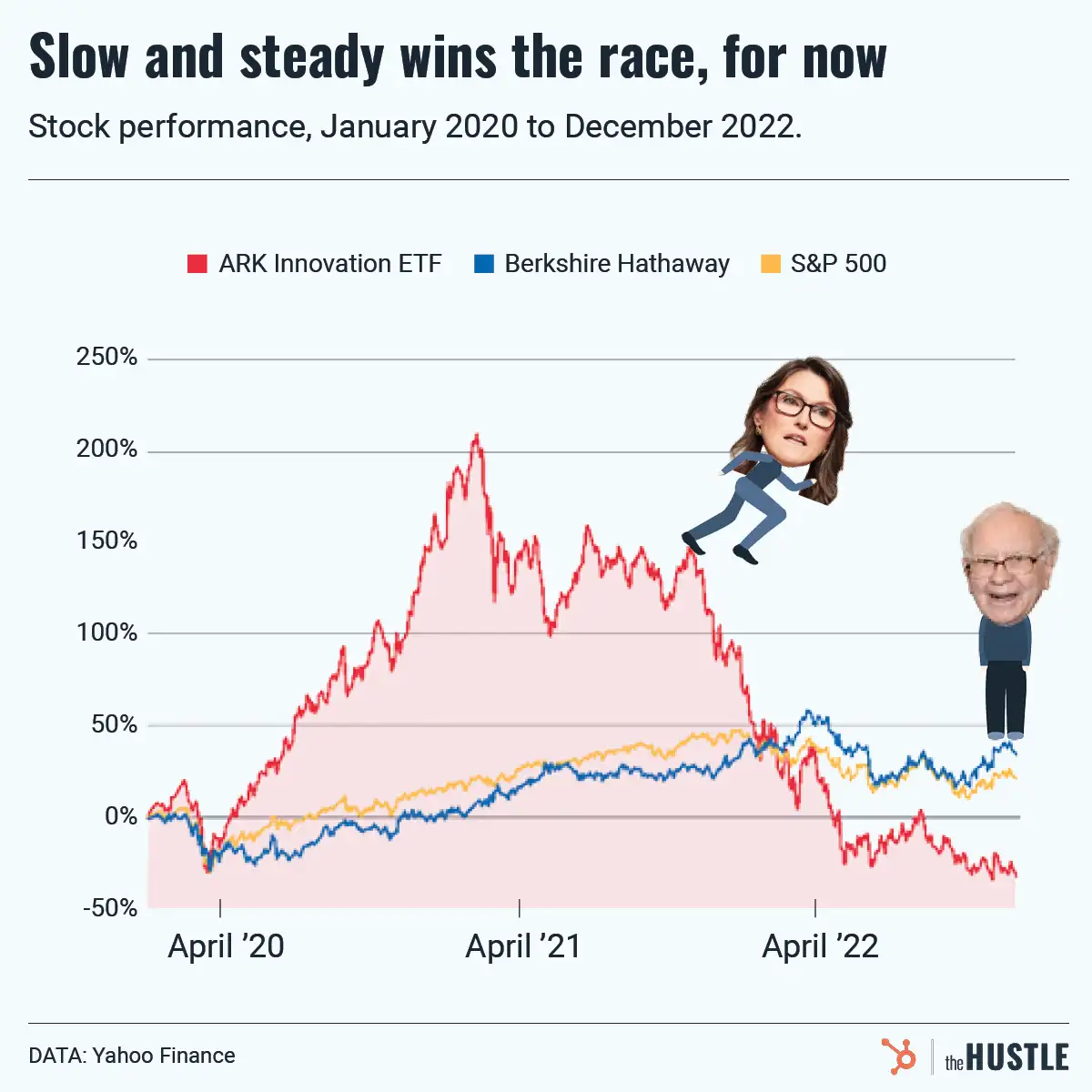

Here’s something that’s important but easy to ignore about money: A lot of financial debates are just people with different time horizons talking over each other.

This is especially true when the economy is in upheaval, like it is now.

It’s critical to remember…

… what you want might not be what I want. Your job’s different from mine. You have different life experiences, different risk tolerances, work-life balance targets, career incentives, on and on.

So of course we don’t always agree on what’s the best thing to do with our money. There’s no world in which we should.

Even if we own the same assets…

… we may have different time horizons. If you are exposed to the opinions of people who own the same investments as you but have different goals, you can be misled and tempted into bad decisions, even if what the other person is saying is right for them.

When different goals exist, reasonable people can and will disagree. Focusing your attention on information that aligns with your own goals is key, but harder than it sounds.

So here’s my advice

Define your own game, then play it and only it.

Few people do. Maybe they have a vague idea of their game, but they haven’t clearly defined it.

And when they don’t know what game they’re playing, they’re at risk of taking cues and advice from people playing different games, which can lead to risks they didn’t intend and outcomes they didn’t imagine.