Bezos’ decadelong, $10B NFL bet is part of a larger streaming playbook for Amazon

Amazon just signed a massive contract to stream Thursday Night Football. Here’s why that matters.

Published:

Updated:

Related Articles

-

-

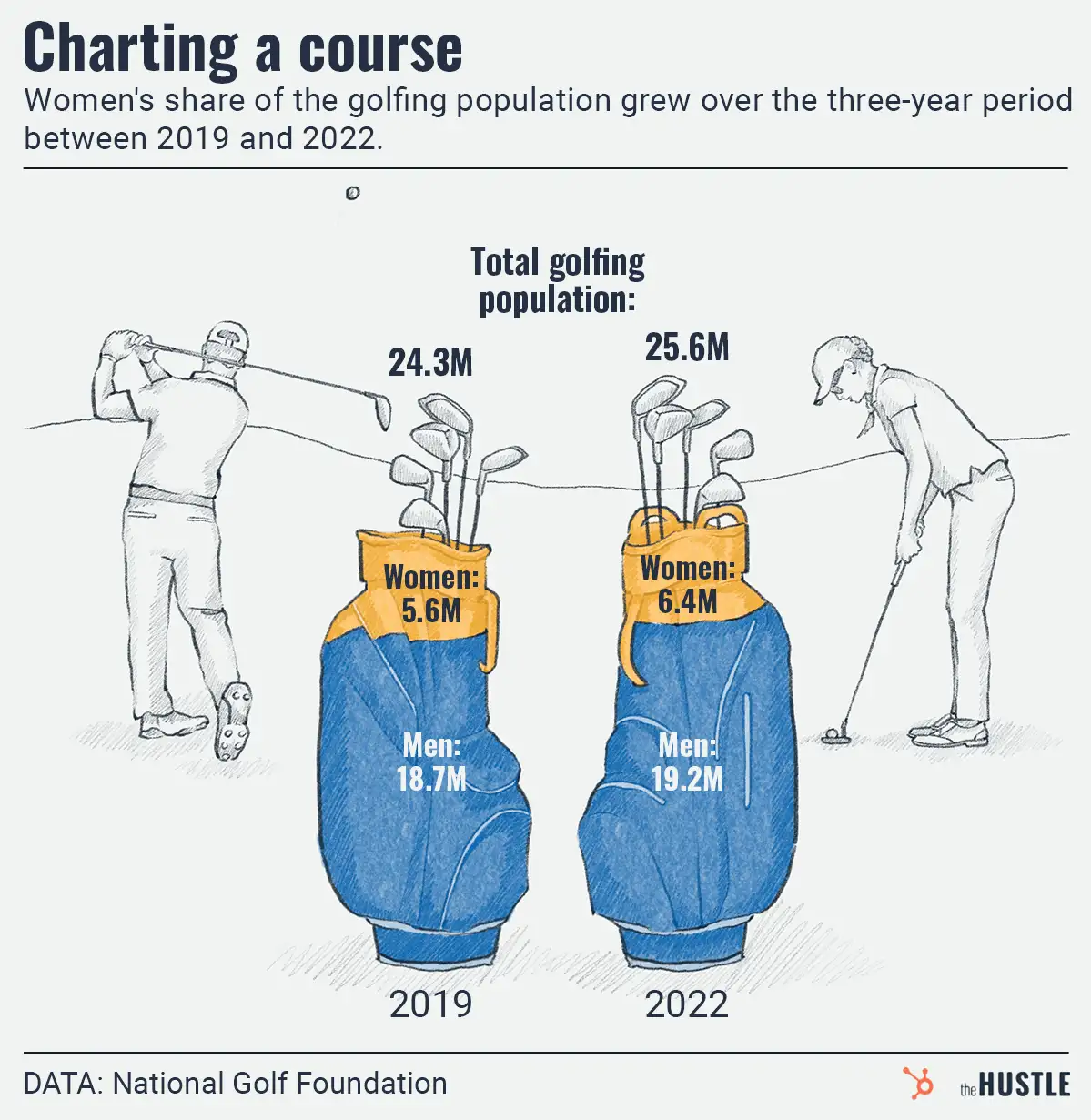

