Steel producer Nucor will leverage federal tax cuts to build a $1.35B steel mill

After a big 2018, Nucor plans to create 400 new full-time jobs by the year 2022 after announcing it will build a $1.3B steel factory.

Published:

Updated:

Related Articles

-

-

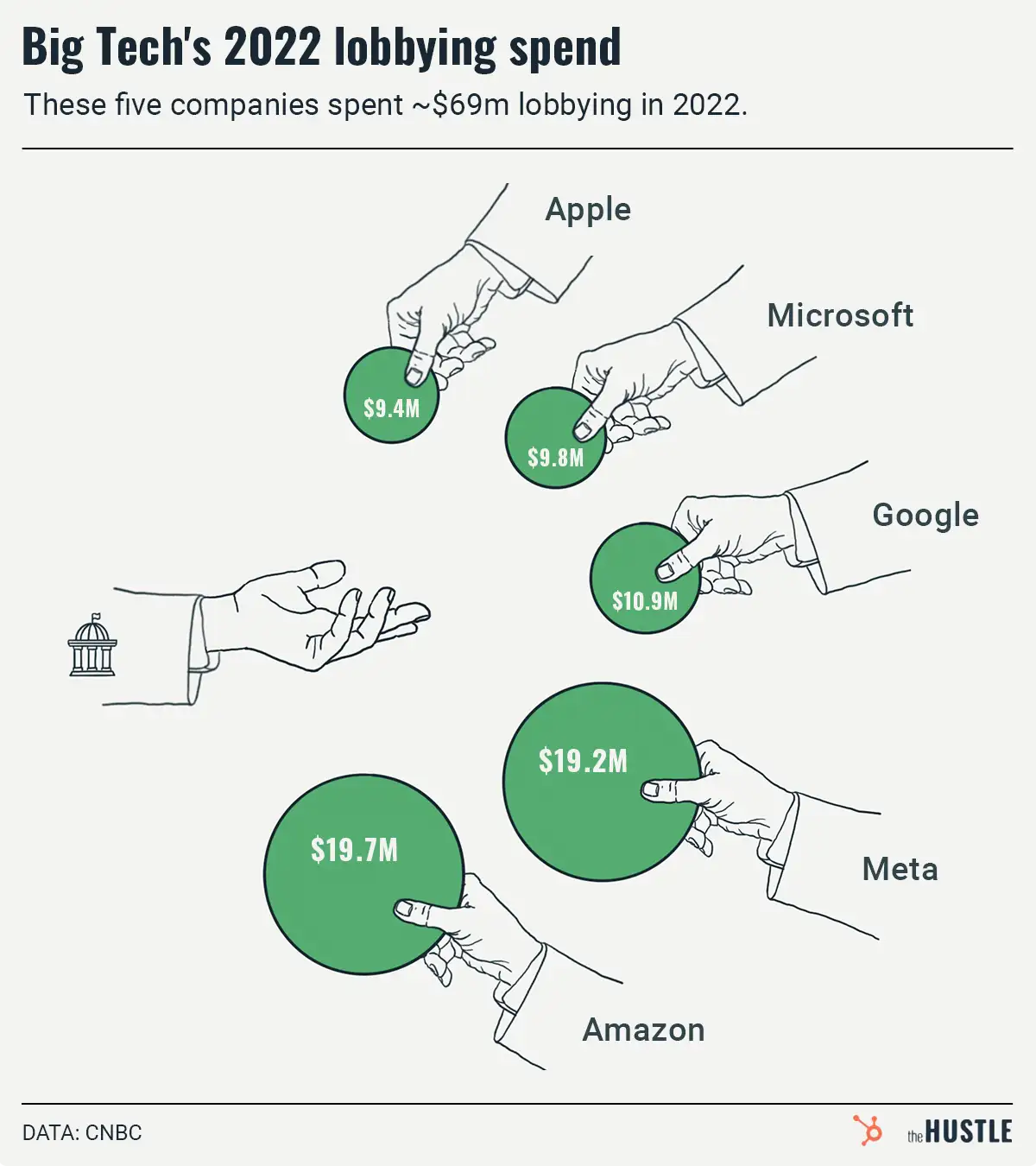

What the past year of tech lobbying looked like

-

The $1.4B prison phone call industry gets an overhaul

-

California fast-food workers could get $22/hr.

-

Timber! Lumber prices are falling hard

-

Could the climate bill help you nab an EV?

