As home prices and mortgage rates continue to climb, new homeowners are embracing a skill learned by many in kindergarten — sharing.

More Americans are renting out rooms in their own homes to fund mortgage expenses and recoup cash, according to Bloomberg.

Homesharing…

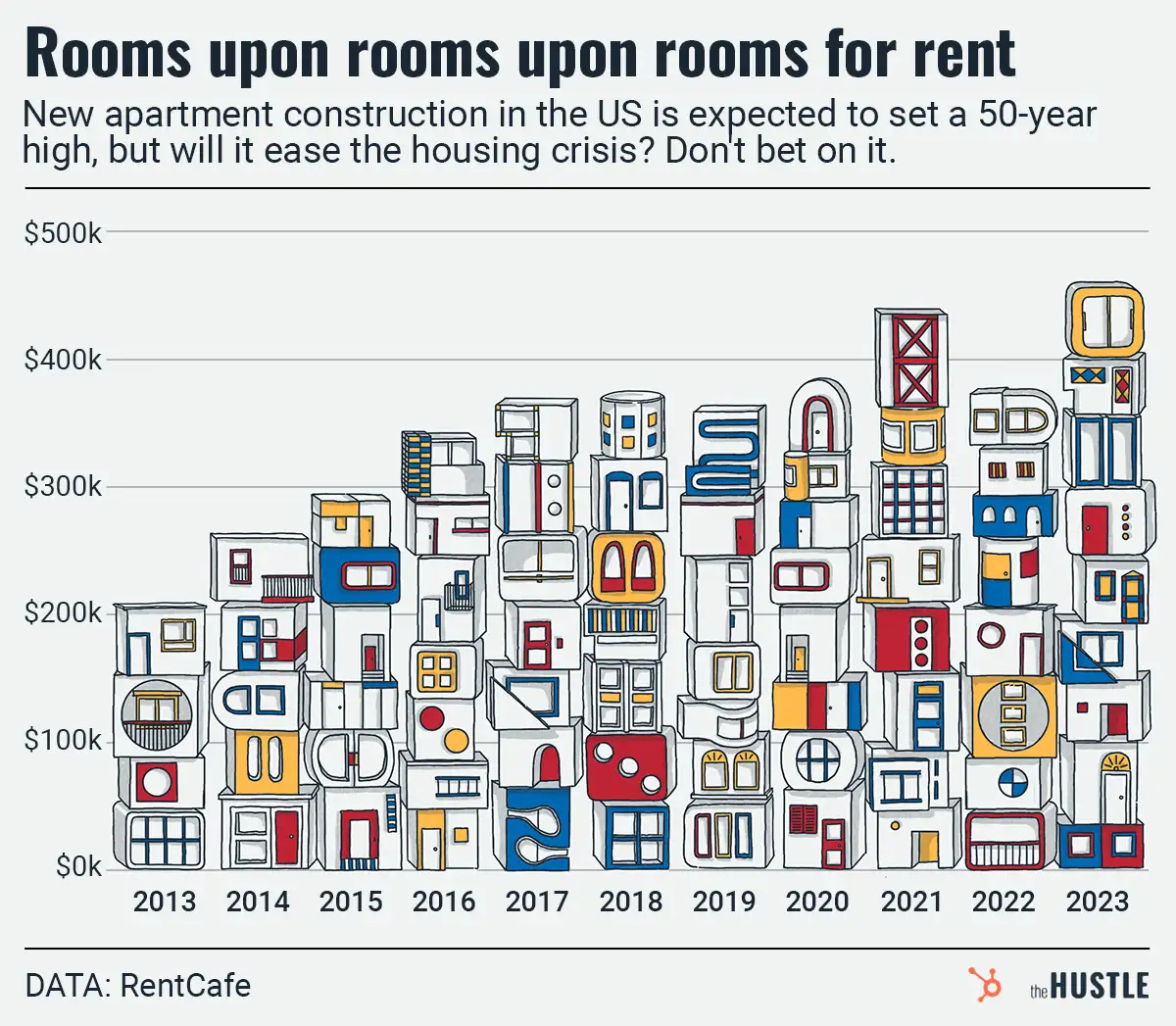

… is a way for younger Americans to break into a housing market that’s experiencing a wee bit of a supply issue. According to Freddie Mac, the US is short ~3.8m housing units, which has greatly impacted prices.

In 2021:

- Home prices rose by 19%, and are expected to rise ~6% this year

- 80% of metro areas saw home prices increase 10% or more

As costs rise, the number of buyers who would consider renting out a portion of their home has jumped from 24% in 2019 to 31% in 2021.

But it differs by generation

While 67% of millennials are open to sharing their homes in exchange for cash, that number drops to 57% for Gen Z and 34% for baby boomers.

This is partly out of necessity:

- Millennials have 20% less wealth than their parents did at the same age.

- The average price of a home today is ~$328k, compared to the ~$216k boomers spent in 1989, adjusted for inflation.

Not everyone is in on sharing

Shawnee, Kansas — a suburb of Kansas City — essentially banned co-living last month, making it illegal to lease to four or more unrelated people.

The ordinance was created to avoid situations where real estate investors would purchase a property and reconfigure the rooms to allow for more renters. But critics say the ban is both classist and racist, making it harder for the city’s most vulnerable residents to find affordable housing.

Perhaps Shawnee City Council needs to be reminded of a classic kindergarten axiom: sharing is caring.