Google is getting back into payments. And, this time, it isn’t messing around.

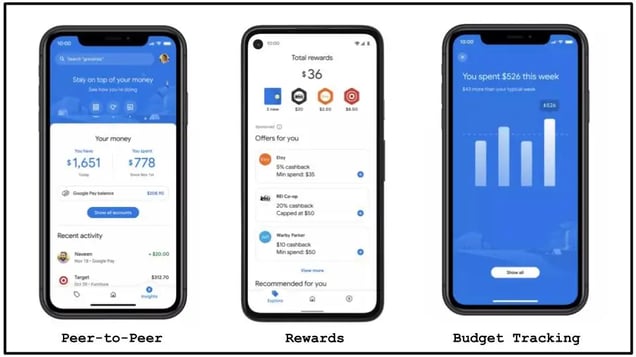

Google Pay is re-launching with features from all its competitors.

Published:

Updated:

Related Articles

-

-

Alphabet’s innovation lab will solve humanity’s biggest problems, if others help foot the bill

-

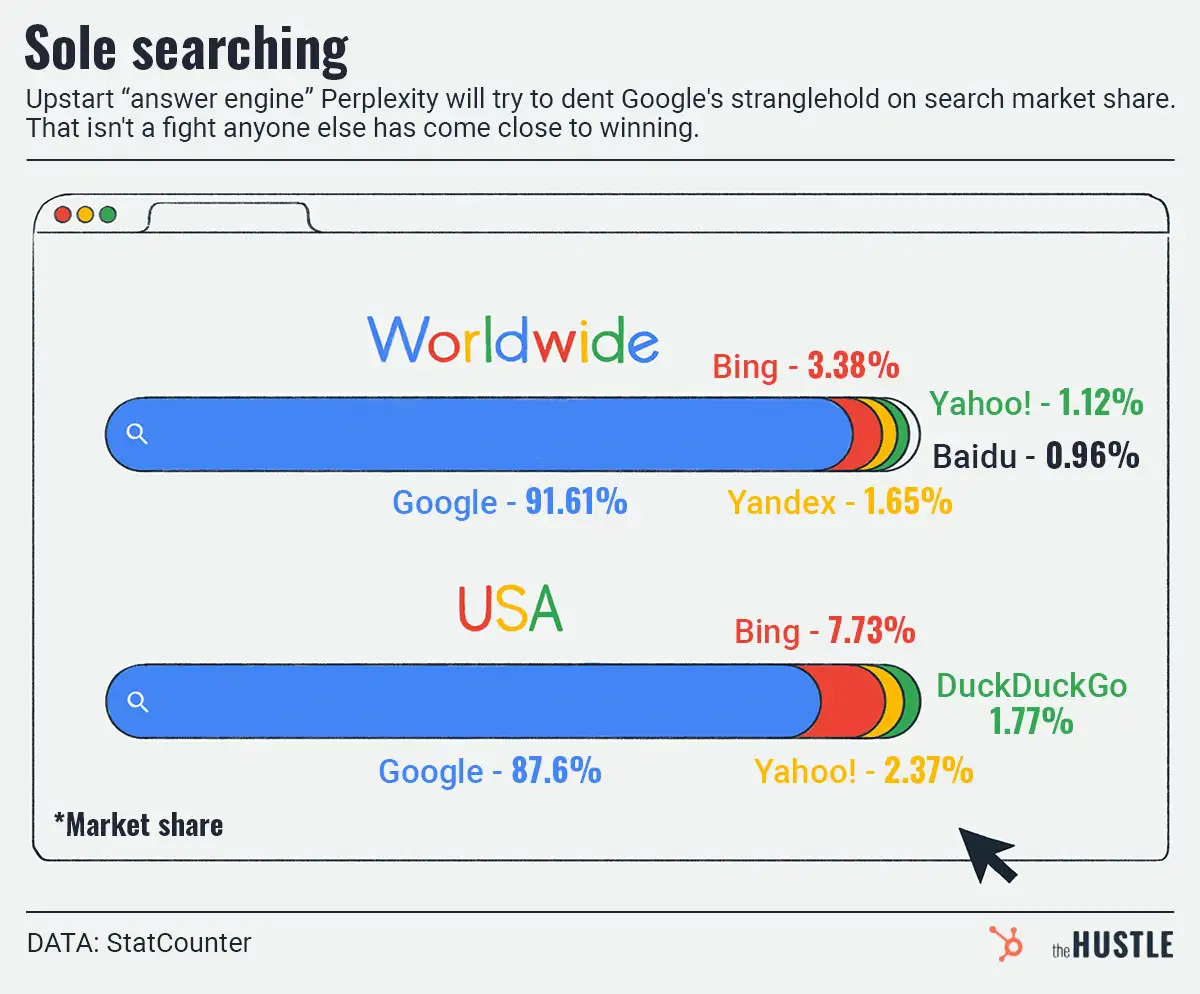

Could a Bezos-backed search startup kick Google’s crown off?

