In March of 2012, Justin Thompson, a 20-year-old security technician from Livonia, Michigan, decided to go to the movies.

Inside, he encountered an atrocity we’re all familiar with: the movie theater concessions stand, with its $8 popcorn, $6 sodas, $5 candy bars.

Left with no alternative, Thompson indignantly bought a treat at an 800% markup. Then, he went home and sued AMC for charging “grossly excessive prices” on its snacks.

“He was taken for a ride,” Thompson’s lawyer, Kerry Korgan, told The Hustle. “I’m sorry, but you can go and get a bag of popcorn at any convenience store for next to nothing.”

The lawsuit was later dismissed, but it raised a question we’ve all asked: Why the hell are movie theater concessions so expensive?

We set out to find an answer — and it took us right to the heart of a declining industry’s business model.

The movie concessions “racket”

Before we dive into the why, let’s take a quick look at just how much you’re overpaying for snacks at the movie theater.

We dug through concessions data from AMC, Cinemark, and a number of other theater chains to compile rough averages of how much certain items cost. Then, we compared these prices to the typical street price you might pay at a convenience store.

It should be said that movie food and beverage prices vary widely by geographic region, theater size, and a number of other factors. In the course of our research, we saw popcorn prices as low as $0.99 and as high as $13.75. The figures you see here are rough, non-definitive industry averages — but they still paint a bleak picture.

Moviegoers pay the highest premium for popcorn.

At most major movie theaters, you’re looking at around $8 for a medium-sized bag of buttered popcorn — nearly the price of the average movie ticket ($9).

At 11 cups, the average medium-sized movie popcorn goes for $0.73/cup. By contrast, a 175-cup bag of genuine movie theater popcorn can be had on Amazon for $48.23, or about $0.27/cup.

A movie theater ICEE ($6.49) runs 4.4x more than a 7-Eleven Slurpee (which is the same thing), and a soda ($5.99) is 3x the cost of a store-bought Coke. One box of movie M&M’s ($4.79) could buy you nearly 3 boxes at your local Walmart.

For a simple date night (let’s say a popcorn to share, two sodas, and some Red Vines), you’re looking at $24.79 — more than the price of two average tickets ($18). For a family of 4, the cost of snacks might run up to $50 or more.

When we examine the markup (profit minus cost) on these products, the figures are even uglier.

Richard McKenzie, a professor at the University of California, Irvine, determined that it costs the average theater around $0.90 to produce a bag of popcorn. At $7.99, that’s a 788% markup.

Including the cup and a free refill, that $5.99 soft drink costs a theater $0.91 (a 558% markup); candy, which can be purchased wholesale for ~$1.16, isn’t far behind.

It’s easy to write this all off as simple price-gouging. After all, movie theaters have a captive audience — and once you’re inside, they have a monopoly on every secondary good you choose to purchase.

But the pricing of these concessions isn’t as simple as it seems.

Theaters don’t make much on tickets

Allen Michaan was just 19 when he built his first movie theater in the 1970s. In his 40-year career, he’s operated more than 20 cinemas, including the historic Grand Lake Theatre in Oakland, California.

As he tells it, pricey popcorn isn’t some diabolical price-gouging scheme — it’s the lifeblood of a theater’s business model.

“After the distributor takes its cut, we barely make money on ticket sales,” he says. “We have to make up for that somehow.”

When a theater wants to show a film, it must agree to pay the distributor a percentage of all ticket sales. This percentage is higher during the first few weeks of a film and decreases over time, but generally averages out to ~70%.

So, if a theater sells a movie ticket for $9, its cut is only $2.70 — and that’s without accounting for other expenses.

Theater owners could price tickets higher, but it wouldn’t do them much good since 70% of any increase goes straight to the studios. Instead, they think of movies as a loss leader: their primary goal is to get as many people through their doors as possible, even if it means breaking even (or losing money) on the price of admission.

