What’s behind California-to-Texas relocations? (It’s more than taxes)

While taxes are a big part of corporations moving from California to Texas, housing costs may matter just as much.

Published:

Updated:

Related Articles

-

-

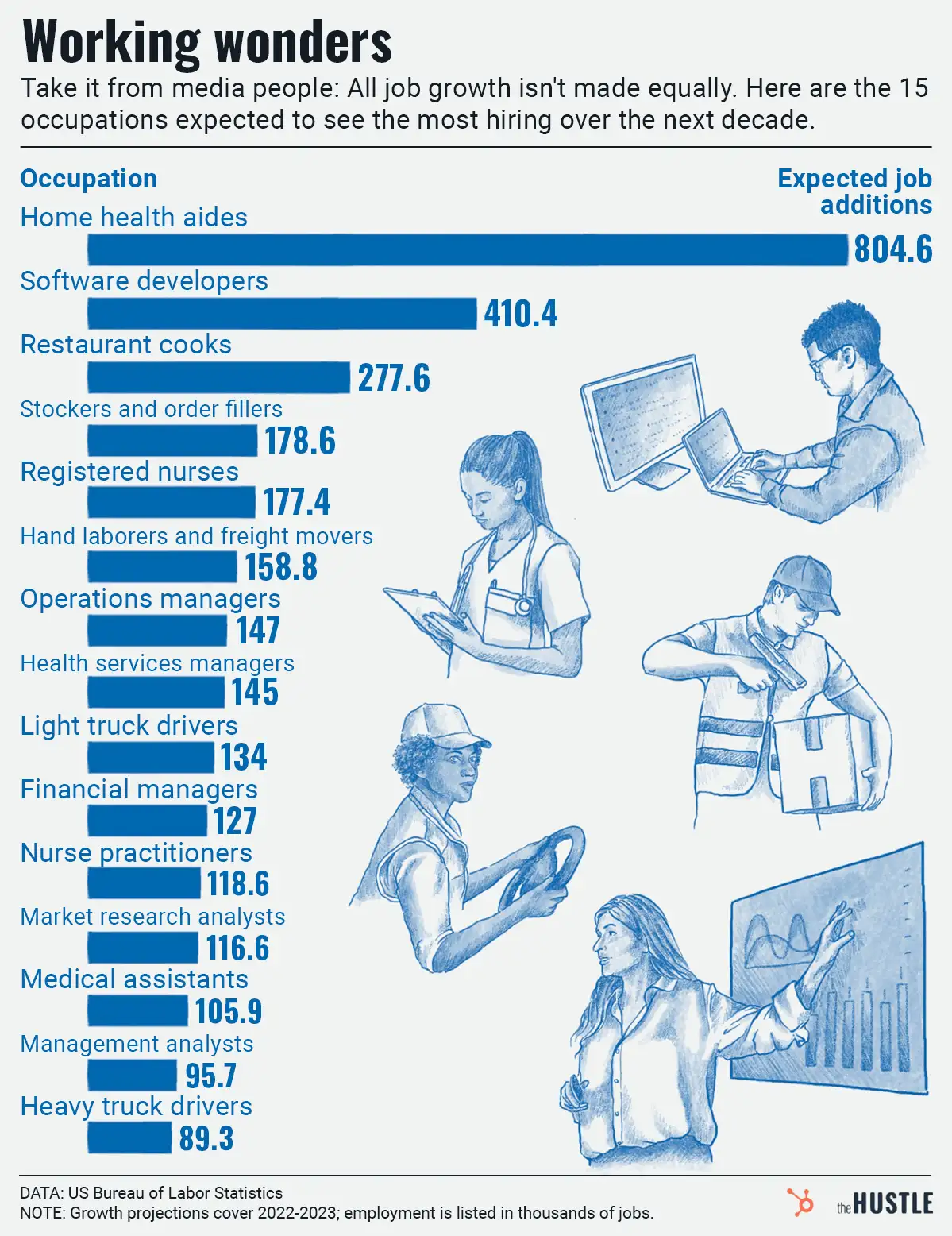

