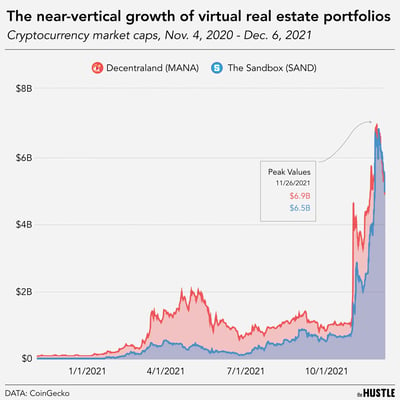

The virtual land boom, explained

“Virtual real estate” may sound like an oxymoron, but a future where pixelated land rivals Manhattan properties is close.

Published:

Updated:

Related Articles

-

-

Adam Neumann’s apartment startup is here

-

What the heck is going on with Airbnb in NYC?

-

Why tech workers are sleeping in expensive boxes

-

Branded residences aren’t just for hotels anymore

-

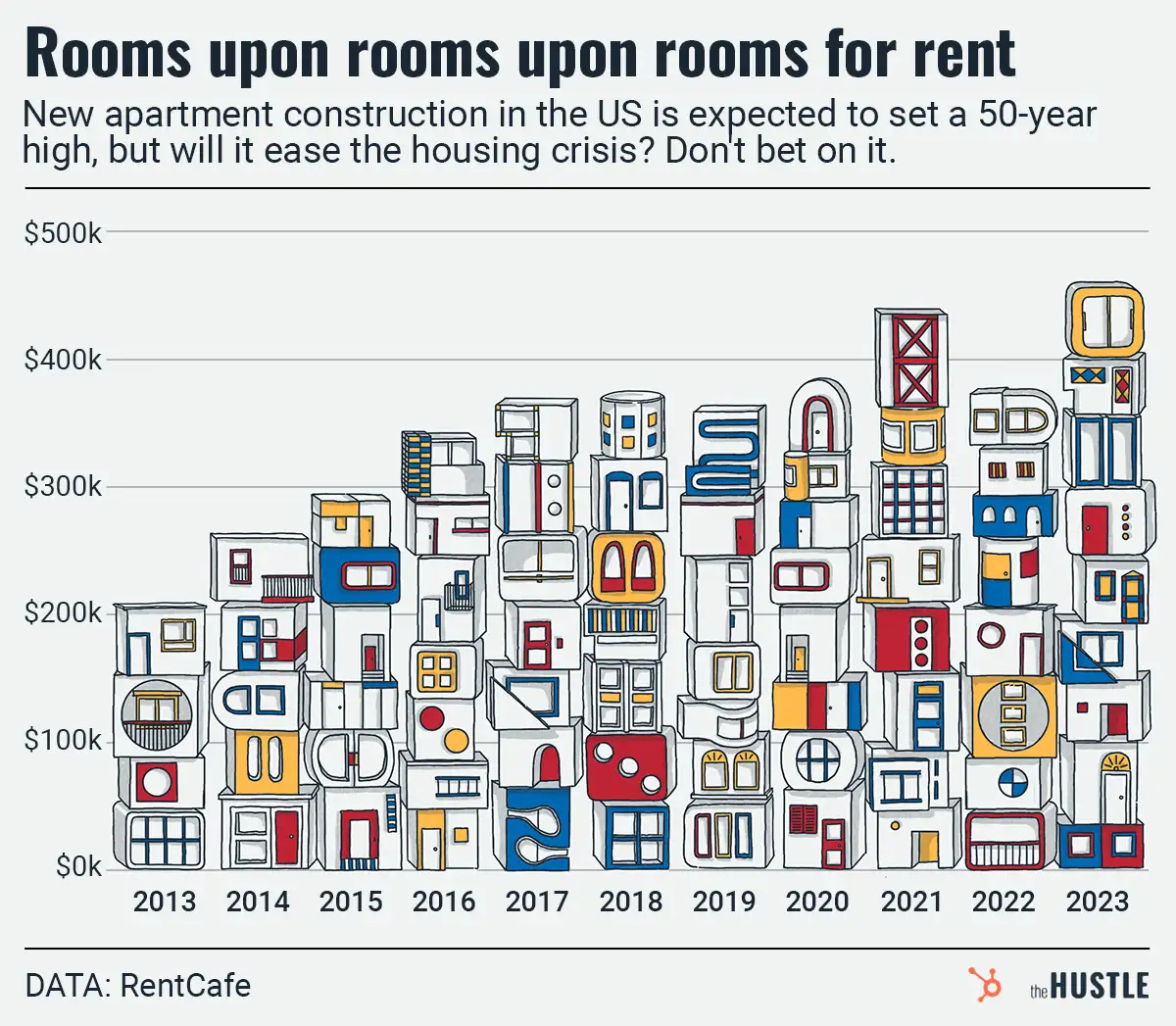

Apartments are getting built at a record clip — it’s too bad they aren’t the right kind

-

Will the Bay Area get a new city?

-

Looking for an edge in attracting talent? Give ’em a reasonable place to live

-

The answer to sky-high housing prices may also be sky-high

-

Does your apartment come with junk fees?