Redbox just IPO’d, and it’s out to prove there’s more than meets the kiosk

Redbox, operator of everyone’s favorite DVD kiosks, IPO’d this week, and wants to prove that it can grow beyond DVD rentals.

Published:

Updated:

Related Articles

-

-

Pirating videos was on the decline; it isn’t anymore

-

Disney will buy Comcast out of Hulu as streaming looks more like regular old TV

-

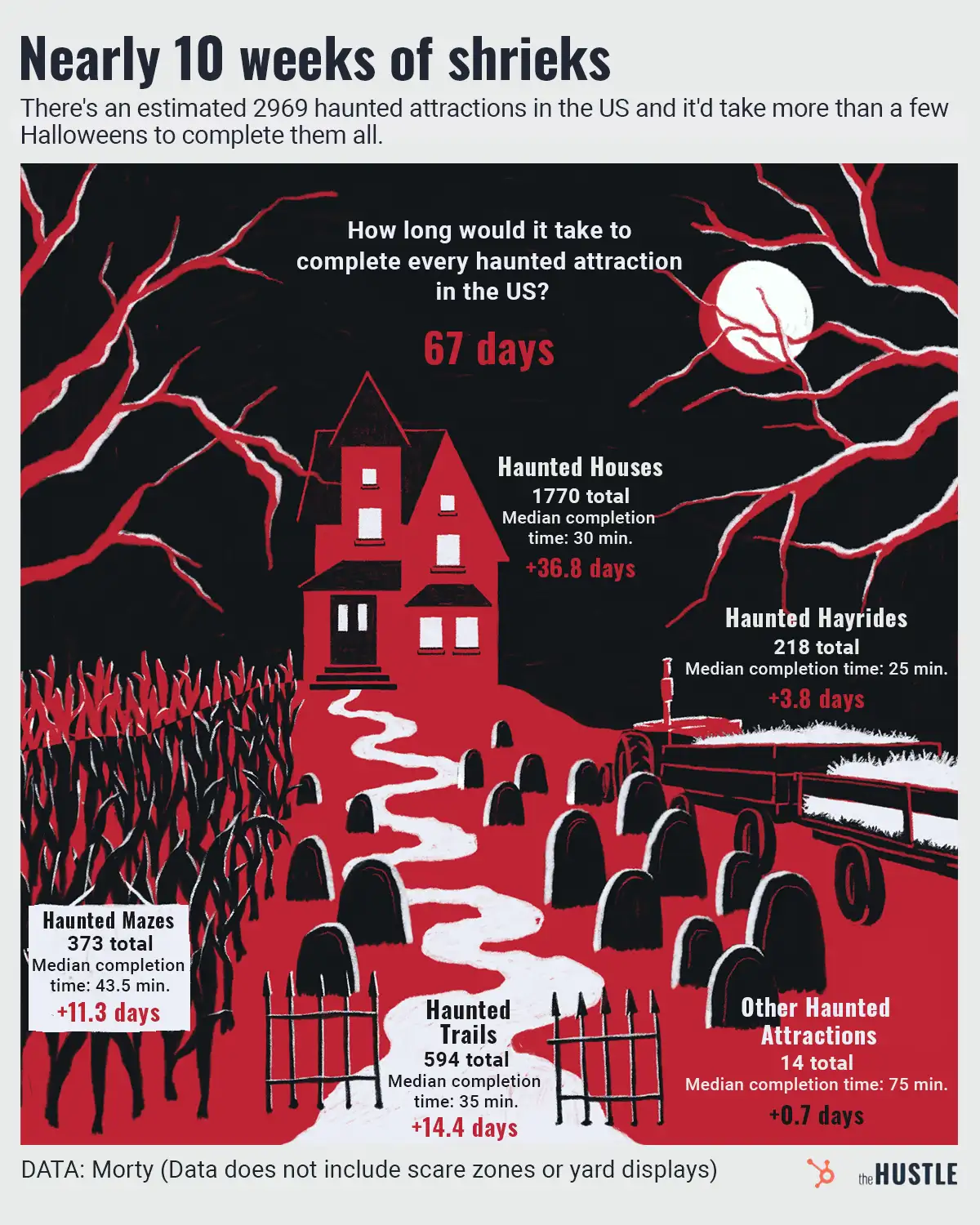

How to find the best haunt this Halloween

-

Las Vegas’ giant $2.3B sphere is officially open

-

Uh, why is Tom Brady in the office? How celebrity-brand partnerships are evolving

