The latest fintech disruptor: The US government

FedNow me!

Published:

Updated:

Related Articles

-

-

Why you usually can’t buy weed with a credit card… for now

-

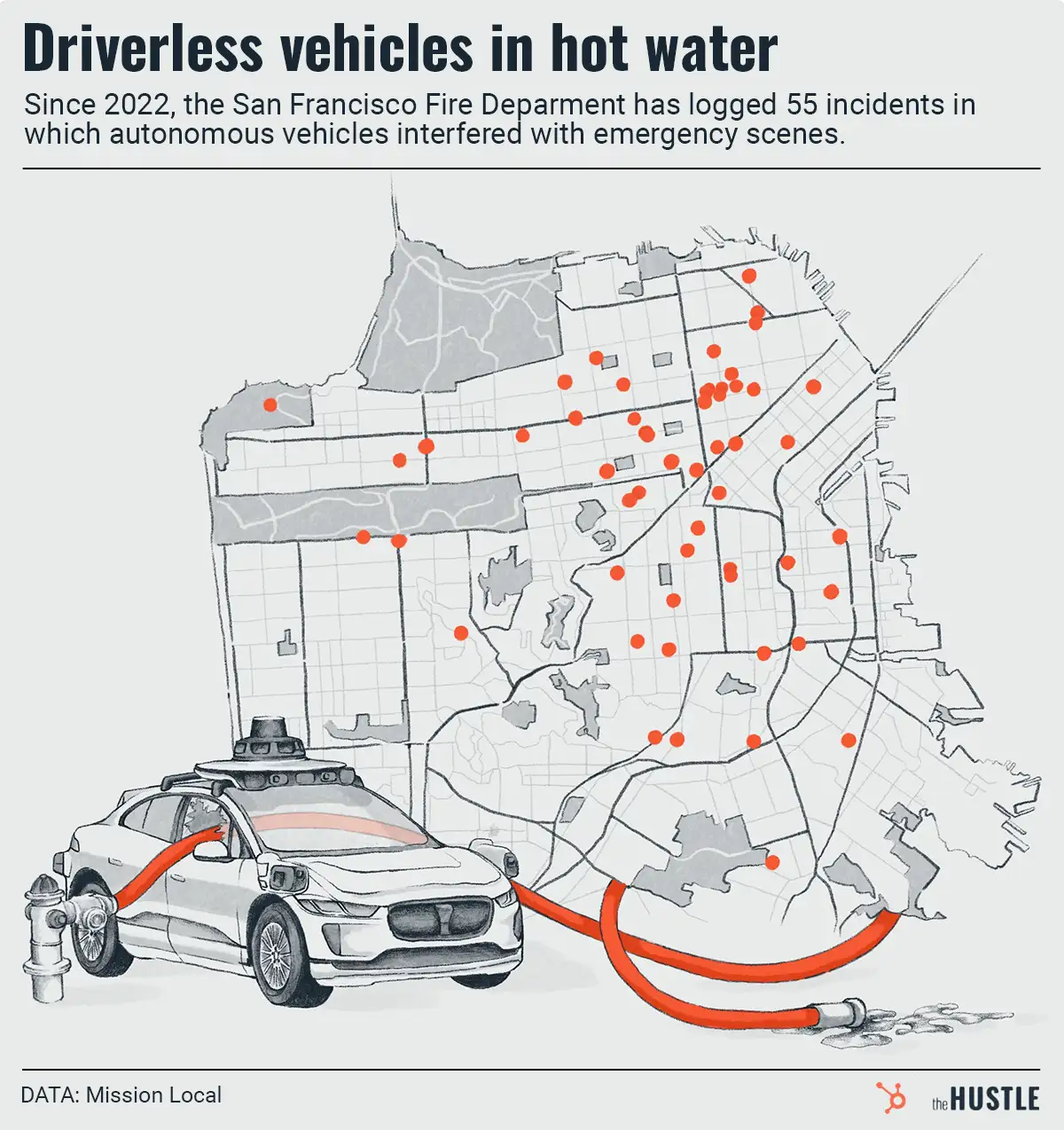

Where there’s smoke, there’s an autonomous vehicle blocking a fire

-

Meta vs. Canada is a long pattern of dismantling news

-

Is the ‘Big One’ about to drop on Amazon?

-

Brrring back the deals: Will the IPO and M&A markets warm up again?

-

TikTok’s new plan to avoid getting banned in the US

-

The Dow index got a makeover. What does it mean?

-

France vs. social media dishonesty

-

Canada’s drug experiment