A company you’ve probably never heard of made IPO history this week.

UiPath, an automation company, made its market debut and notched the 3rd largest US software IPO in history, behind only Snowflake (No. 1) and Qualtrics (No. 2).

By market’s close on Wednesday, the company’s market cap had settled at a hefty $35.8B — which leaves only one question…

WTF is UiPath?

The company was founded in 2005 by Romanian entrepreneurs Daniel Dines and Marius Tîrcă.

Originally called DeskOver, UiPath was based in Romania but later rebranded and moved its HQ to the US in 2017. Today, about ¼ of its ~3k employees are still based in Romania.

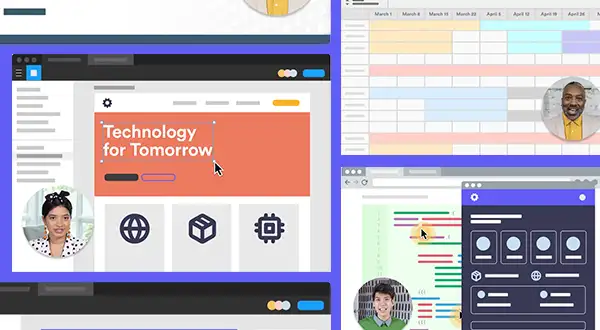

UiPath helps enterprises automate tedious manual tasks done on computers, something they refer to as RPA or…

… Robotic Process Automation

They call their automations “software robots” that do robot-like work for humans — tasks like filling forms, moving files, inputting data, and scraping documents.

The real gem is that creating these software robots requires no coding, and they can interface with existing software using AI-fueled “computer vision” — think robots actually seeing what they click.

This all rolls up into a serious business:

- $580m in annual recurring revenue (+65% YoY)

- Margins up to 89% (the highest in software)

- 7,968 customers (+32% YoY)

And according to UiPath, the market for robot automation is expected to reach $30B by 2024, up from $17B in 2020.

It could be a Hot Robot Summer…

…thanks to UiPath’s 145% dollar retention, meaning its customers are staying and increasing budgets by 45% into the next year — a strategy insiders call “land and expand.”

But it’s not all robots and sunshine.

UiPath will have to weather a public market that’s souring for high-flying tech companies. In 2021, a cloud index of 58 cloud companies has dropped 7%; meanwhile, the Dow is up 10%.

Hot Dow Summer, anyone?