iDebt: Apple partners with Goldman on new mobile credit card

Apple will start testing its first credit card in partnership with Goldman Sachs, linked directly to the Apple Wallet.

Published:

Updated:

Related Articles

-

-

Apple vs. apples

-

Mac made a big change for gamers

-

Why Apple is betting big on Vision Pro: Because it can

-

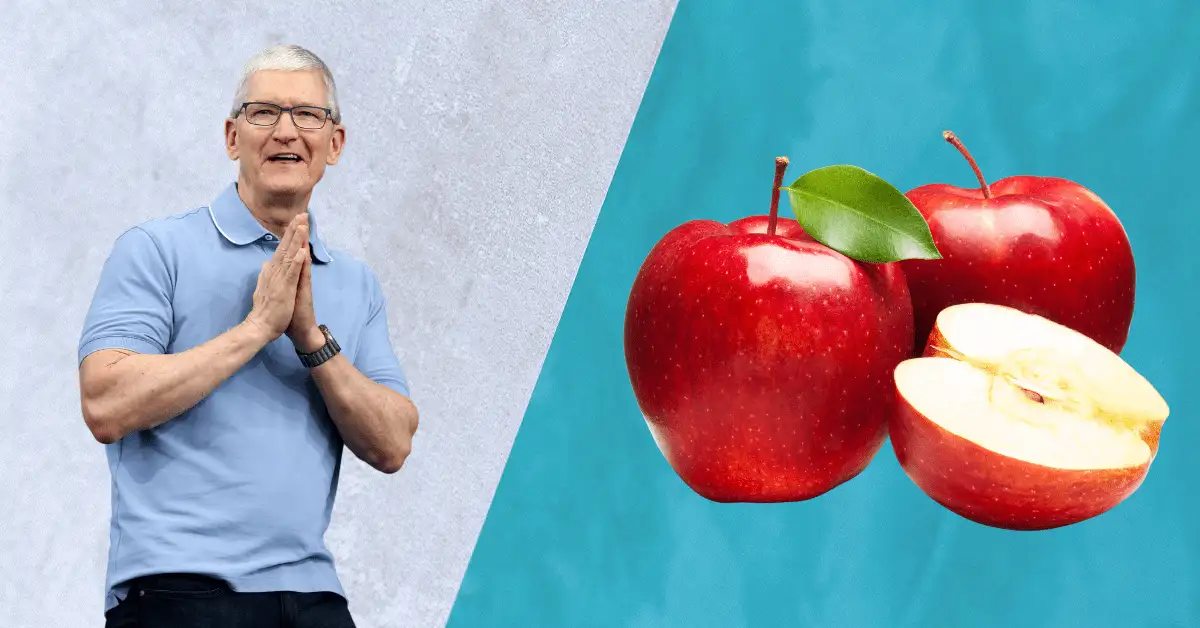

Is India Apple’s next frontier?