The golf industry takes a big swing on women players

-

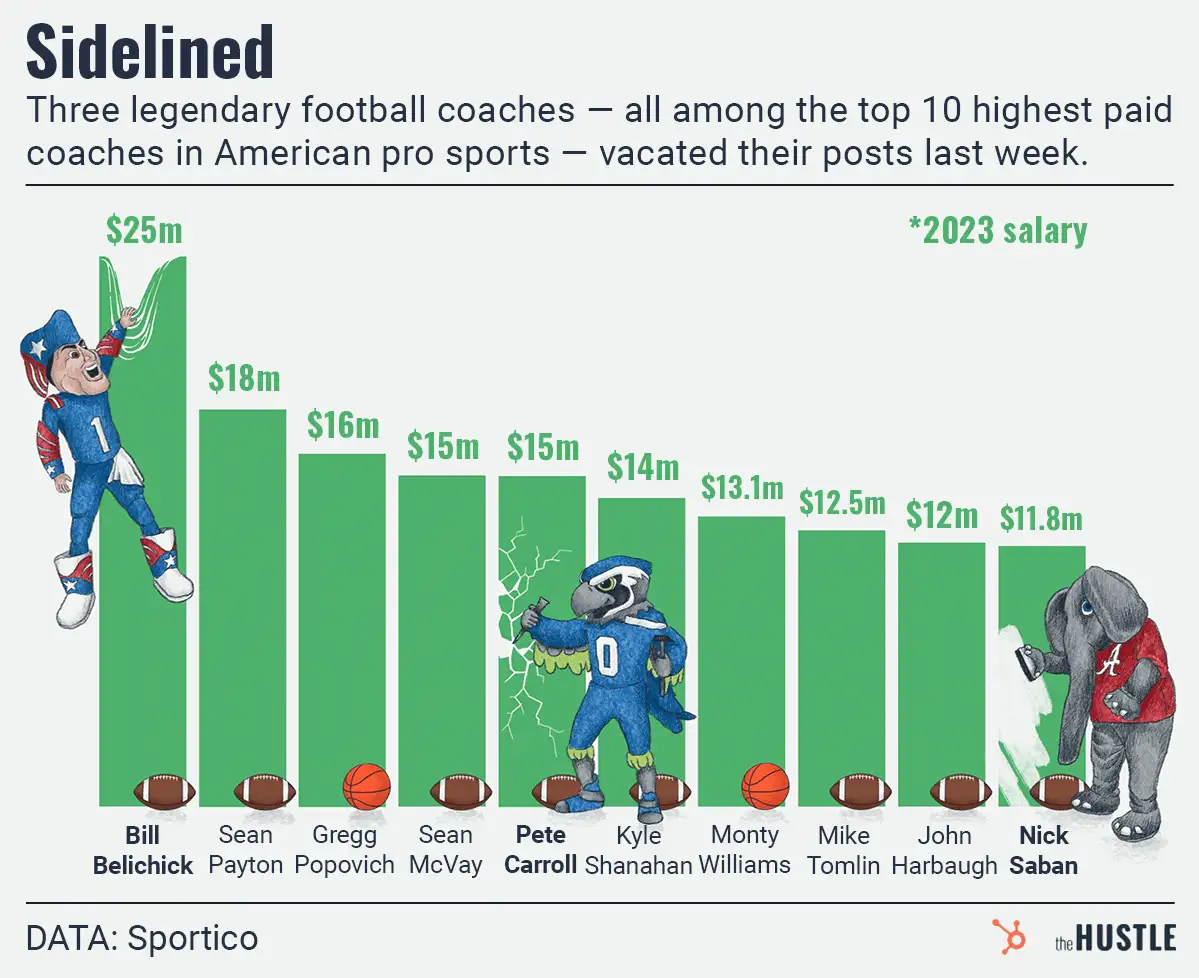

Win or lose, football coaches keep cashing in

-

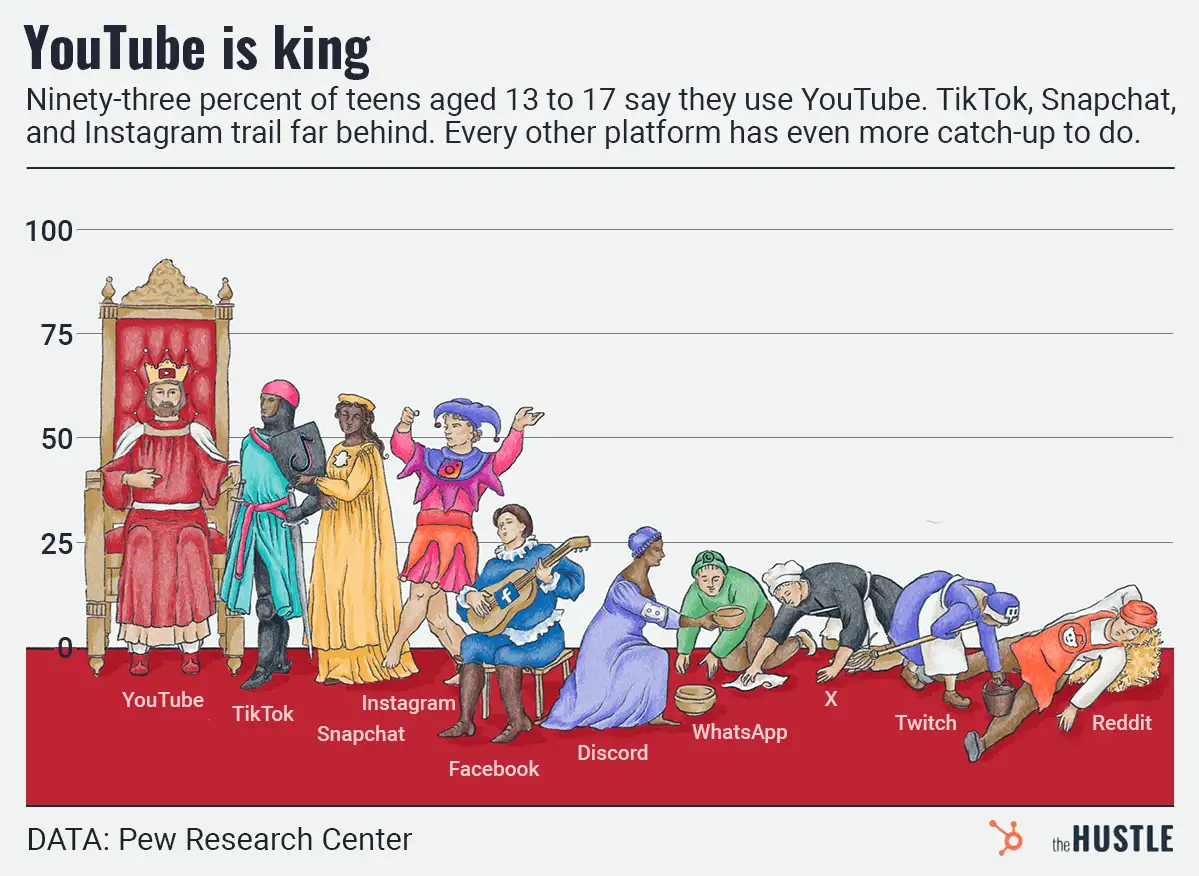

Teenagers are obsessed with YouTube — and so is everyone else

-

Disney will buy Comcast out of Hulu as streaming looks more like regular old TV

-

Indoor golf clubs bring the sport — and the schmoozing — inside

-

As the NBA returns, its boardroom is just as entertaining as the on-court product

