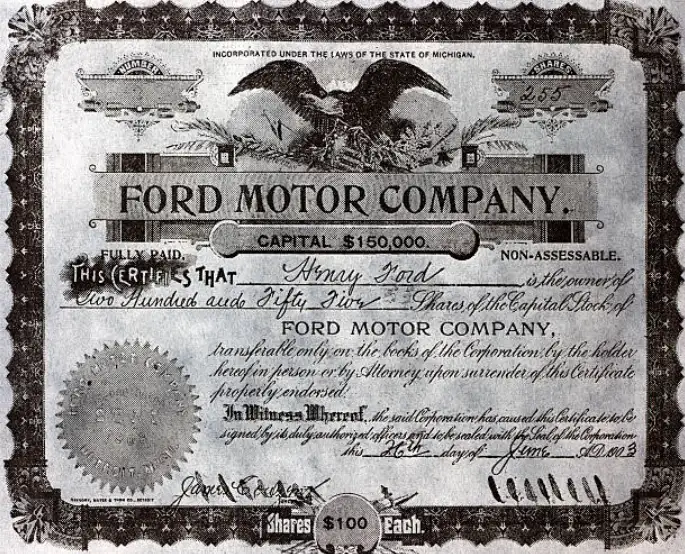

Photo credit: Getty Images / ilbusca

Move over Dunder Mifflin, there’s a new corporate top dog in Pennsylvania.

According to a report from the Wall Street Journal, the owners of Susquehanna International Group (SIG) — a derivatives trading firm based in Bala Cynwyd, PA — have been sitting on a 15% stake in ByteDance (TikTok’s China-based holding company) for years.

SIG is an option-trading giant

Per the WSJ, SIG was founded in 1987 by Arthur Dantchik and a group of college friends. Today, the privately held firm is responsible for more than 1 in 5 options trades in America.

SIG, which has no outside investors, has printed so much cash in the past few decades that the ownership group has aggressively looked for investment opportunities outside of its core business.

The investment portfolio is extensive

SIG’s owners started with so-called PIPE deals (the sale of large public equity stakes in a private transaction) in the 1990s.

The road to TikTok began in the early 2000s when the firm opened SIG Asia Investments in Shanghai. In total, SIG’s China arm invested a collective $2B in 260 companies, including ByteDance.

SIG plunked down $5m in ByteDance in 2012, the year of the company’s founding. Today, that stake is worth $15B — a casual 3000x return.

That’s more “paper” than Dunder Mifflin has ever made.