This marketplace lets you snap up stock in high-end collectibles

Investors are snapping up fractional shares on luxury items like cars and high-end handbags.

Published:

Updated:

Related Articles

-

-

It’s all about the luxury goods, baby

-

Luxury brands seek a miracle inside their (ostentatious, overpriced) bag of tricks

-

Cold plunges are going corporate

-

Soho House brings exclusivity to the masses

-

On the rocks, please: Luxury ice is in

-

Brrring back the deals: Will the IPO and M&A markets warm up again?

-

The Dow index got a makeover. What does it mean?

-

The ice bath business is on fire

-

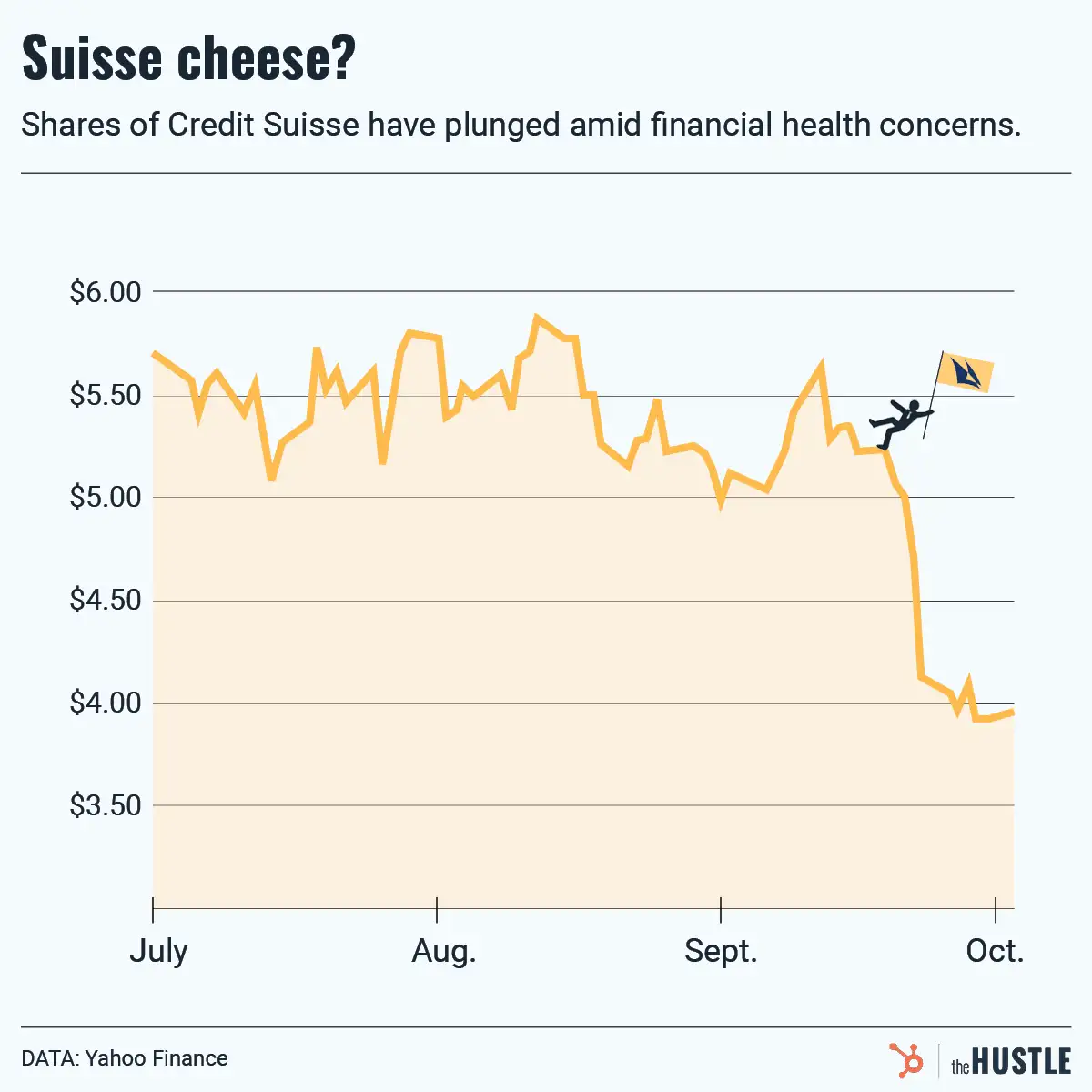

Not those credit default swaps again…