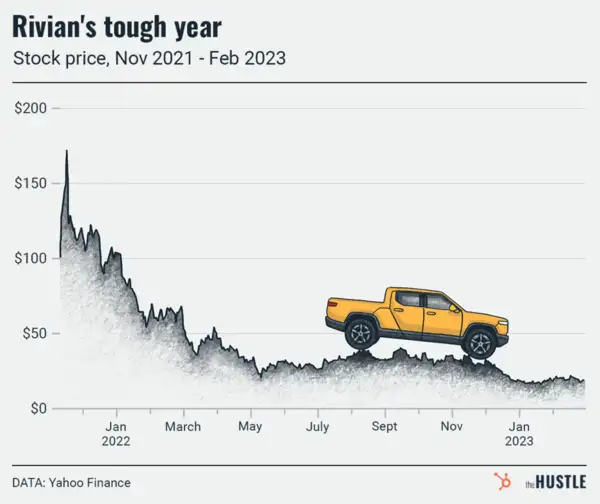

On July 1, one of the world’s top Apple analysts, Neil Cybart, wrote an article titled “Apple is pulling away from the competition.”

Since then, Apple has gained $500B+ in market cap and — on the road to becoming the world’s first $2T company — smoked its Big Tech frenemies.

Apple has built its advantage for years

Each of its new products is designed to handle tasks once managed by sibling devices — and in “an increasingly personal way,” Cybart told us yesterday.

Computing tasks are moving from the Mac to the iPhone to the Apple Watch — while all of Apple’s products work seamlessly together (except the charger cables).

In comparison, Apple’s top tech competitors are all over the place:

- Samsung is aimlessly launching products just to be “first” (i.e., foldable screens)

- Amazon bet big on the Echo instead of wearables

- Microsoft’s Surface has failed to break through with consumers

iPhone sales are slowing but other products are picking up the slack

Apple has built a sticky ecosystem around its flagship product with services and non-iPhone revenues accelerating in recent quarters.

Cybart estimates that of Apple customers, 50% own only one product (iPhone). Once these people go deeper into the ecosystem, watch out.

Expect millions of users to add additional items like the AirPods, Watch, subscription or — as Cybart predicts — a face wearable in the years to come.

The biggest risk to Apple?

To be sure, Apple has significant supply chain and business exposure to China (~17% — or $40B+ of its 2019 revenue) as well as antitrust concerns (e.g., Epic Games).

However, Cybart tells us the biggest risk to the Cupertino giant is a lack of focus.

Customers are embracing Apple’s current strategy, he says — but “if you see Apple stretch itself into areas where it doesn’t have the same user experience, that could start the gradual unwind of its ecosystem gains.”

***

UPDATE (08/24/2020 @ 12PM PST): Here are my full notes on what Cybart says is Apple’s key risk factor:

- China & antitrust are ‘headline’ risks: “People are nervous about the effects of these risks but when you look at the actual revenue impact, it’s a low percentage.”

- The biggest risk for Apple is losing focus: “If you see them doing a whole lot more and stretch themselves into areas where they won’t have the [same quality of] experience, it could unwind ecosystem gains.”

- Culture is key: “Apple’s ability to focus is based on its culture. If new products have a weaker experience, people may say ‘maybe I don’t want this [new] device’ and you’ll see a slow unraveling.”

- All-in on personal tech: “Apple has made a very concentrated bet: technology is becoming increasingly personal. Its product line is extremely focused. So far, the wearables bet has paid off. But, if it didn’t, there weren’t many other options.”

***

And you can check out an in-depth Tweetstorm analysis here: