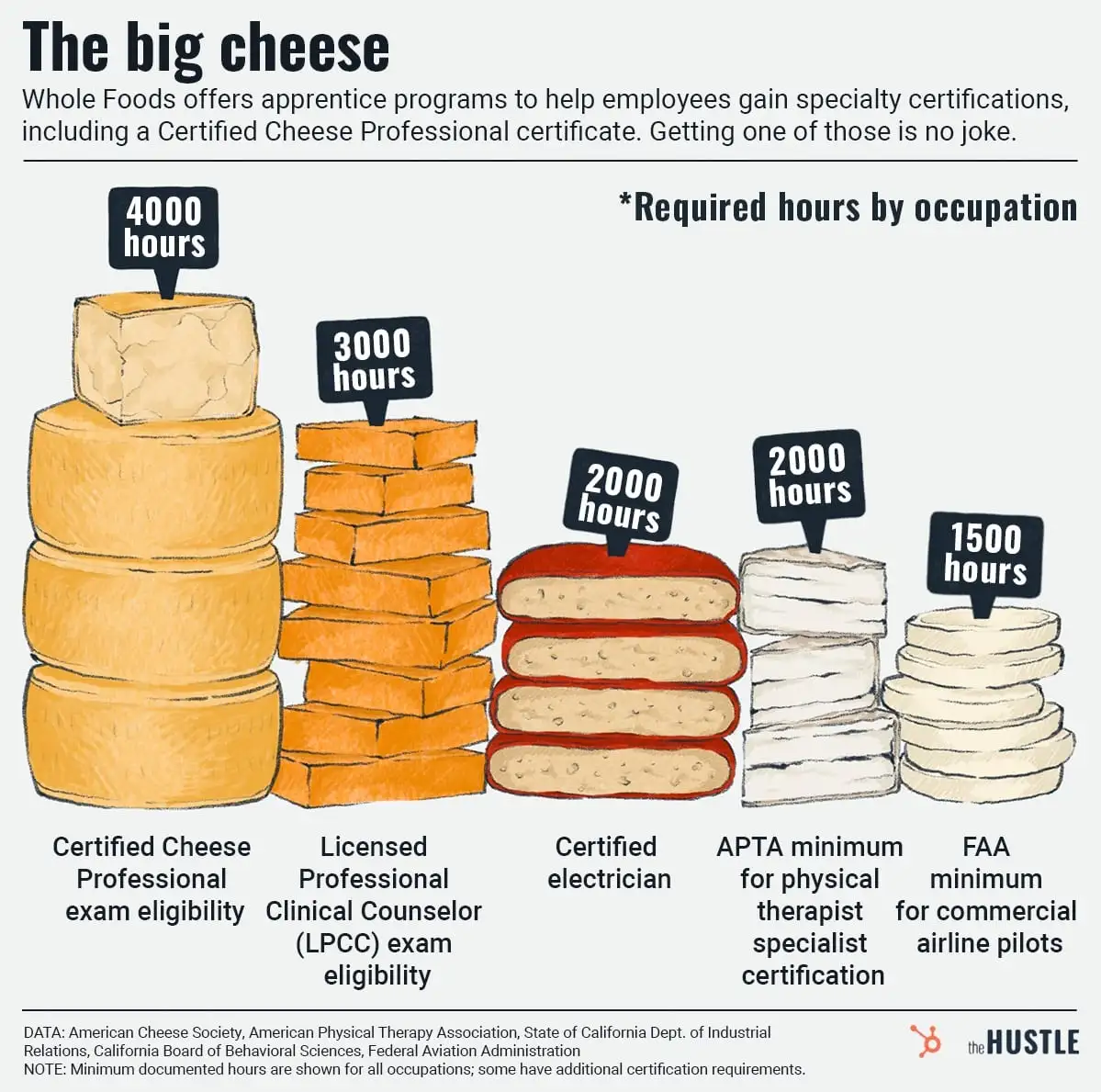

Career development could be an ace up Whole Foods’ sleeve

-

Baby food for adults was just as sad as it sounds

-

Doritos is using AI to appeal to gamers’ sensitive ears