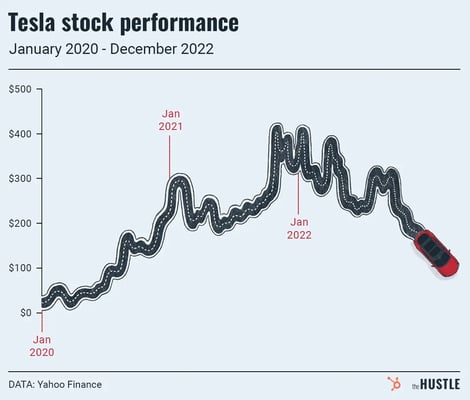

Tesla’s not-as-epic-as-expected end to the year

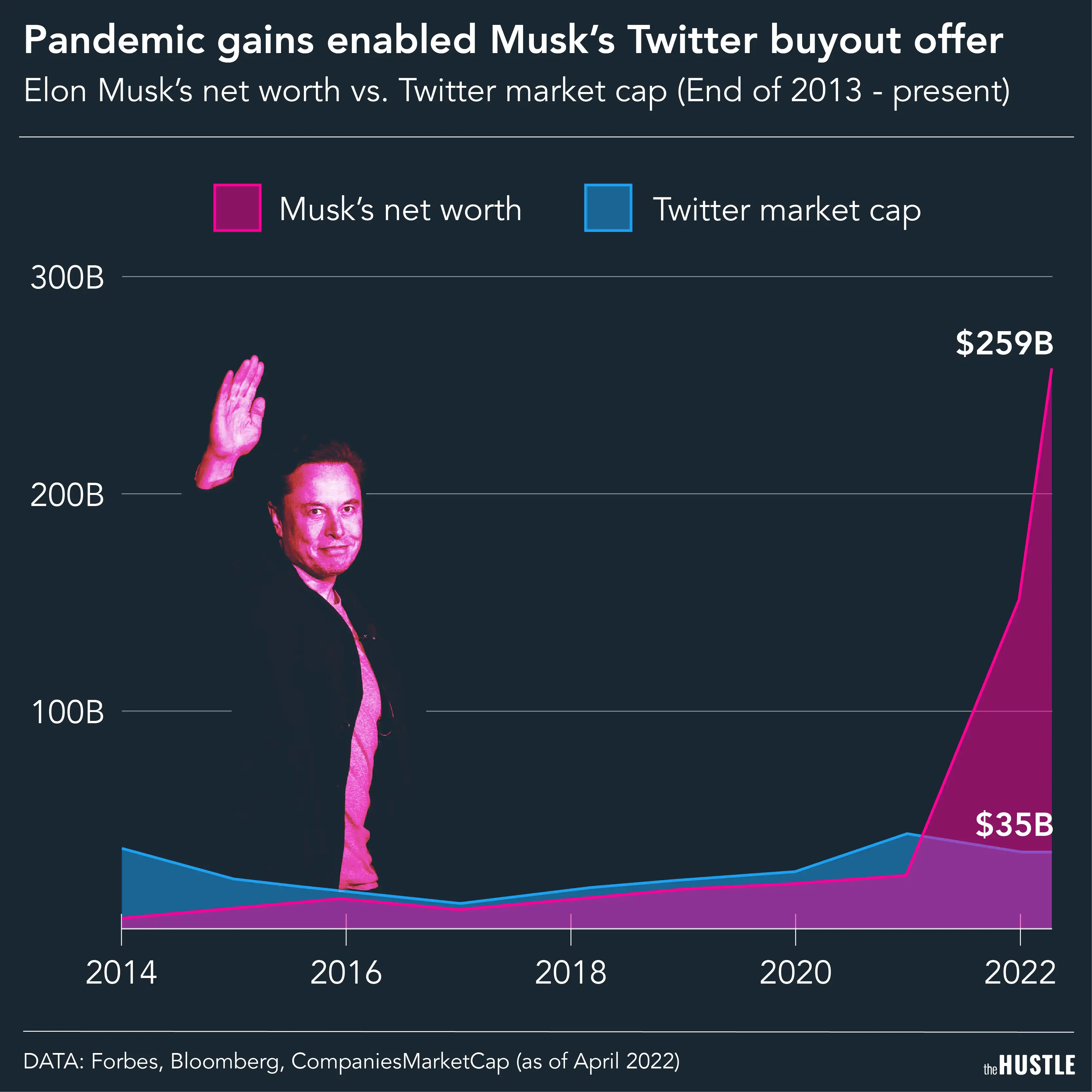

Macroeconomics and Musk’s Twitter purchase are to blame for the stock’s downturn.