-

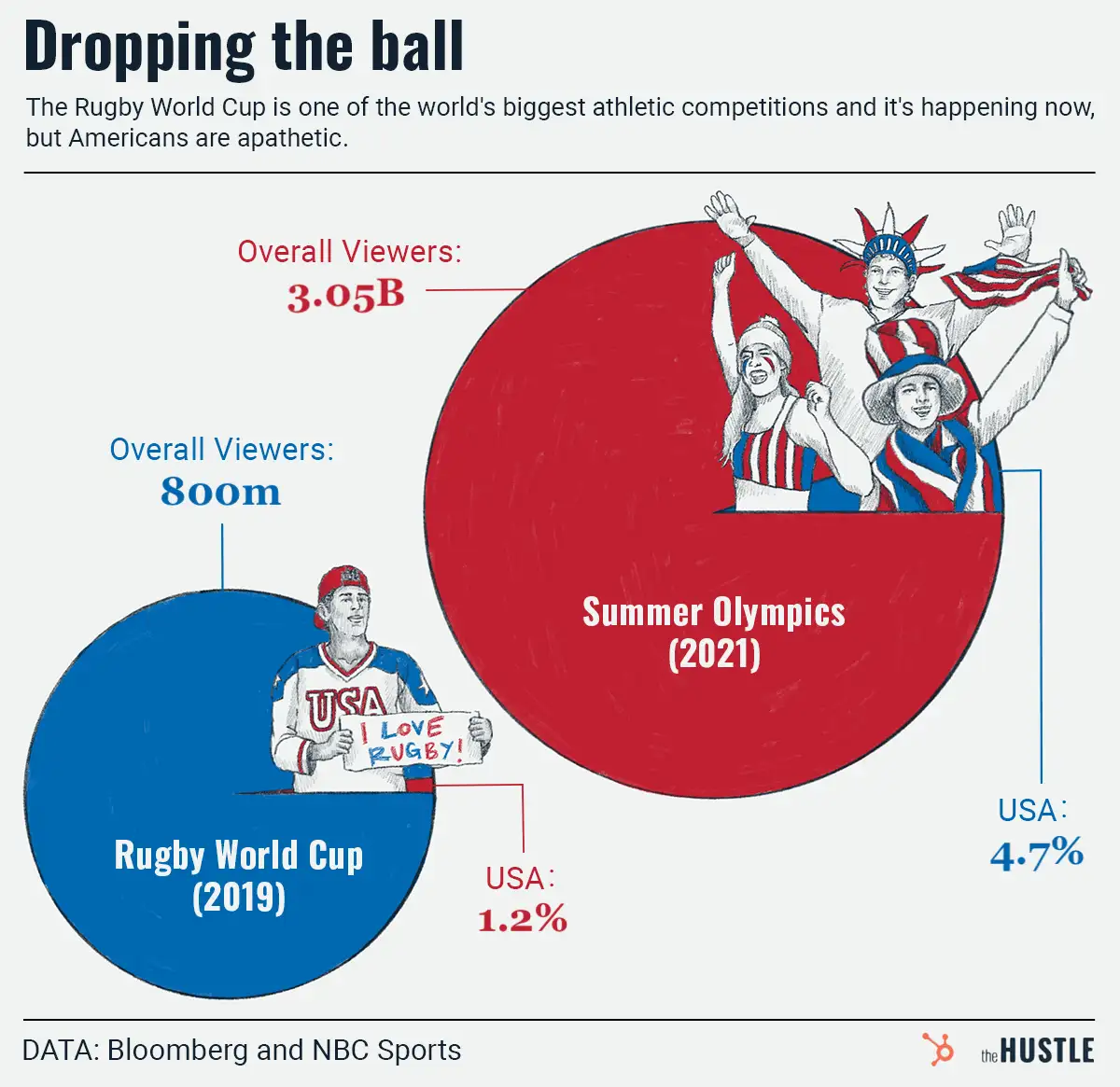

‘The Rugby World Cup is on!’ says basically nobody in America

-

No, we do not want