-

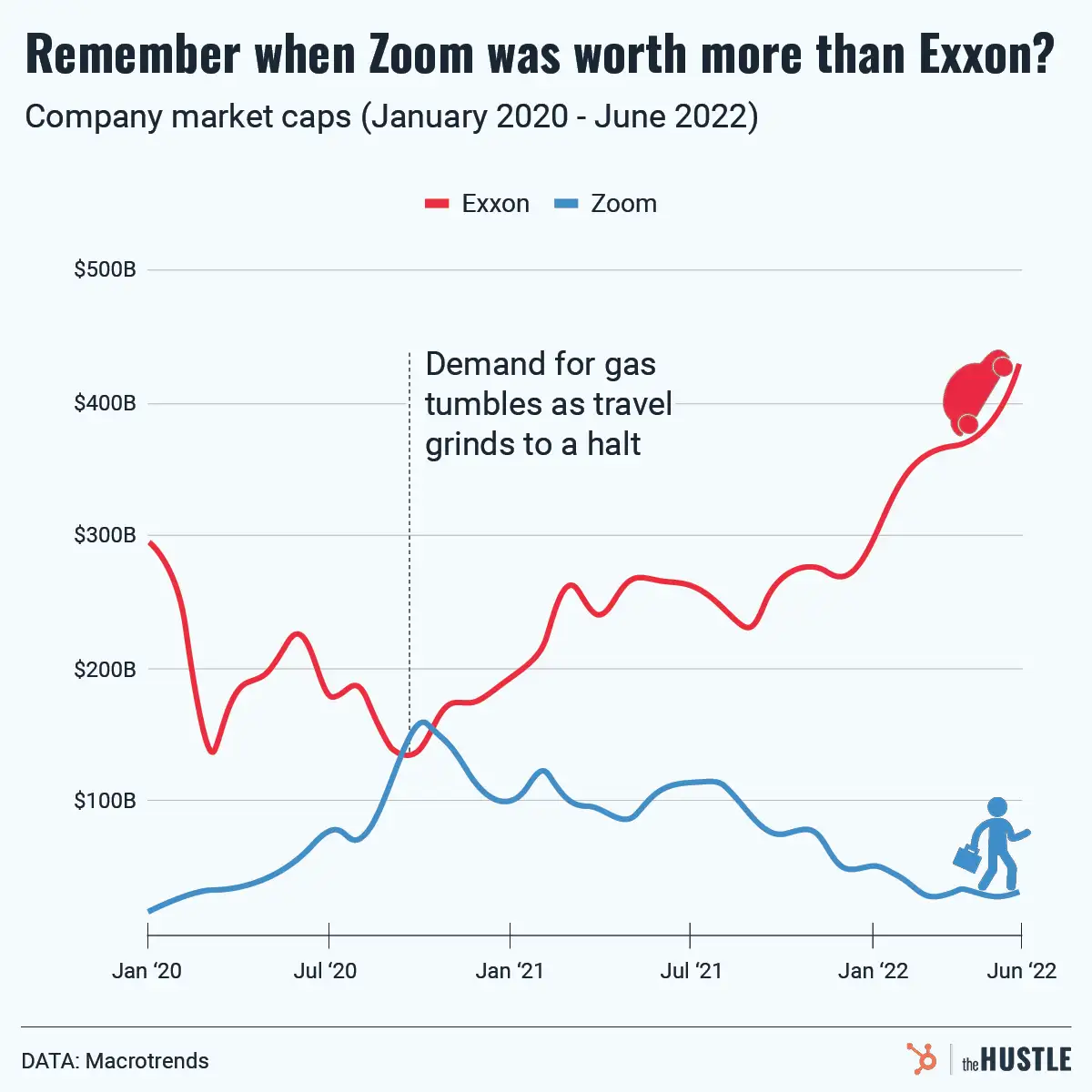

The news around gas prices, explained

-

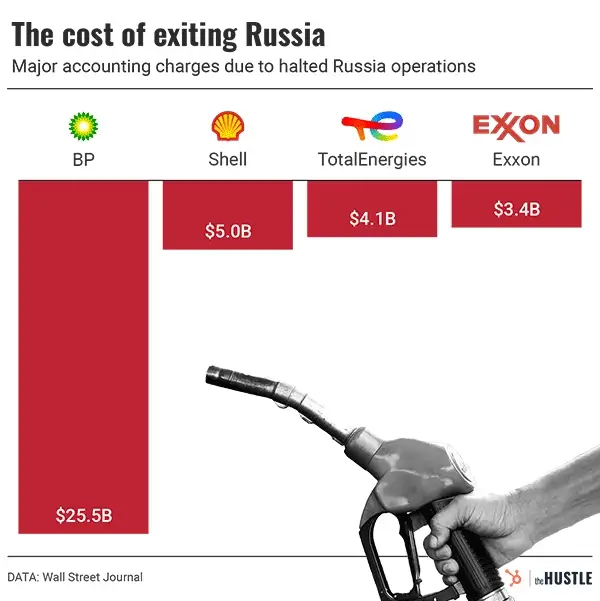

Backing out of Russia is costing oil companies billions

-

Digits: Terrible gas mileage, Coca-Cola cocaine, and more wild numbers

-

The trouble with TurboTax