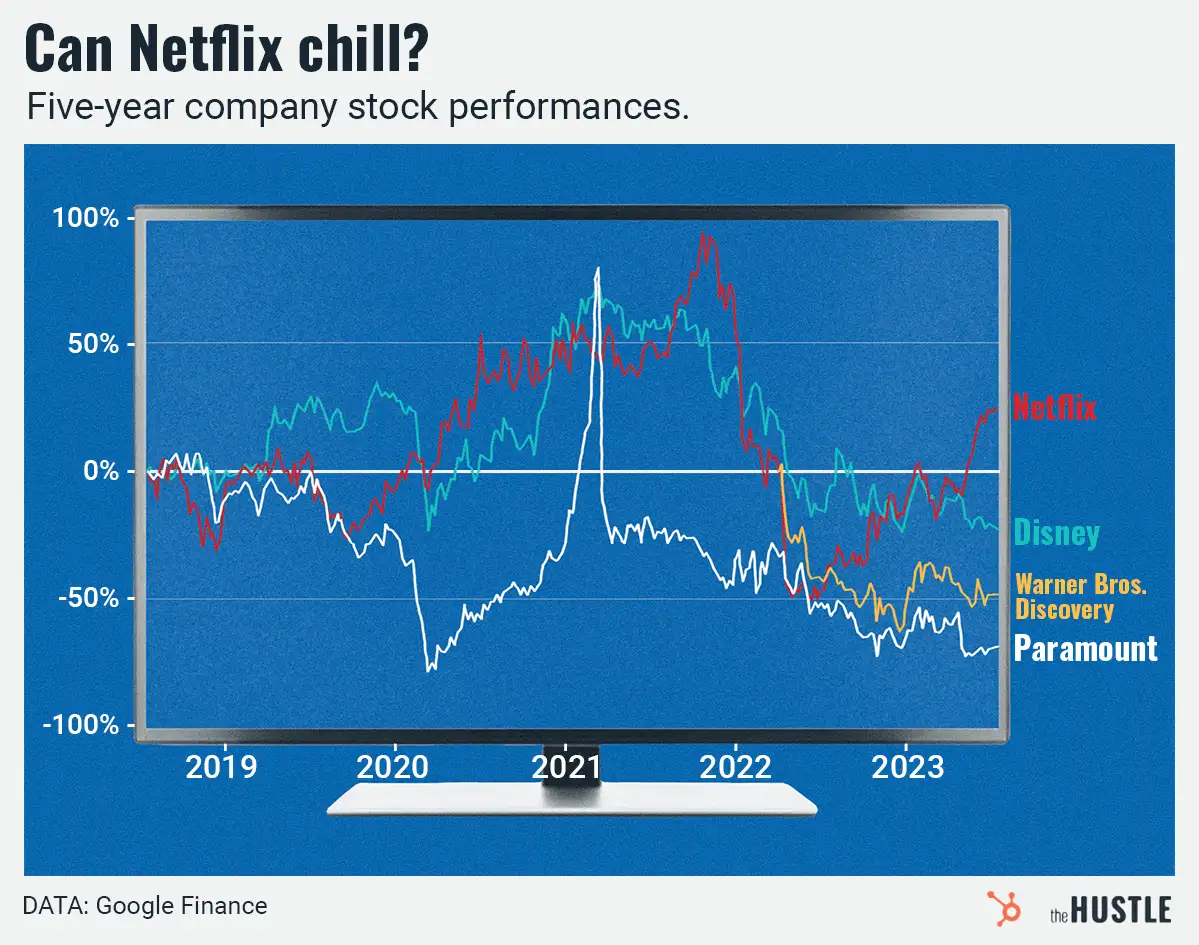

AT&T has reported positive earnings results for Q3, beating its revenue goals and showering WarnerMedia (formerly Time Warner) with the lion’s share of credit.

The telecom giant acquired Warner back in June for $85B with the intention of building a sustainable on-demand subscription video and advertising business.

And it seems WarnerMedia has delivered in its first full quarter with the company, boosting AT&T’s revenue by almost 7% year-over-year (around $8.2B).