‘How’d the economy fare in 2023?’… is a great question

-

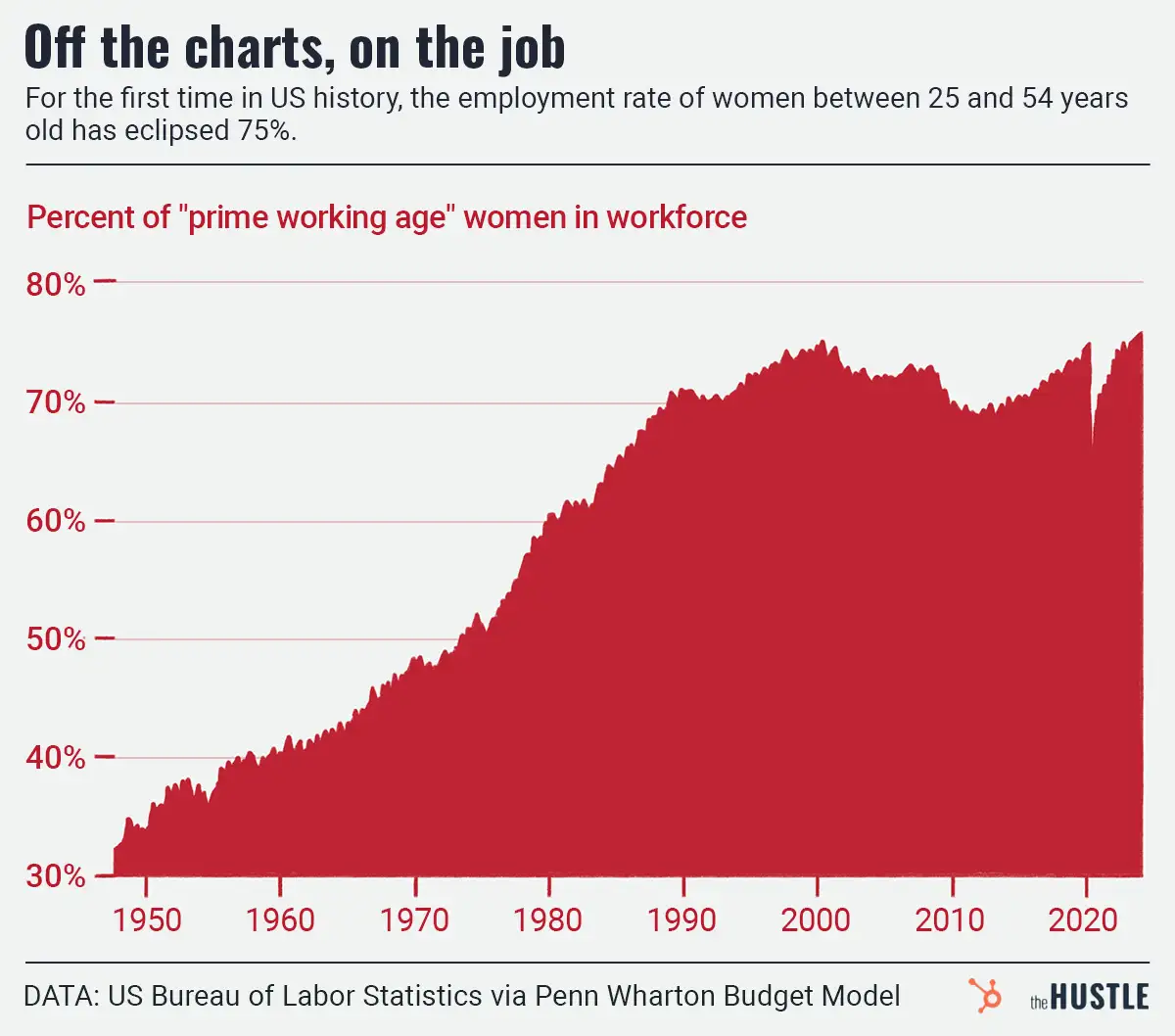

More college-educated moms are working than ever before

-

Please chill this long weekend, CEOs

-

How do you feel about the job market? Probably pretty weird