Published:

Updated:

Related Articles

-

-

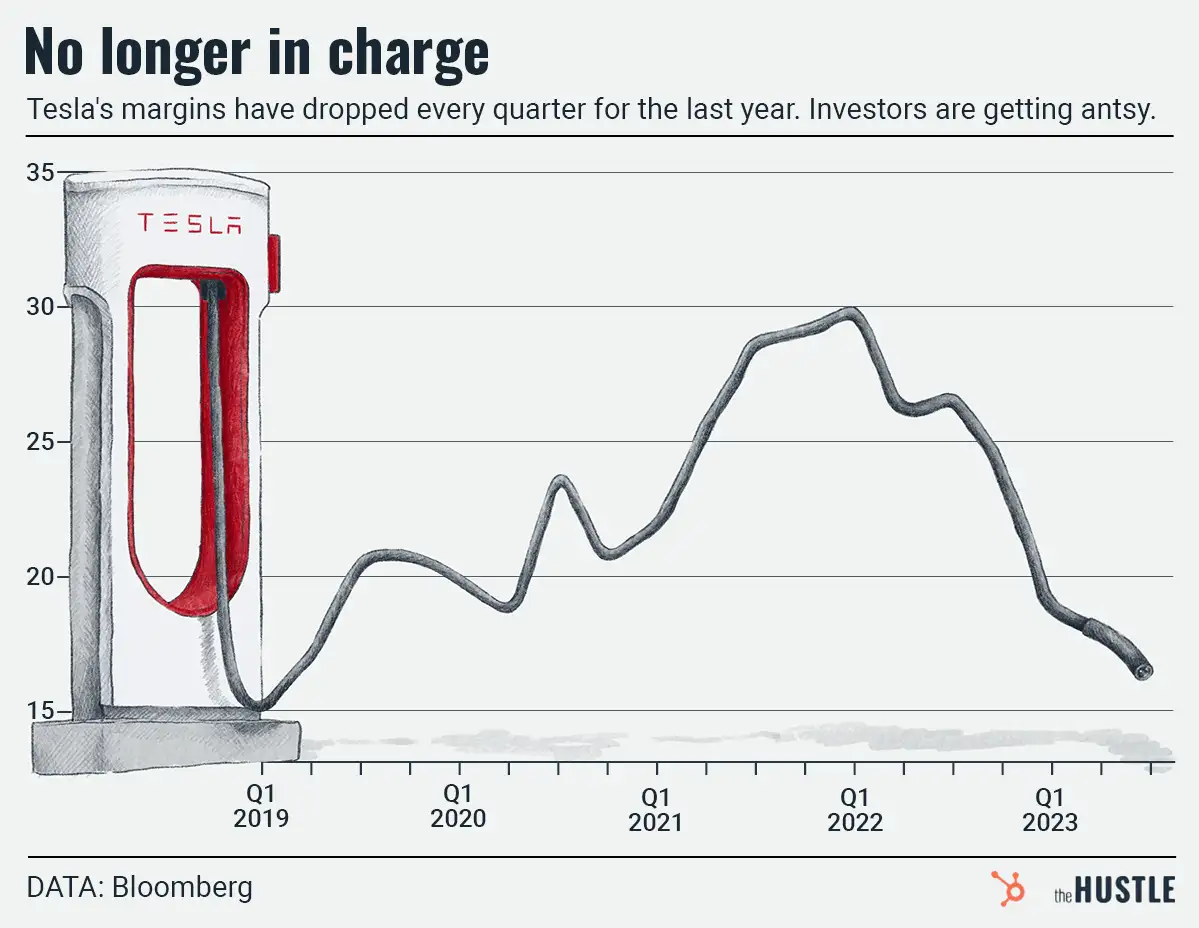

Tesla is struggling, and the outlook for improvement isn’t thrilling anyone either