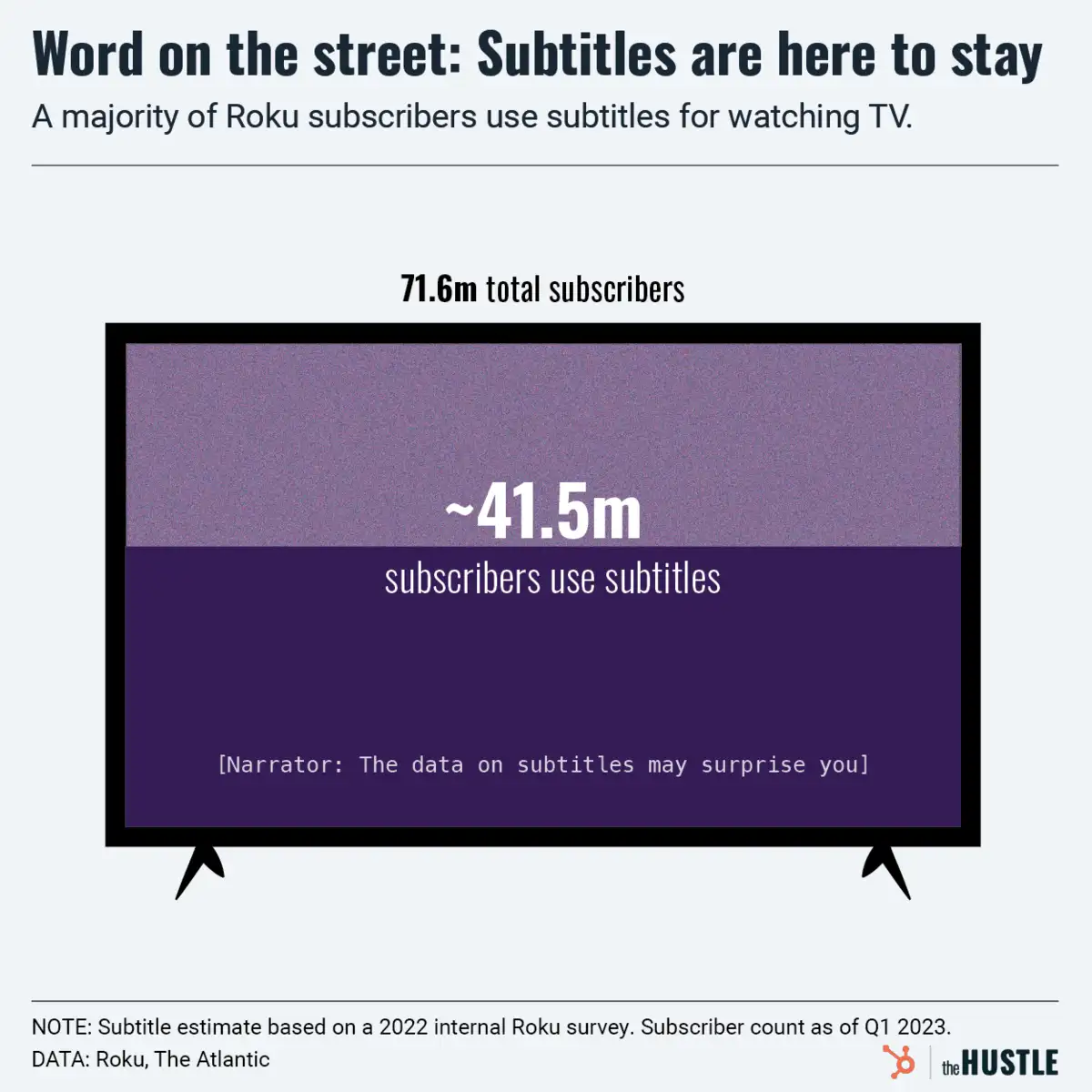

Xandr also put on a good show

AT&T’s advertising business, Xandr (born largely out of the acquisition), also performed well, boosting ad revenues 34%.

On the flip side, growth of its rival’s digital media business, Verizon’s Oath (formed last year by combining companies like AOL and Yahoo), has stayed flat.