Amazon Music Unlimited

-

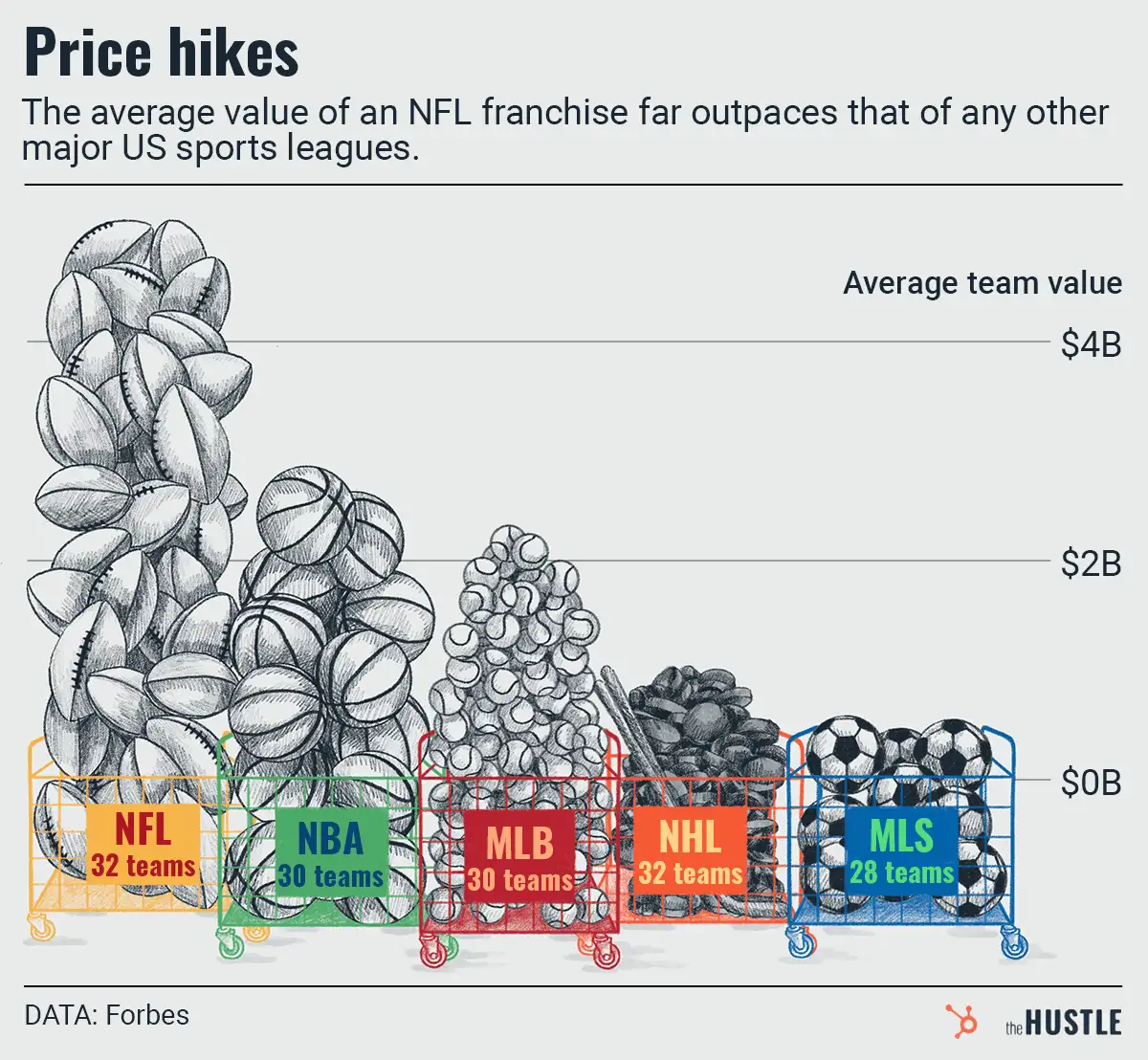

The NFL is back, bigger than ever, and seriously, wow, it’s huge