Venmo and Cash App are a scammer’s paradise

Fraud rates on payments apps are 3x to 4x more than on debit or credit cards.

Published:

Updated:

Related Articles

-

-

The Lord minteth in the weirdest alleged crypto scam yet

-

Why Zelle reversed course on refunding fraud victims

-

Move over, stocks — alternative investing apps are here

-

Hackers will hack anything — including your sex toys

-

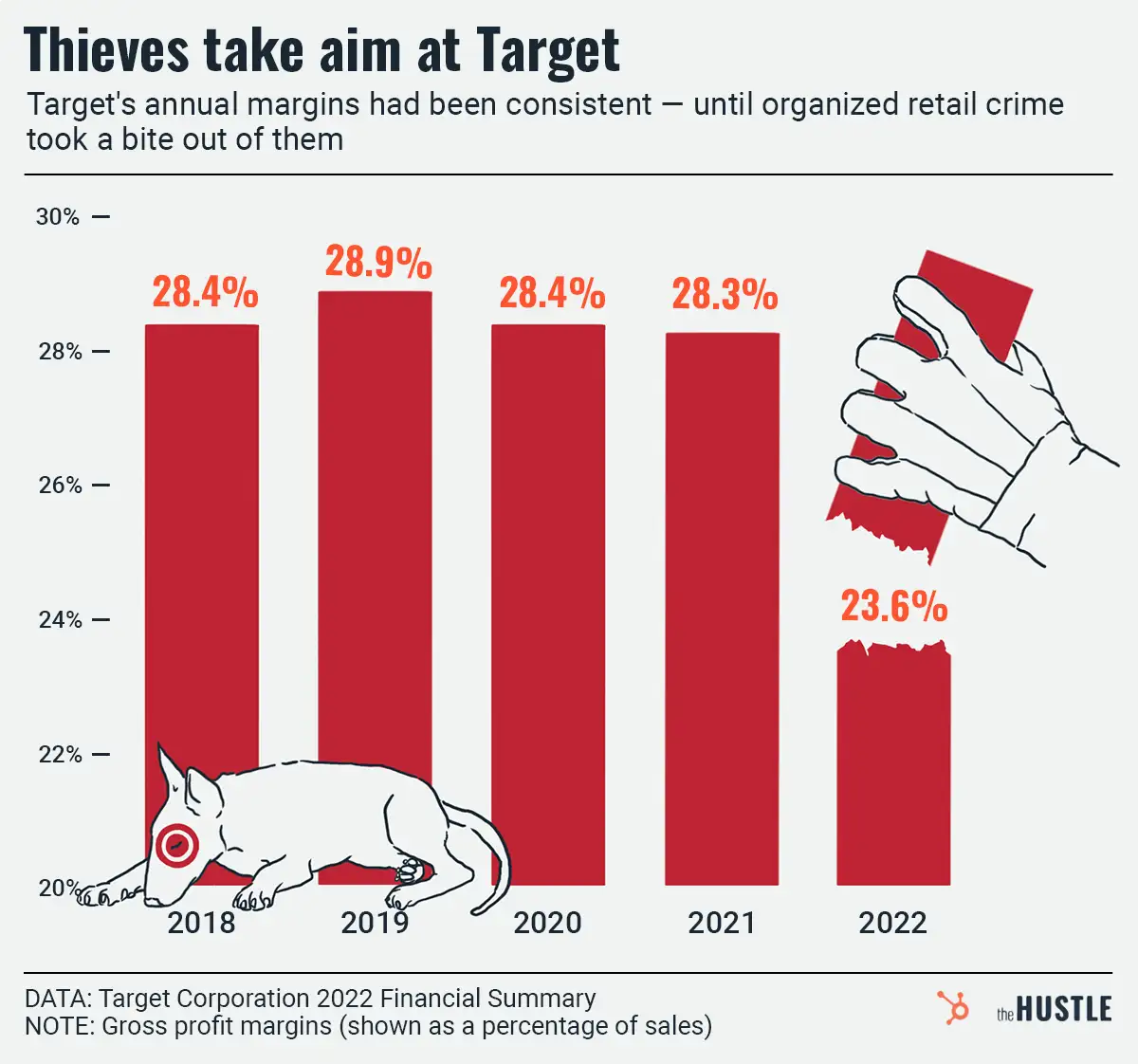

People love stealing stuff from Target

-

Saying you run a business is easier than actually running one

-

Wash trading and crypto, explained

-

Scandal: JPMorgan accuses founder of faking 4m+ accounts

-

How LinkedIn’s handling its bots