Earlier this week, while waiting to board an early morning flight from San Francisco to Portland, Oregon, I found myself stranded in Terminal 2, hungry and parched.

My search for sustenance led me to a breakfast bar, where I procured a bagel and a small beverage. The total? $11.50 — more than double the typical street price.

It’s a familiar story for any traveler: Held captive with few purchasing options, we’re often made to shell out 2-3x the going rate for a nibble of food, or pay a 100%+ markup for a water bottle. (Heaven forbid you need a neck pillow, earplugs, or some Advil…)

What exactly makes airports so expensive? The answer is a bit more complicated than “It’s runway robbery!”

A frugal person’s worst nightmare

An airport’s revenue is generally split 50-50 between two broad categories: Aeronautical (money it makes from landing fees and airlines), and non-aeronautical (parking, concessions, hotels).

The concessions component — which includes food, beverage, and retail sales — makes up as much as 60% of total revenue and is extremely integral to its bottom-line.

“In terms of dollars, airport parking is #1 but concessions run a close second,” says Blaise Waguespack, a professor of airport marketing at Embry-Riddle Aeronautical University. “It’s a huge business.”

That’s not hard to believe when you look at the price tags on certain items.

The Hustle recently analyzed various goods in 4 airports (SFO, LAX, JFK, PDX) and found certain items to be more than double the going rate on the street.

Today, most airports impose regulations on how much vendors can charge — typically no more than 10-15% above the going “street price.” But street pricing can be problematic in many ways.

For one, it’s an ambiguously-defined term: “Street” could mean anything from a corner store to a tourist mecca, like a zoo. It’s also nearly impossible to find real-world comparisons for some of the food items sold at airports. Then, there’s the fact that these regulations often aren’t policed effectively.

“A [big] issue with street pricing is that the airport must commit to enforcement, or the pricing controls will simply be ignored,” says Alan Gluck, a senior aviation management consultant with ICF. “It’s kind of a snake pit.”

Many of the actual prices you pay far surpass street pricing limits. Water bottles, for instance, often sell for more than double the going rate: A 20 oz. Dasani, which can be had for $1.69 at a convenience store, averages $3.49 at JFK airport.

This hasn’t stopped us from buying them: According to data from Hudson Group, which operates 950 airport stores in the US, water bottles take up the top 5 spots on its list of top-selling items.

Airports take a number of measures to make sure we spend money after clearing security, including:

- Clustering concessions into “neighborhoods.”

- Monitoring foot traffic, enplanement data, and “dwell time” (the amount of time we spend waiting for our planes to board).

- Forcing us to snake our way through duty-free shops to get to our gates.

We spend an average of $7 for every hour we spend in a terminal; conversely, our spending decreases 30% for every 10 minutes we stand in a screening line. To increase dwell time, airports encourage us to arrive extremely early and they invest in expediting the security process.

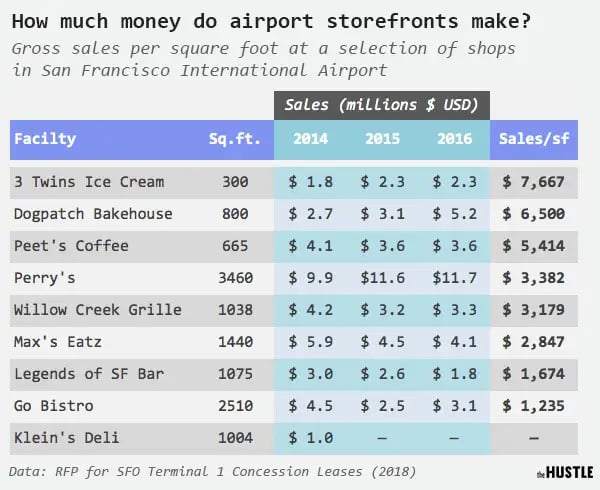

On paper, all of this spending appears to be extremely lucrative for airport businesses. According to financial data on 9 eateries in San Francisco International Airport obtained by The Hustle, sales figures can range as high as $7.7k per square foot — more than 10x the national average outside of airports.

But these places aren’t minting as much money as you think.

“There really needs to be a high volume of traffic to make [airport retail] worth it,” says Michael Lindsay, owner of elizabethW, a boutique that sold everything from $6 lip balms to $60 perfumes at SFO in 2015. “You need to sell a lot to cover your costs.”

These costs range from steep rent to logistical headaches to employee retention issues — and combined, they can mitigate the allure of being an airport vendor.

The hidden costs of running an airport business

Sarah Imberman first got into the airport retail space in 2011, when she opened Sarah’s Candies, a boutique sweets shop, at Chicago O’Hare. Today, she heads S. Levy Foods, a firm that runs local restaurants and shops at 4 major airports around the US.