-

Apple’s big changes, courtesy of the EU

-

Why Apple store workers are unionizing

-

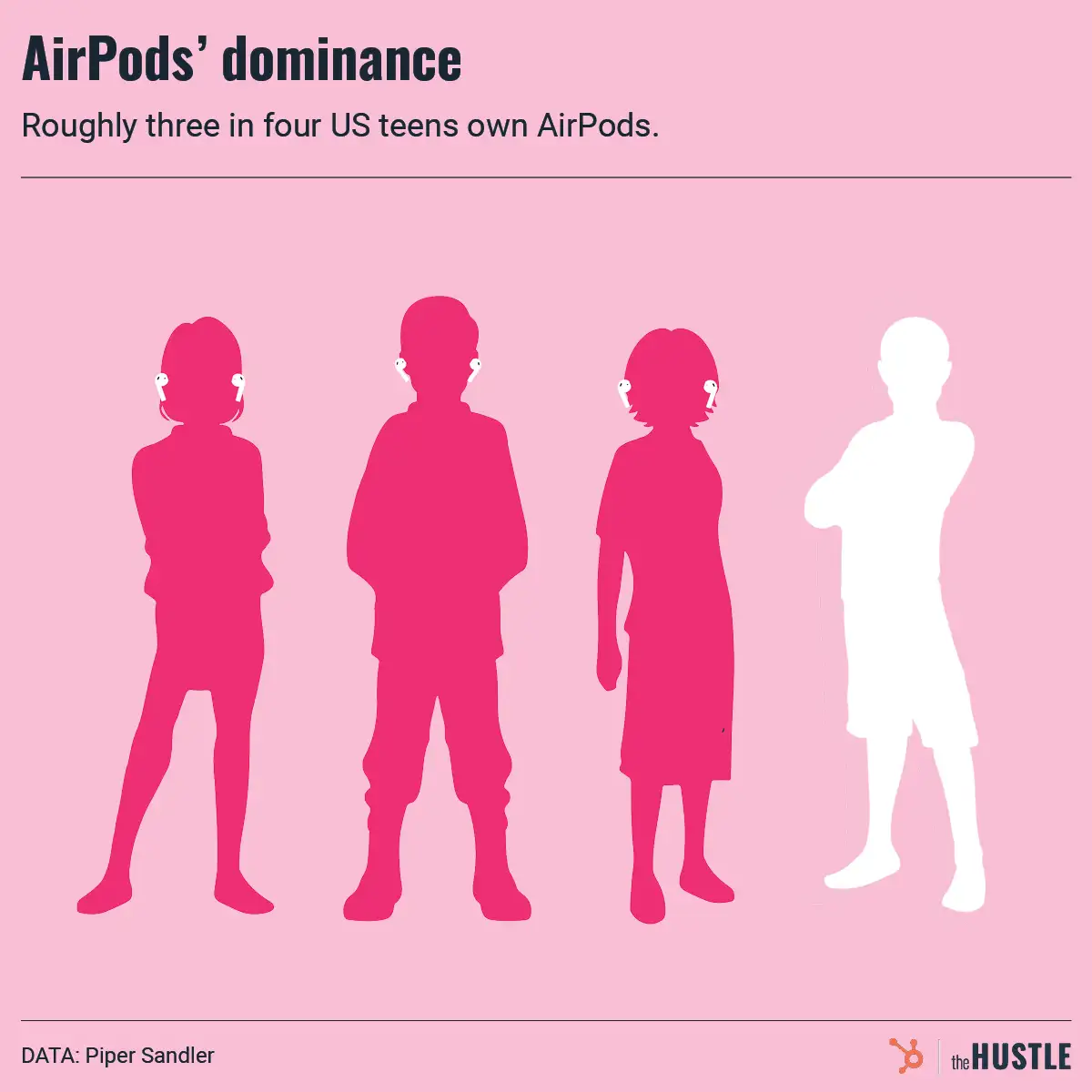

What AirPods say about the future of Apple

-

Digits: Jordan, Ferrari, and Yellen

-

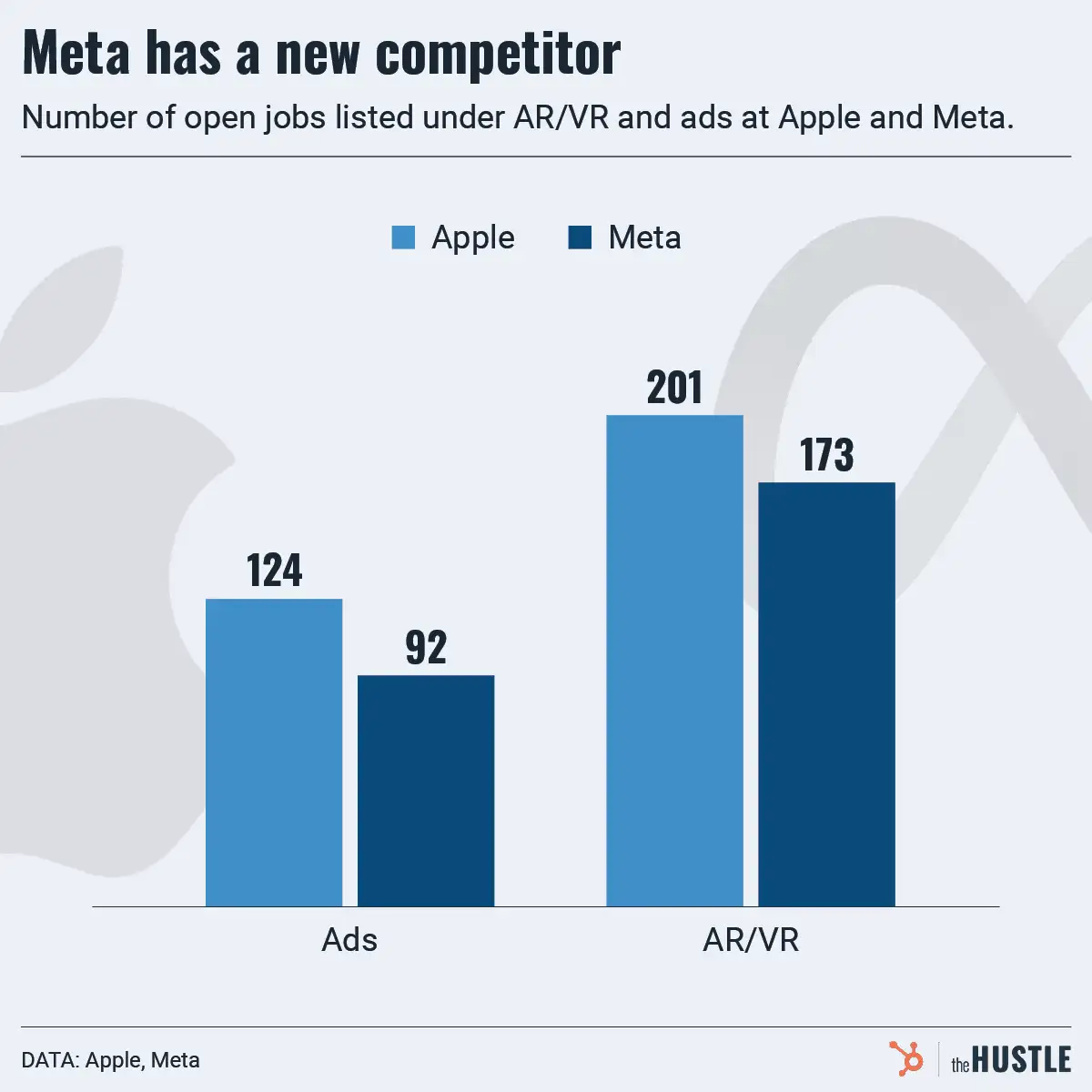

Are Apple and Meta rivals now?