Zoom plans to report its quarterly earnings today, which gives us the chance to check in on one of quarantine’s best running jokes: Google Meet’s attempt to stymie Zoom’s astronomical growth.

Google’s desperation is best signified by the insertion of a comically large blue Google Meet button in every Google-related crevice.

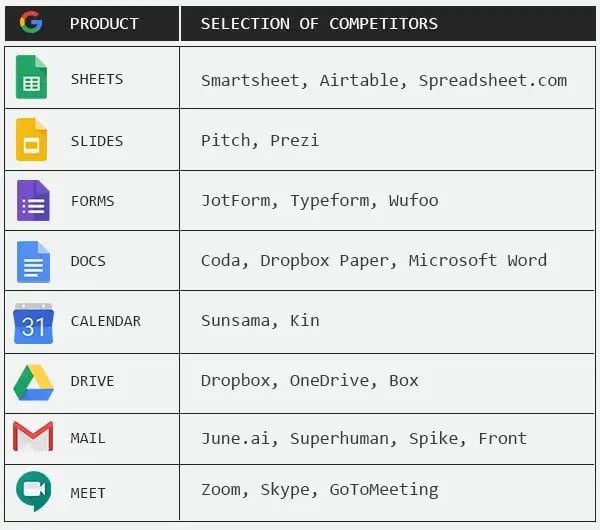

Ross Simmonds, founder of the B2B content strategy firm Foundation Inc., tells The Hustle that the battle is a perfect example of what he terms “the unbundling of G Suite.”

G Suite (Docs, Meet, Drive, etc.) is a drop in the bucket for Google

Google’s parent firm Alphabet reported Q2 2020 revenue of $38B, of which less than 10% came from its Google Cloud unit (which includes G Suite).

With >90% of Alphabet’s revenue still ad-based, the company’s lack of focus on G Suite is not surprising.

The strategy around its messaging and video chat strategy has been particularly bad. Apologies in advance for the PTSD, but do you remember: Google Talk, Google Voice, Google Hangout, Allo, or Duo?

G Suite’s historical lack of focus has put each product category up for grabs:

Zoom’s video chat rise has been undeniable

Zoom doubled its revenue guidance for the year and its market cap has increased 3x (to $85B) over the past 6 months.

In response, Google has focused its video chat efforts in recent months and leveraged its massive distribution advantage (1B+ Gmail users).

In addition to the offensively large blue button, Google Meet has added basic features that were (shockingly) unavailable pre-pandemic: Meet in web and mobile, tile layouts, high-quality audio, and customizable backgrounds.

The effort seems to have paid dividends, with a 30-fold usage increase from January-April.

Where else is Google vulnerable?

Simmonds has been impressed by Google’s response to Zoom but believes there are still opportunities to unbundle G Suite, “especially where Google is not focused.”

In addition to video, he says competition for alternatives to Sheets (e.g., Airtable) and GMail (e.g., Superhuman) is getting more and more crowded.

But, G Suite targets that could be ripe for the pickings include Slides, Forms, Calendar, and Keep.

Whatever competitor arises, there’s one sure way to know if they’re gaining traction: a big-a$$ blue Google button.