-

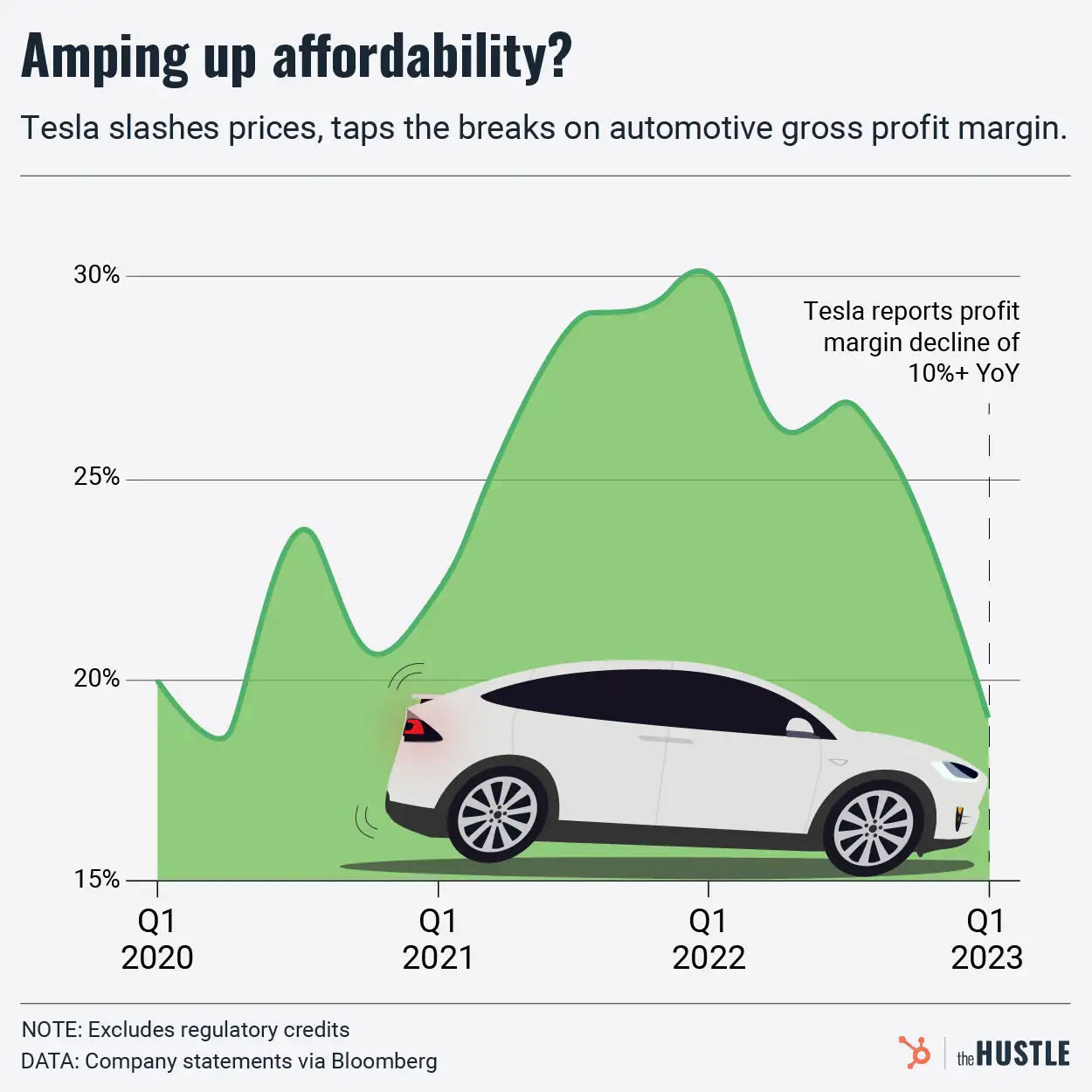

Tesla charges ahead with lower prices, sacrificing profits and shocking rivals

-

The Dow index got a makeover. What does it mean?