-

The American economy is fine, but Americans aren’t

-

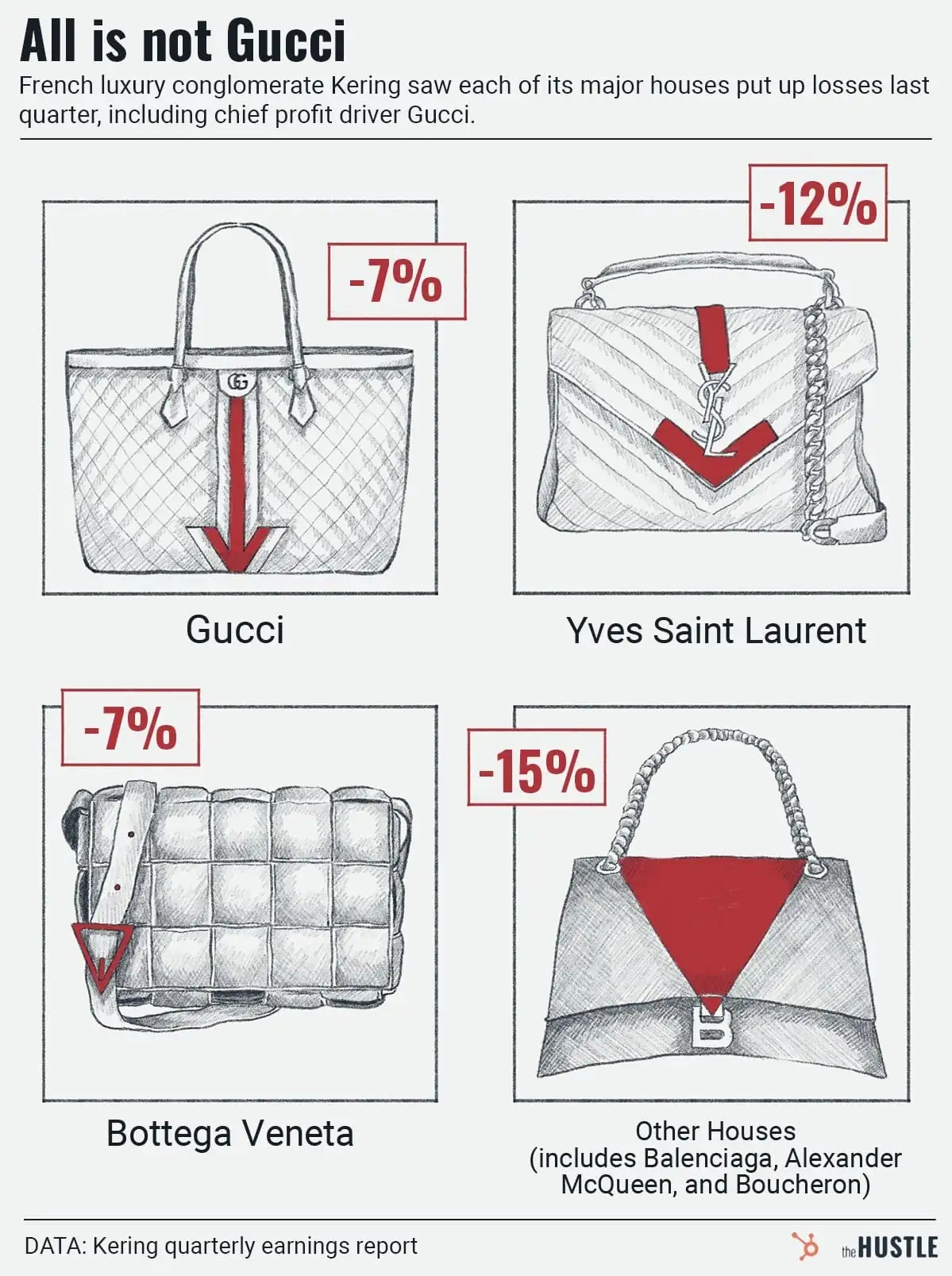

Luxury brands seek a miracle inside their (ostentatious, overpriced) bag of tricks

-

Need help brushing up on the new dictionary?

