The hottest trend in finance? ‘Blank check companies’

SPACs (AKA ‘blank check companies’) are storming public markets

Published:

Updated:

Related Articles

-

-

A bunch of young Americans are living on their parents’ tab

-

Please chill this long weekend, CEOs

-

Need help brushing up on the new dictionary?

-

Brrring back the deals: Will the IPO and M&A markets warm up again?

-

Where business is headed in 2023: Highlights from 3 reports

-

How a soda reseller built a multimillion-dollar empire

-

The Dow index got a makeover. What does it mean?

-

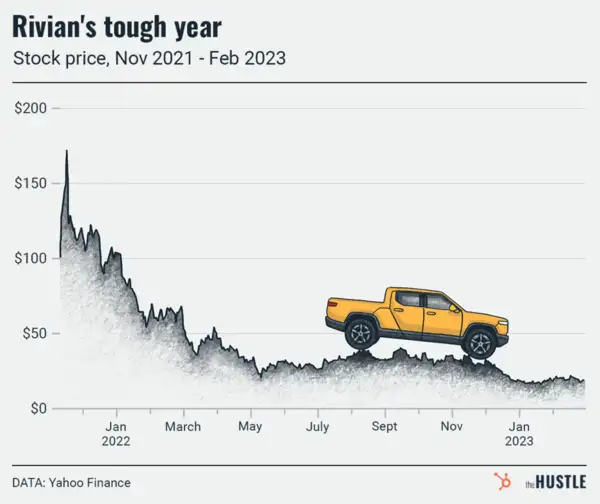

What’s up with Rivian?

-

Which schools pump out the most founders?