But AT&T’s stock is still on the decline

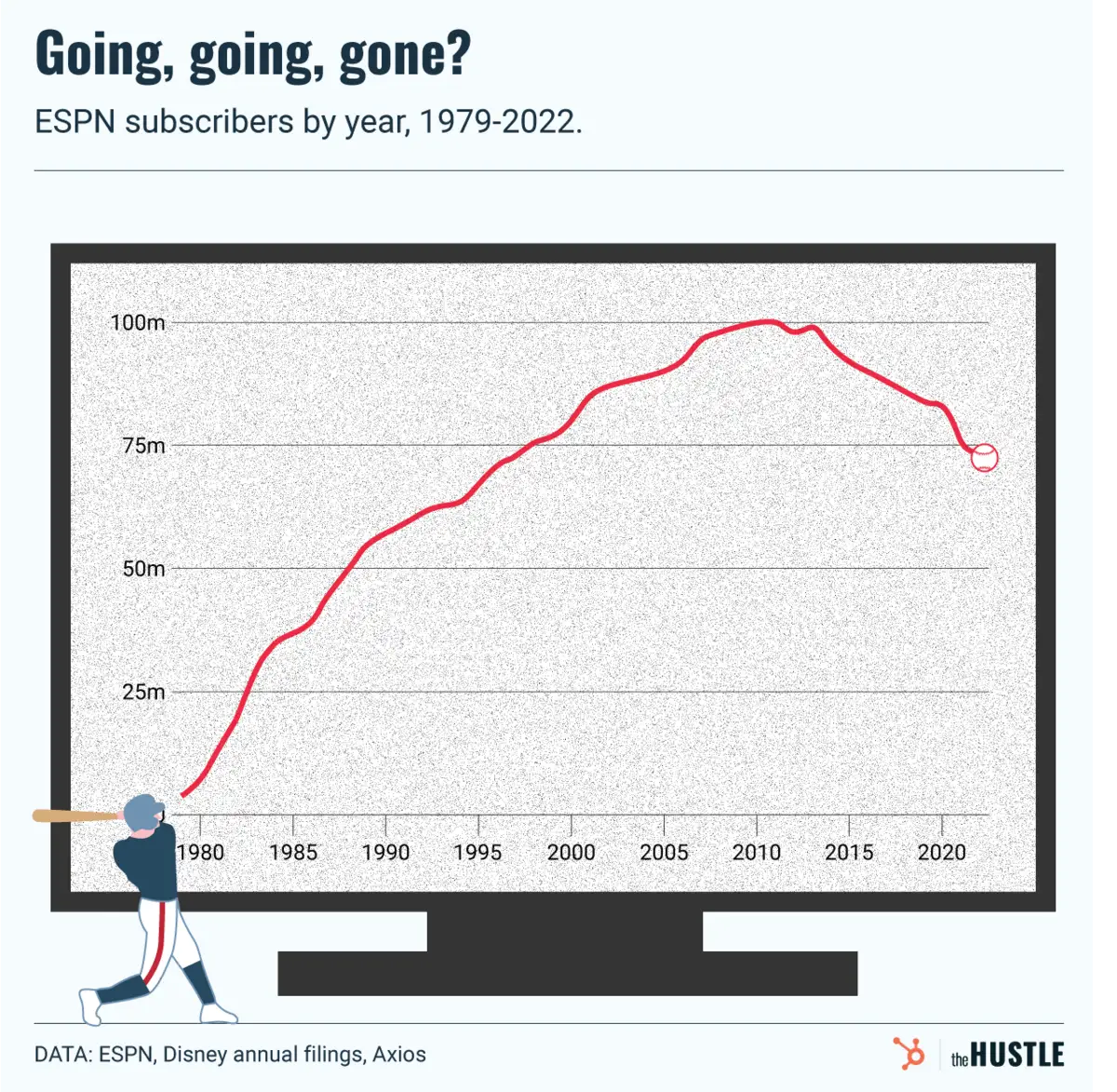

Ironically, while Warner may have helped earn AT&T some cash, they did no favors in the loyalty department. After 3 consecutive quarters of subscription gains, AT&T saw a surprising loss this quarter, losing 297k TV customers (analysts predicted gains of 53k).

And, since the Warner acquisition did haul in more on-demand subscription revenue this quarter, analysts believe Turner brand’s cable channels likely took the brunt of the subscription dip.