-

A tense situation at the happiest place on earth

-

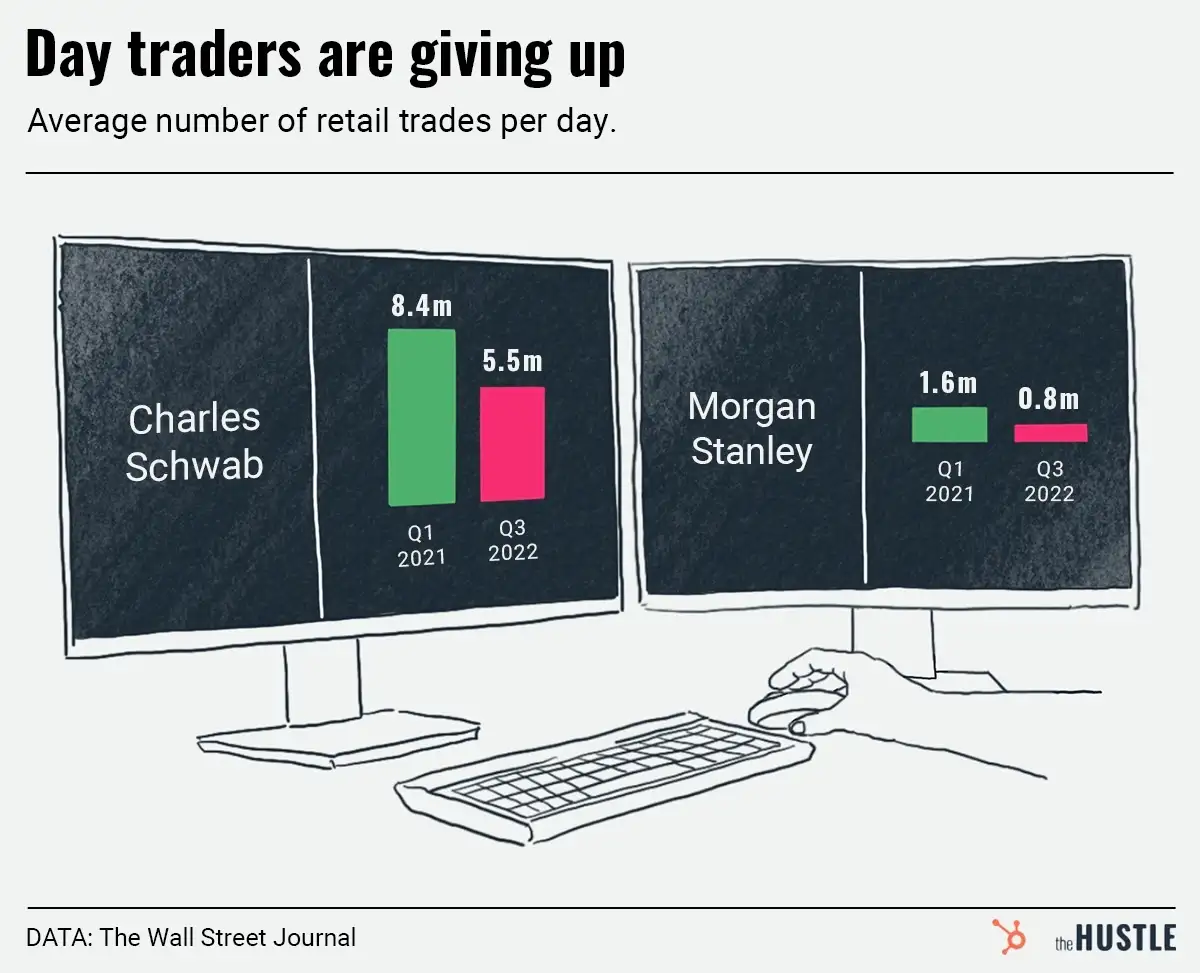

Amateur investors are bowing out

