China’s Uber, DiDi, files its US IPO

Didi owns 90% of China’s ride-share market and could go public at $70B+.

Published:

Updated:

Related Articles

-

-

Federal traffic control updates are getting the green light

-

Electrified roads could be the tipping point for EV adoption

-

Saudi Arabia will host the 2030 World Expo (and incidentally, World Expos are still a thing)

-

A ‘finders keepers’ fight except it’s over $20B in sunken treasure

-

It’s not a great time to be GM’s Cruise

-

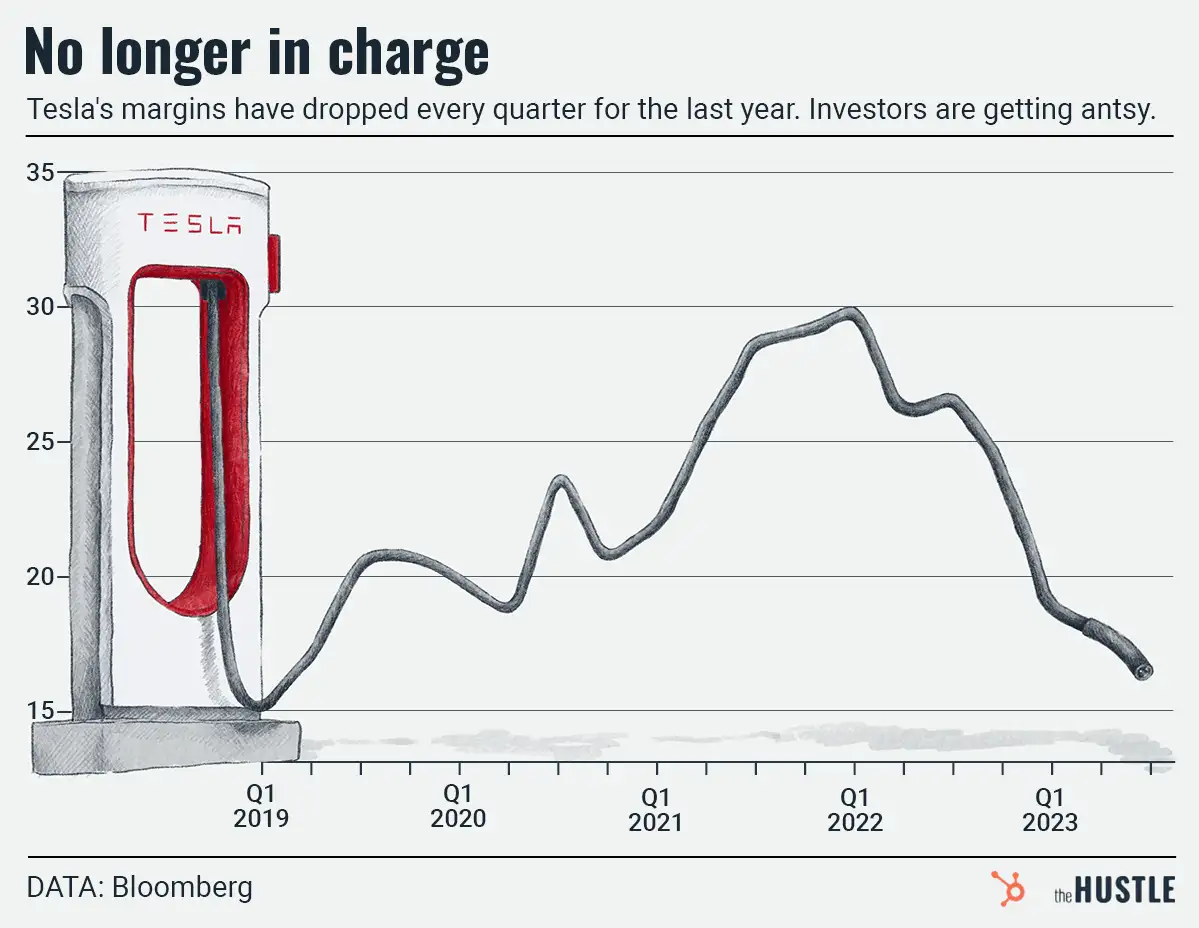

Tesla is struggling, and the outlook for improvement isn’t thrilling anyone either

-

The world was already horrifying — technology is making it more so

-

If an auto industry exec tells you their job doesn’t suck, don’t believe them

-

Just because you can easily fly this new helicopter doesn’t mean you should