Why Instacart and DoorDash are launching credit cards

Instacart and DoorDash are exploring branded credit cards. What’s in it for them and the banks?

Published:

Updated:

Related Articles

-

-

Brrring back the deals: Will the IPO and M&A markets warm up again?

-

Domino’s ups its delivery game

-

The Dow index got a makeover. What does it mean?

-

DoorDash wants to deliver everything

-

Not those credit default swaps again…

-

Are we caught in a ‘bear market trap’?

-

Digits: Crypto ads, Kilimanjaro, and more

-

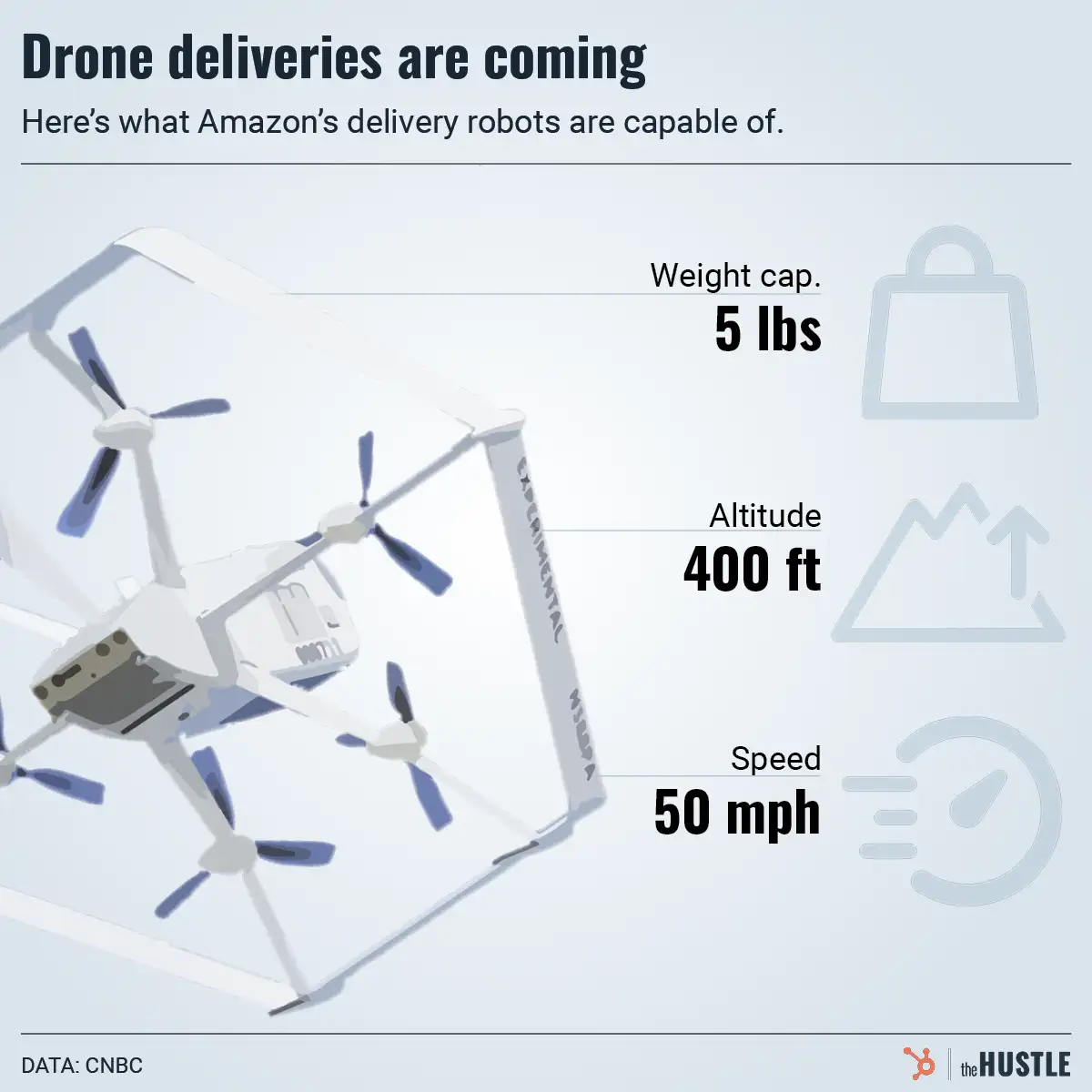

Amazon is rolling out the delivery drones

-

Where the heck is all our change?