-

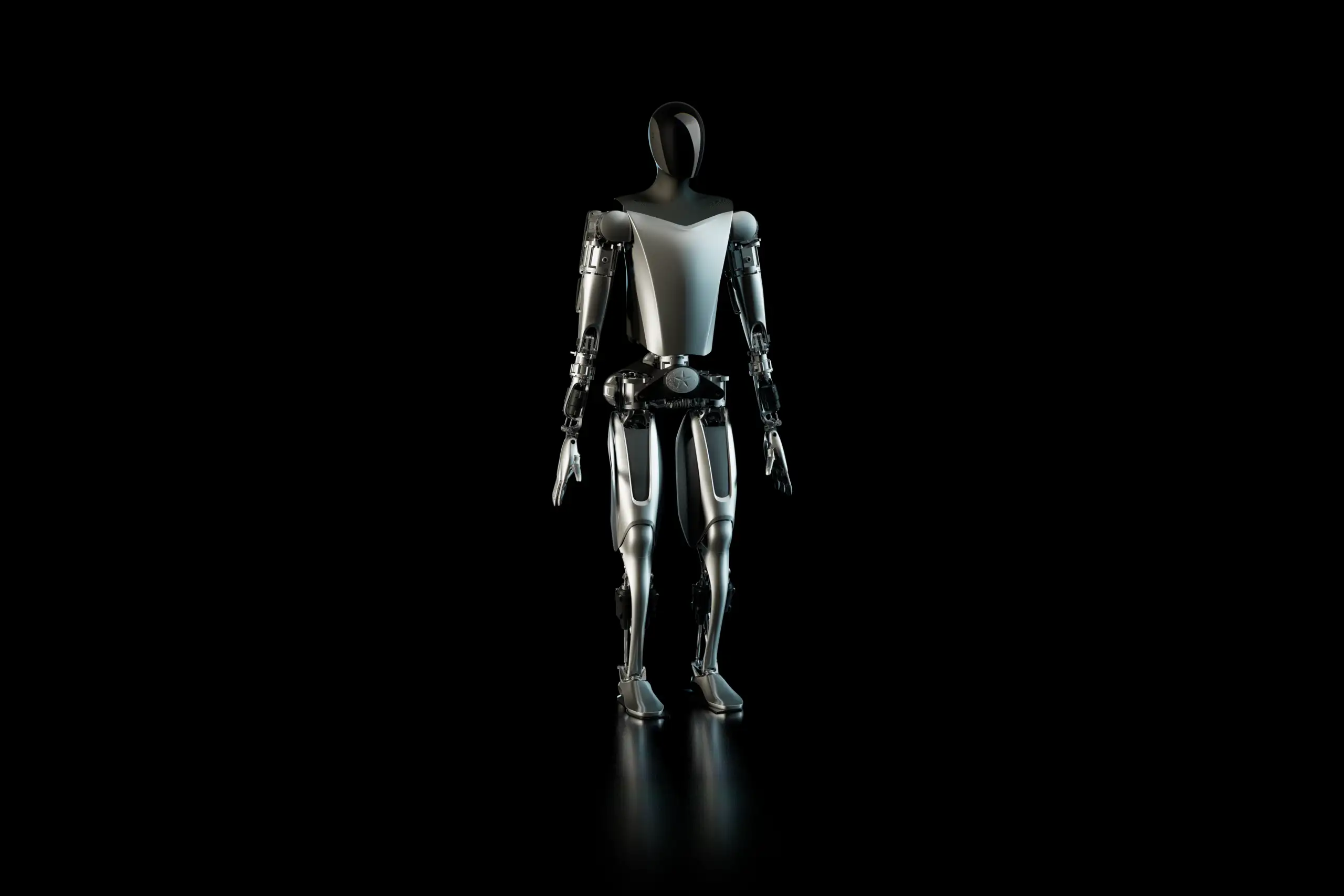

Tesla’s robot, explained

-

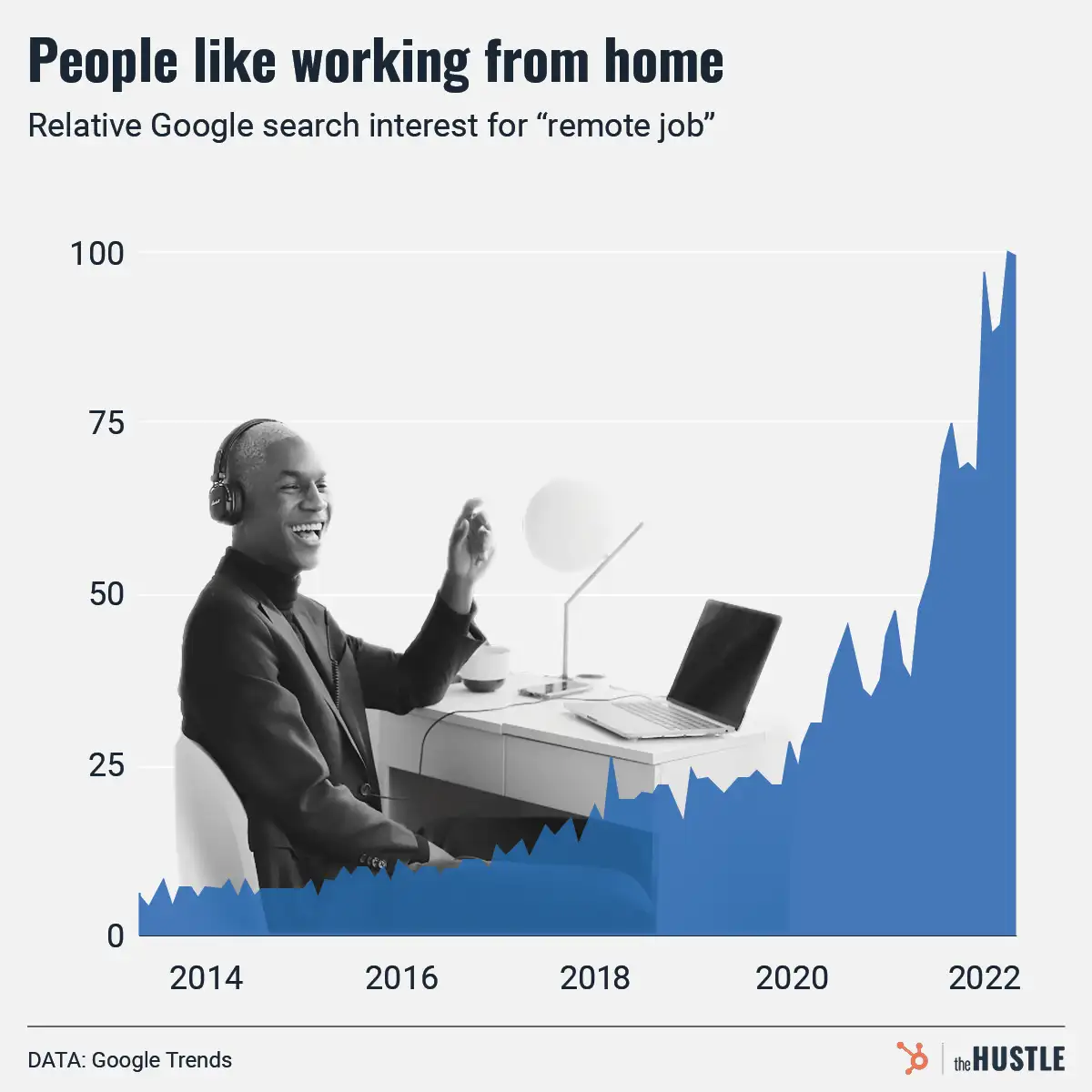

Musk says screw remote jobs

-

Elon Musk just offered to buy Twitter. Why?

-

Why do companies do stock splits?