Slack follows Spotify’s lead with a direct listing, and now IPO fundraising is optional

Slack plans to follow Spotify’s lead by listing directly without a fundraising IPO, and that could soon be normal.

Published:

Updated:

Related Articles

-

-

Big Tech power rankings: Where the 5 giants stand to start 2024

-

The government can read your push notifications

-

Enshittification just keeps happening

-

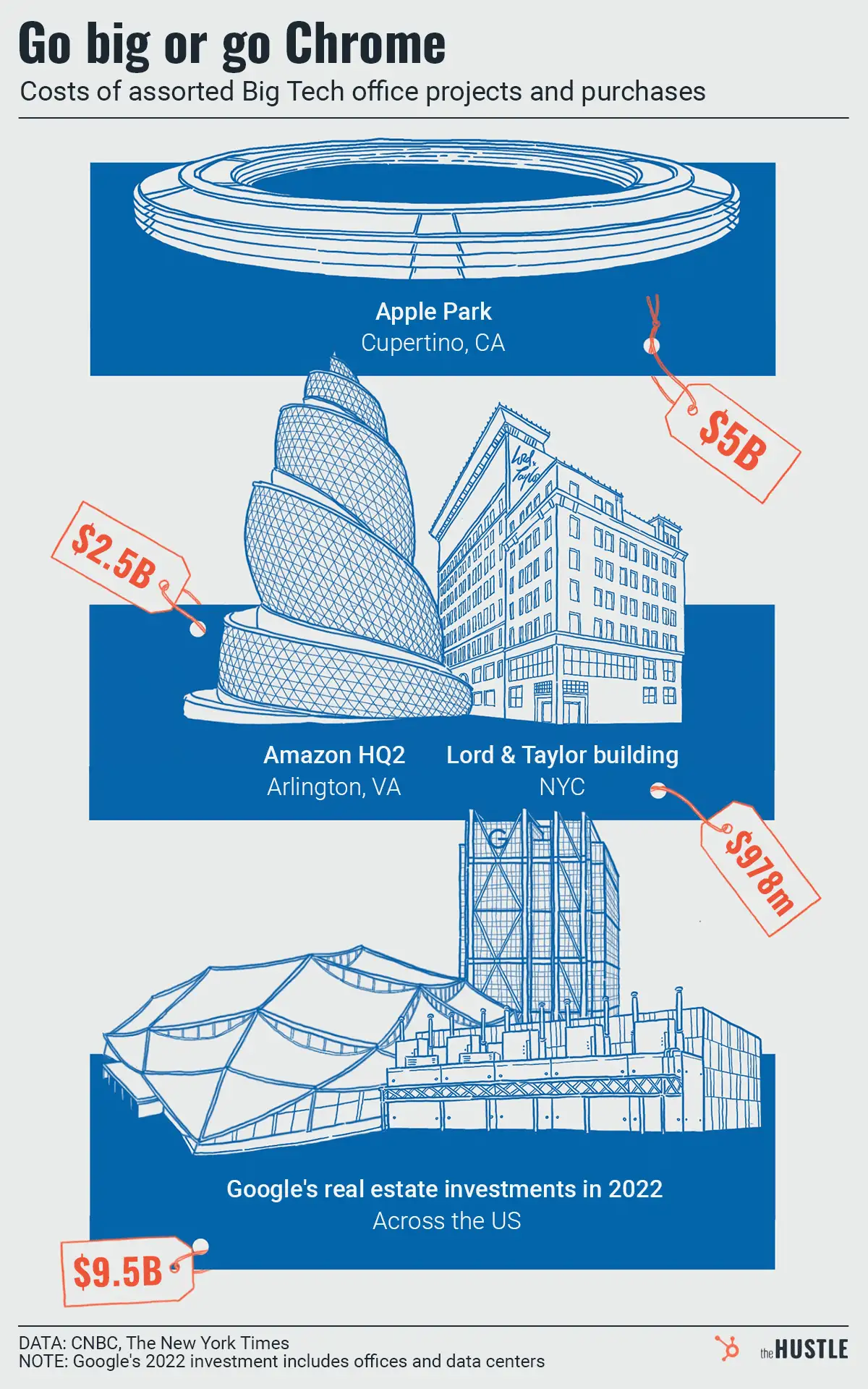

After years of building pricey playgrounds, Big Tech recalibrates

-

TikTok’s new plan to avoid getting banned in the US

-

Why are there so many tech layoffs?

-

Is eBay’s brief renaissance over?

-

Can Netflix be a lifestyle brand?

-

All rise: Emoji have entered the court