Ever notice that when a neighborhood gets trendier and more expensive, the family-owned dessert shop gets replaced by a gourmet popsicle store that sells fancy Dilly Bars for $5 each?

The same thing is happening to America’s economy, according to The New York Times. Prepare for the gentrification of everything — or, in corporate speak: premiumization.

What is premiumization?

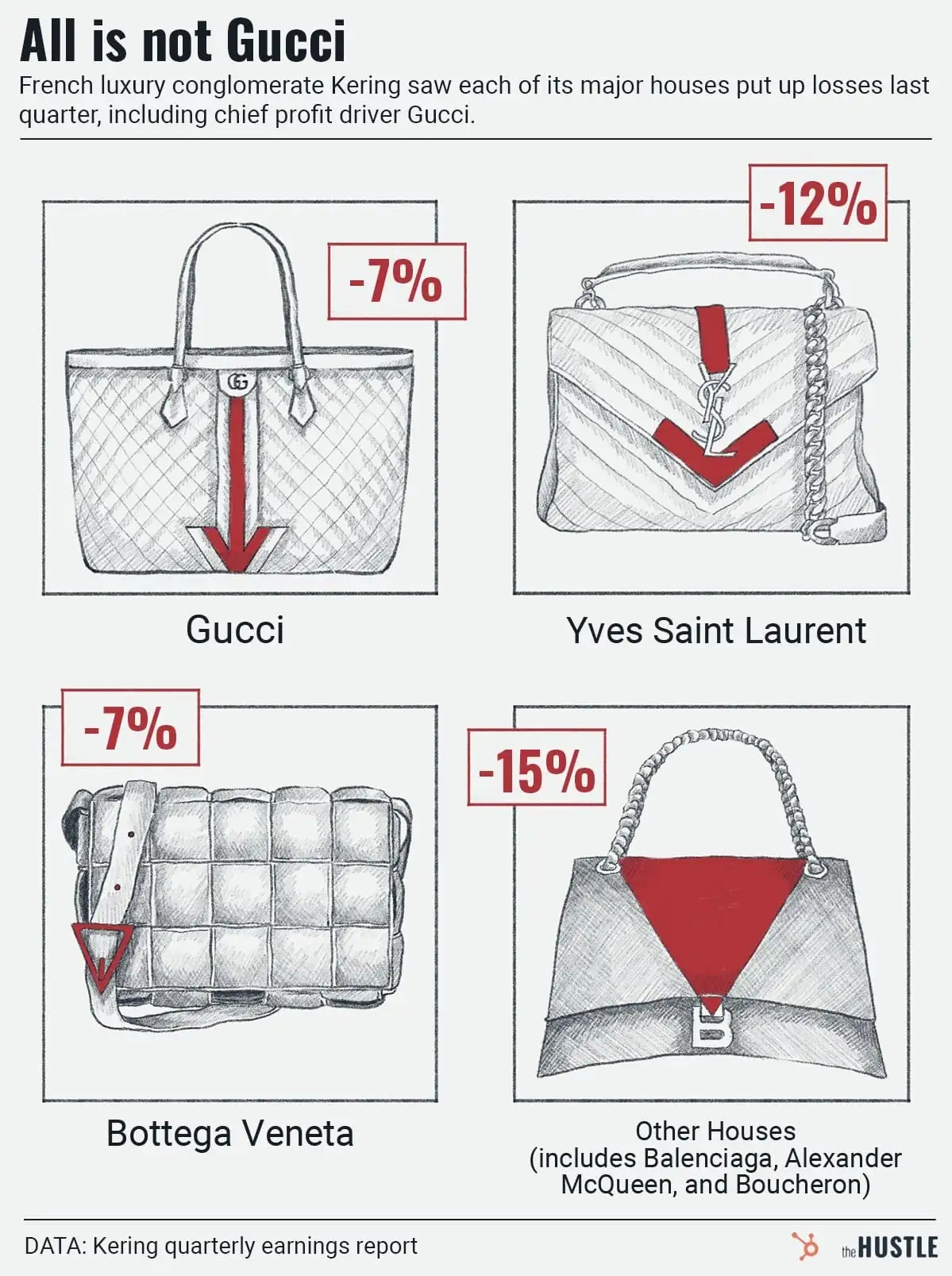

It’s when companies emphasize luxury versions of their products and sell them at elevated prices. By attracting higher-income clientele, companies believe they’ll be able to maintain or improve profits while selling fewer goods.

The trend is well under way:

- The NYT counted ~60 mentions of premiumization in recent earnings calls and investor meetings.

- Krispy Kreme plans to sell fancier donuts around holidays and other occasions.

- WD-40 rolled out a pricier version of its lubricant with a “smart straw.”

There’s an obvious downside

When brands prioritize selling premium goods to higher-income consumers, they may provide fewer products and experiences for the middle class.

- Across the US auto industry in 2017, 36 car models were available for less than $25k, comprising ~13% of new car sales.

- Last year, the number of models under $25k fell to 10, taking up 4% of new car sales.

By reducing the number of goods produced, premiumization could also keep inflation high.

Is premiumization sustainable?

In this early stage of the trend, it’s difficult to gauge the long-term effects, or even a brand’s likelihood of success.

Last year, for instance, Six Flags offered fewer discounts while jacking up prices. Despite a 22% increase in per-guest spending, its profits fell ~10%.

Then again, have you ever heard of Popbar?