-

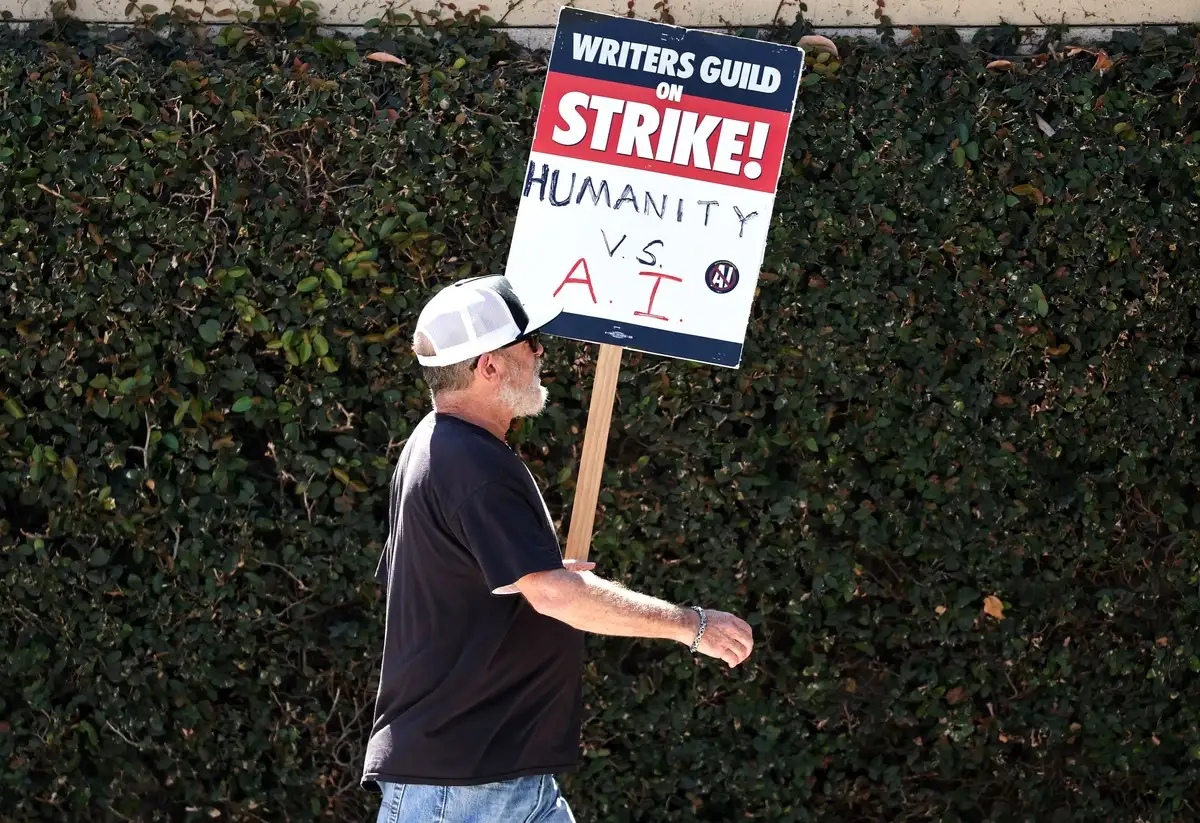

‘AI is not a writer:’ Why the writers’ strike deal matters beyond Hollywood

-