According to Imberman, the higher costs you pay for goods in an airport can be attributed to a minutiae of operating expenses most customers never think about:

- High rent (airports take a % of total sales)

- High construction costs

- Steep security, handling, and logistical costs

- Costly labor (higher average salaries than traditional retail jobs)

“There are a lot of misconceptions about airport pricing,” she says. “I’ve operated both in street retail and airports. The cost of doing business in an airport is EXTREMELY higher.”

Rather than charging set monthly amounts, airports generally take a cut of storefronts’ gross sales; the more a store makes, the more it pays in rent.

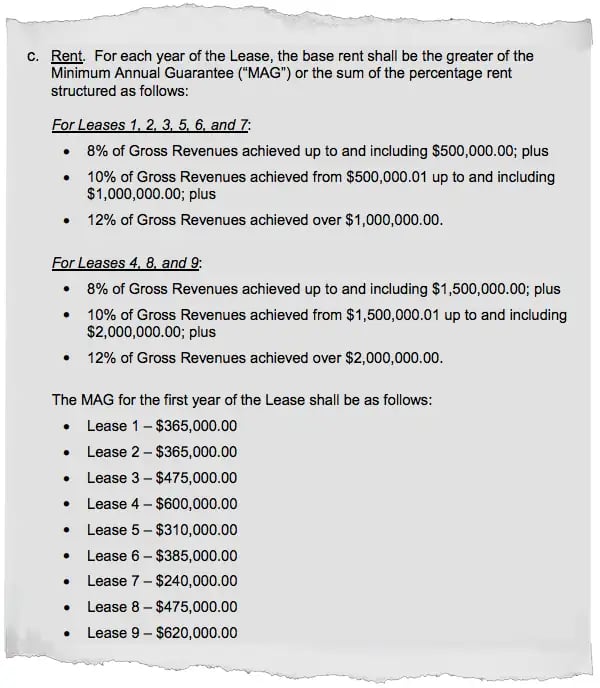

When a retail spot opens up in an airport, the city puts out a Request for Proposal (RFP) and opens it up for bids. An aspiring restaurant or storefront must declare a Minimum Annual Guarantee (MAG), or a base amount it pledges to pay the airport each year, based on set percentages of projected sales.

For example, the airport might specify that it wants 10% of all sales up to $1m, and 12% on anything over $1m. If you estimate your sales at $1m, your MAG would be $100k per year; if you end up doing $1.5m in sales, you’ll pay $160k.

A 2018 RFP for 9 retail openings at SFO lists MAG fees of between $365k and $630k per year and requires a 10-year commitment — a hefty cost for any small business, even one in a highly trafficked location.

Once a business manages to beat out competitors and lock down a location, it faces another hurdle: Extreme construction and remodeling costs.

“The cost per square foot to build out in an airport ranges from a low of about $450/sf to $2k/sf [compared to the national average of $56/sf],” says Gluck, the aviation consultant. “It can be hard to get contractors, and if there is a great deal of construction going on in the region, the airport will need to compete for skilled and unskilled labor.”

Then, there are the astronomical handling fees.

While restaurants and retail outlets on the street have the luxury of streamlining their supply chains and logistics, airport storefronts must deal with the constant added cost of post-9/11 security measures.

“Everything — and I mean everything — has to go through security,” says Imberman. “We also have to do things like count our knives several times every day. There are a lot of precautions to take.”

These security measures also equate to extra labor costs.

“Employees have to get to the airport every day, pay for parking, go back and forth through security, and wear special badges that can take several weeks to get,” Imberman adds. “Turnover is super expensive.” Many airport jobs are also unionized and pay as much as $2/hr more than similar jobs outside of the airport.

These extra costs are factored into the prices we pay for a water bottle, a breakfast burrito, or a pack of earplugs.

Where there’s a boarding gate, there’s an opportunity

The tricky logistics of airports make things costlier both for operators and consumers — but these challenges don’t seem to be hurting the space much.

According to a recent report, airport retail is a $40B per year business globally, and is projected to grow to $60B by 2022. While brick-and-mortar retail continues to decline in the face of e-commerce, airport sales are up 7% over the past 2 years. Some 3.8B people pass through airports each year, and that figure is projected to double in the next 20 years.

This growth, and the relatively outdated nature of airport retail, presents an interesting opportunity for entrepreneurs.

Mobile apps that deliver food directly to boarding areas (like At Your Gate and Airport Sherpa) are already making their way into the space. And there’s more to come: In the 2018 white paper, The Airport Retail Revolution, IFC consultants lay out a future ripe with digital disruption, automated kiosks, and immersive shopping experiences.

Before you jump in, just remember to remove your shoes and belt.