-

Where business is headed in 2023: Highlights from 3 reports

-

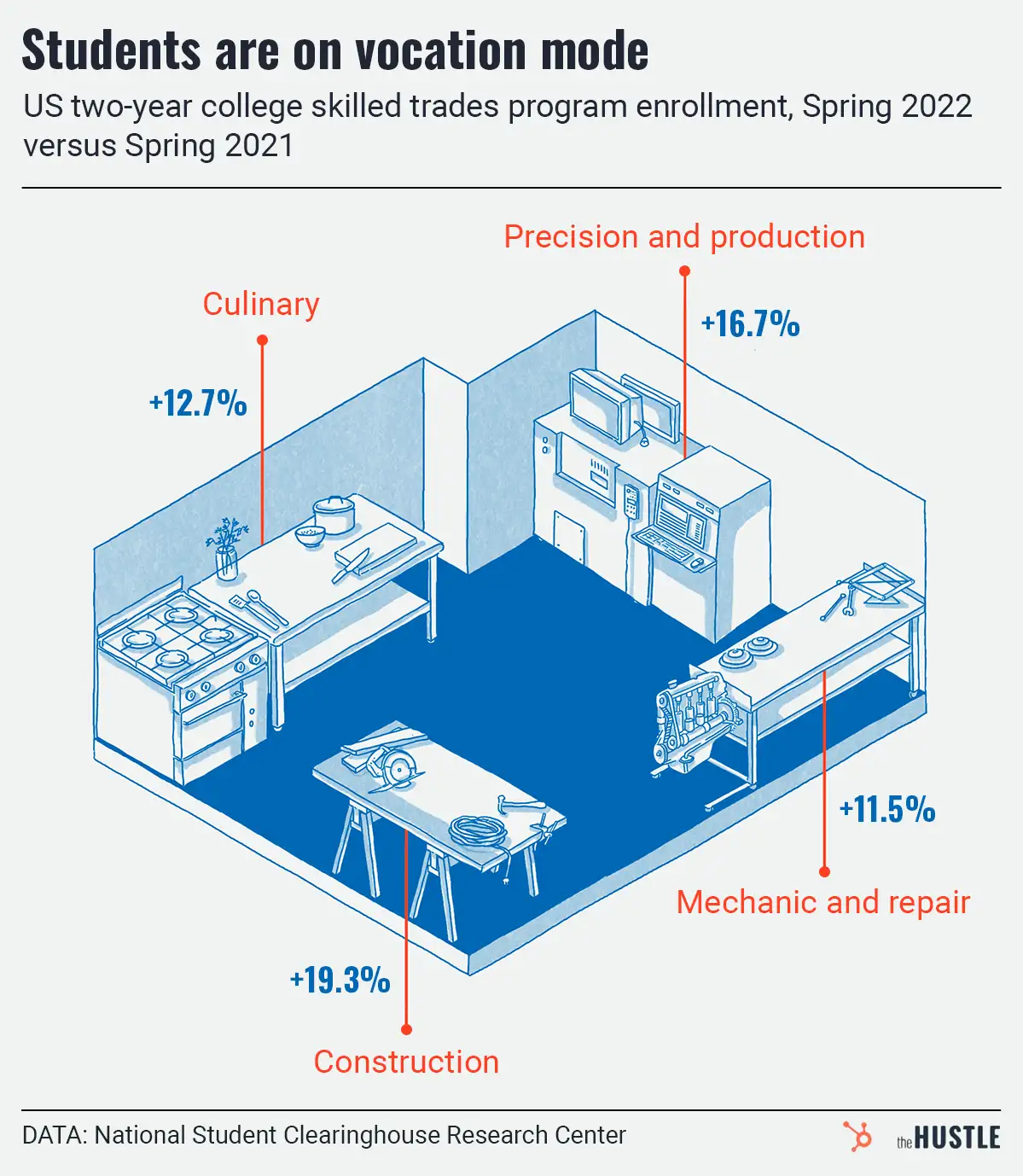

Degrees of separation: As college enrollment drops, trade school sign-ups rise