-

Big Tech power rankings: Where the 5 giants stand to start 2024

-

Are Google’s top recipes a grift?

-

The government can read your push notifications

-

Is Google manipulating us with its search results?

-

Brrring back the deals: Will the IPO and M&A markets warm up again?

-

Enshittification just keeps happening

-

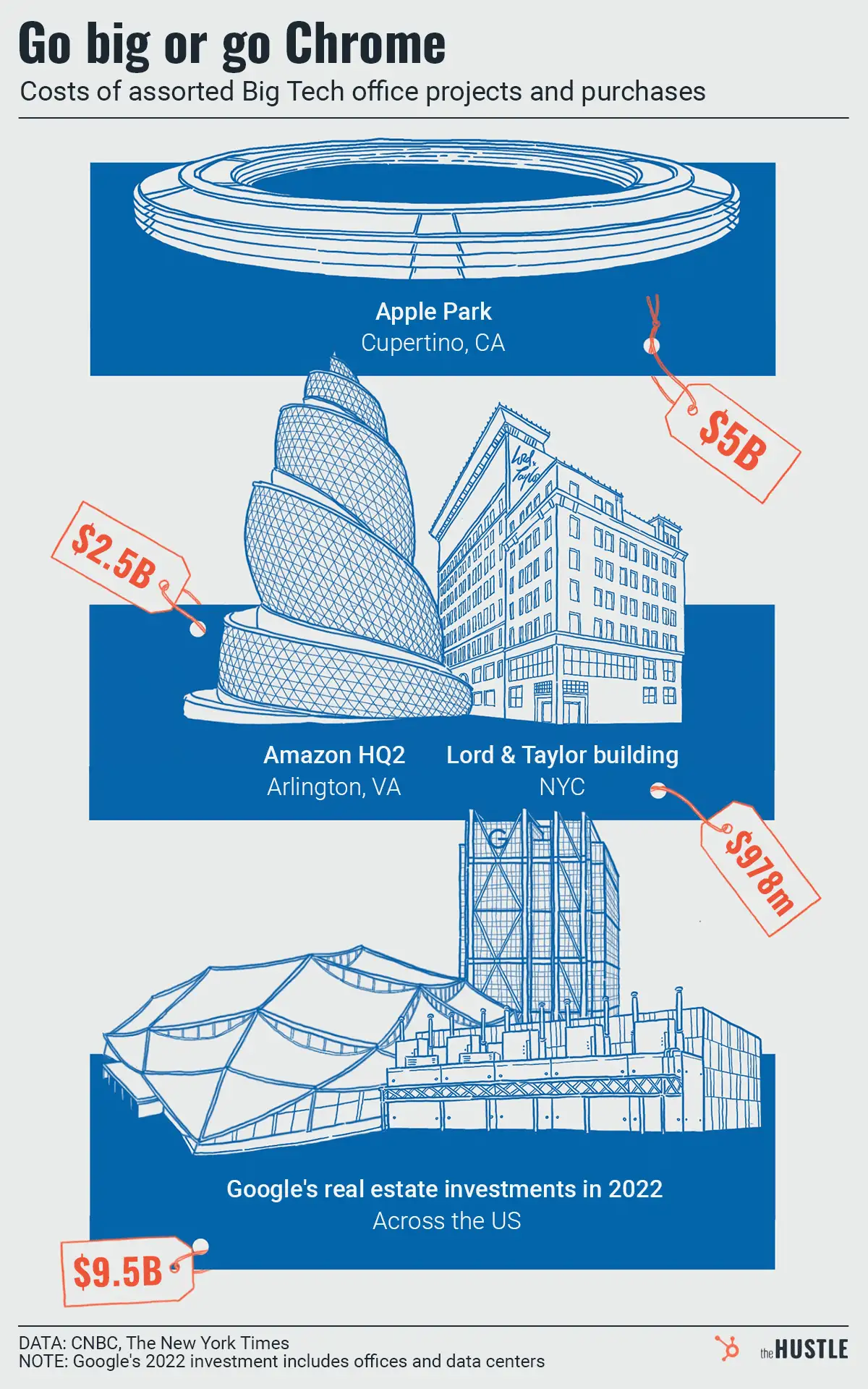

After years of building pricey playgrounds, Big Tech recalibrates