Can lipstick and underwear predict economic activity?

The logic behind several economic indicators aren’t holding up.

Published:

Updated:

Related Articles

-

-

Brrring back the deals: Will the IPO and M&A markets warm up again?

-

The Dow index got a makeover. What does it mean?

-

Could the Adderall shortage impact the workplace?

-

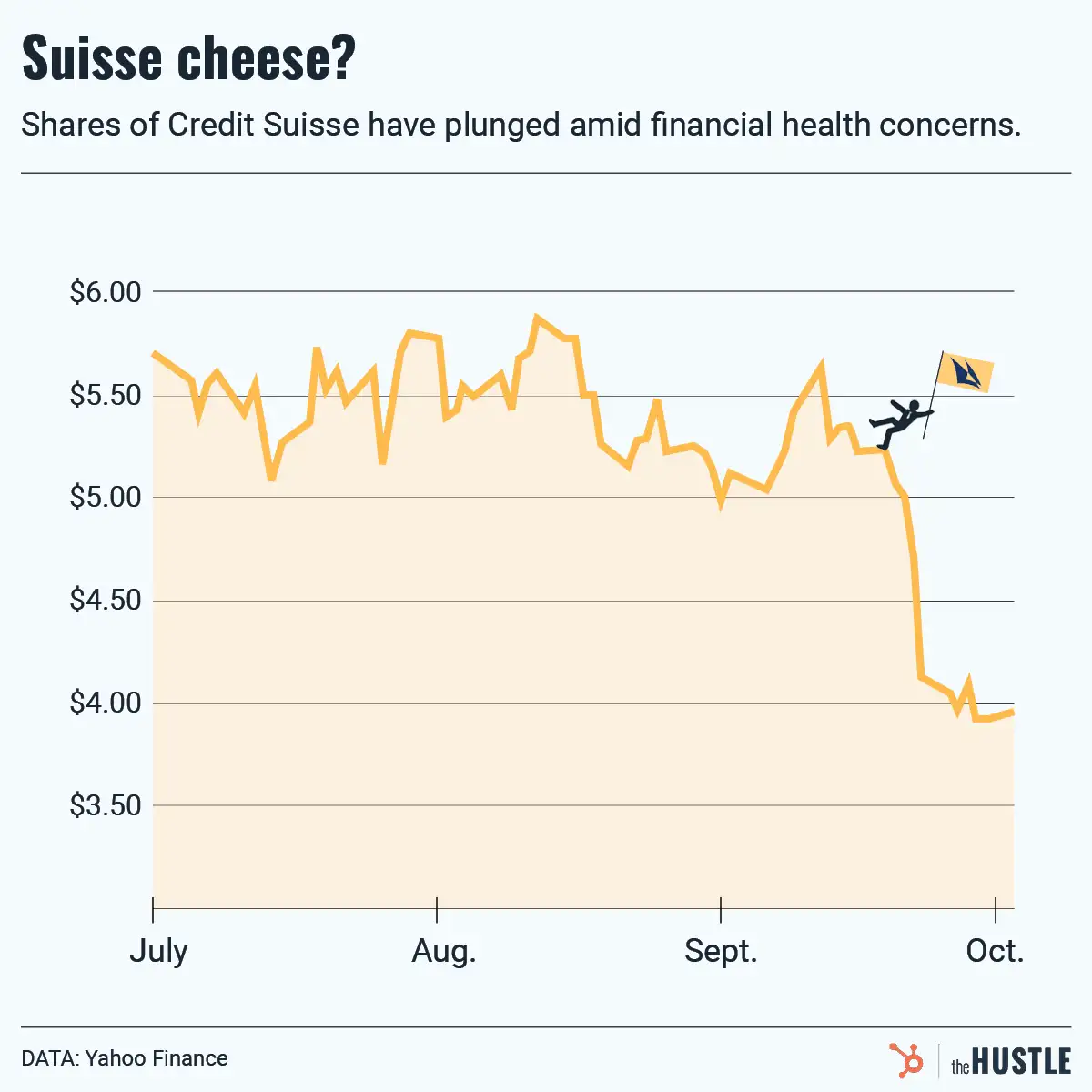

Not those credit default swaps again…

-

Are we caught in a ‘bear market trap’?

-

Digits: Crypto ads, Kilimanjaro, and more

-

Where the heck is all our change?

-

Bear and bull markets, explained

-

Have we reached peak tipping?