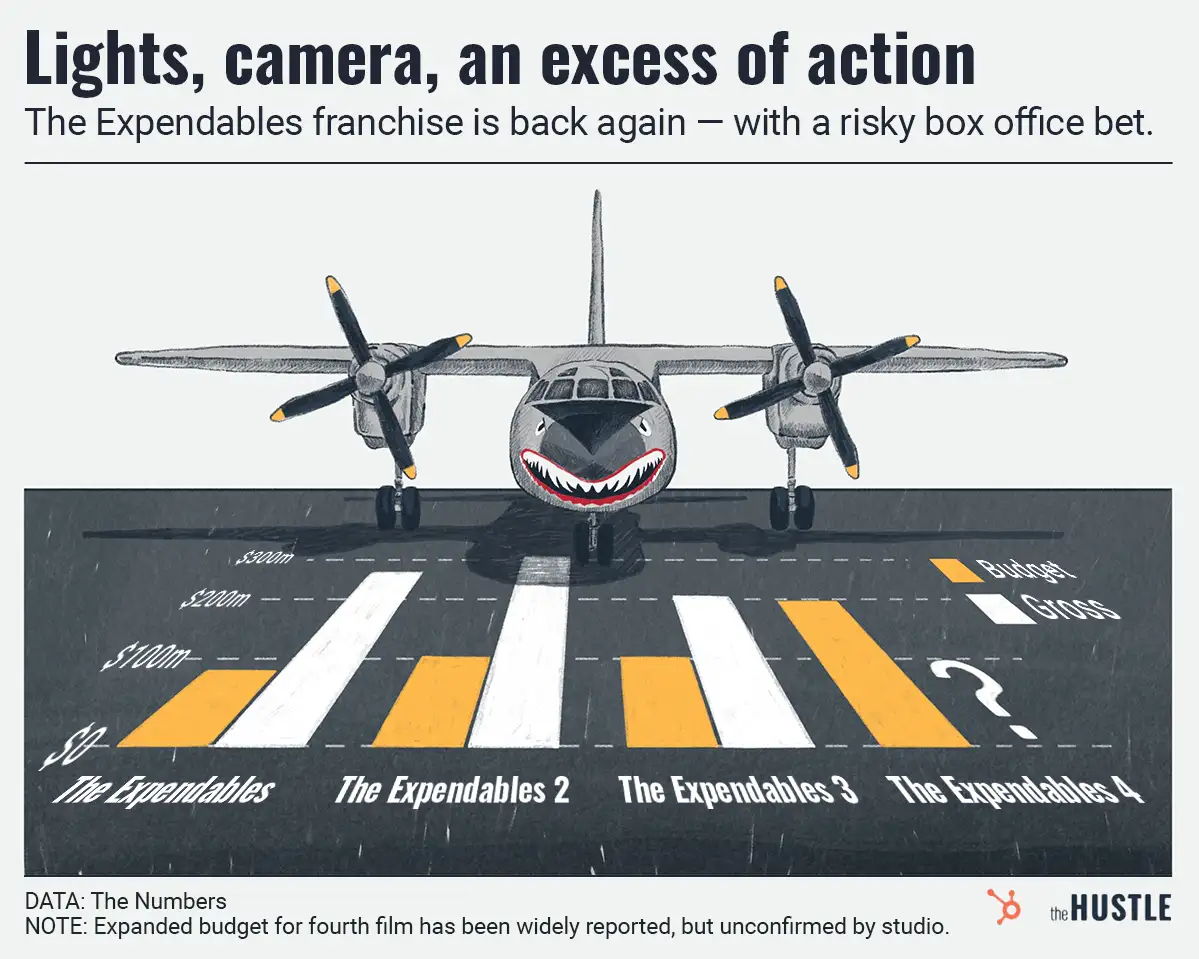

When a $789m film franchise turns risky

-

Why do festivals keep ending in disaster?

-

The history of the Magic 8 Ball