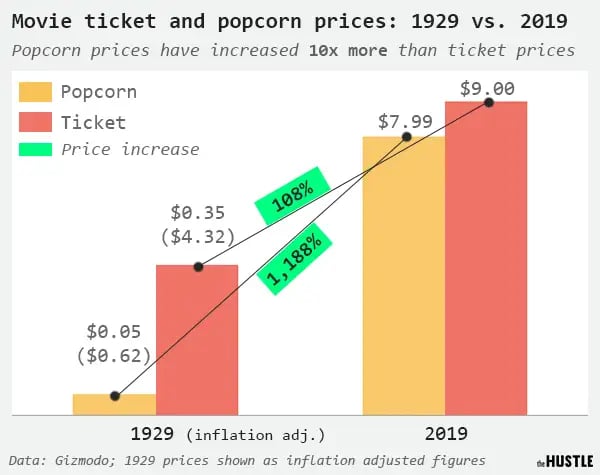

In fact, the price of a movie ticket hasn’t gone up much in the last 90 years. In 1929, a ticket was $0.35; today, it’s $9. Adjusted for inflation, that’s a fairly reasonable price increase of 108%.

The same can’t be said for movie popcorn: Over the same period, its price has gone up a whopping 1,188% — more than 10x the increase of a movie ticket.

Movie theaters’ margins are made not on their primary product (movie tickets), but on secondary products at the snack stand, where customers guzzle ICEEs and shove buttery kernels down their gullets.

“If we didn’t charge as much for concessions as we did, the tickets to the movies would cost $20,” the CEO of Regal Cinemas, the nation’s second-largest theater chain, told the Los Angeles Times in 2008.

To survive, Regal and other cinemas adhere to an old industry adage: “Find a good place to sell popcorn and build a movie theater there.”

The popcorn business

Unlike tickets, concession sales are not shared: theaters keep 100% of the revenue they generate. And this revenue generates much higher profits.

The Hustle looked through annual reports (2015-2018) from two leading movie chains (AMC and Cinemark) and found that concessions account for ~30% of total gross revenue, yet make up 45-50% of gross profits.

In 2018, Cinemark sold $1.8B in tickets at a cost of $1B (distributor fees). By contrast, concessions brought in $1.1B at a cost of just $181m — an 84% profit margin.

This strategy of selling a primary good at cost (or at a loss) and making the bulk of profit on a complementary good (like popcorn) is a form of the widely employed razor and blades business model. Microsoft, for instance, will sell its Xbox consoles at a steep loss to get people to buy them, then make healthy returns on games and accessories.

“Theaters are able to keep a positive profit because of concession sales,” says Ricard Gil, a business professor at Queen’s University in Canada.

Gil, along with a colleague from Stanford, analyzed 5 years’ worth of revenue data from a major movie chain and found a different motivation for expensive popcorn: Theaters use it as a way to price discriminate, or charge customers varying prices for the same experience (in this case, seeing a movie).

“There is a wide dispersion in willingness to pay for a movie experience,” says Gil. “How much a customer values her movie experience is positively correlated with her valuation of concession consumption.”

Some moviegoers value the experience of seeing a movie at $9 and buy only the ticket; others might value it at $23.50 (the price of a ticket, plus popcorn and an ICEE). Snacks enable a theater to segment its customer base into “high-value” and “low-value” groups.

Popcorn is no savior

Even with $8 popcorn and 84% profit margins, most movie theater owners aren’t living the high life.

“I’m not getting rich off what you pay for popcorn and soda,” says Paul Turner, who runs Darkside Cinema in Corvallis, Oregon. “I drive a 26-year-old van.”

Profits from popcorn, he says, are used to pay off the high overhead costs of running a theater: staff, rent, AC, utilities, and the constant upgrades (Surround Sound, IMAX, 3D) that consumers demand.

Popcorn also can’t salvage the bones of a declining industry.

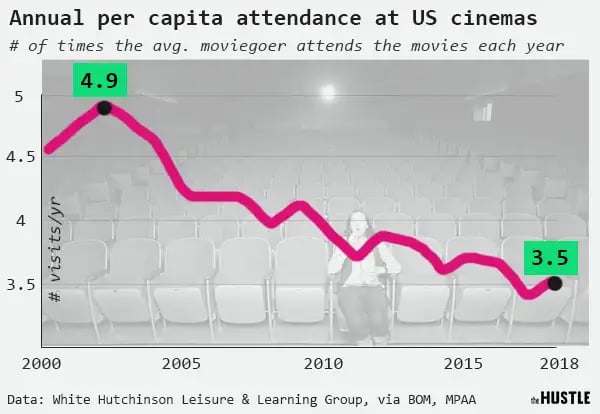

Less than 10% of the US population goes to the movies, compared to 65% in 1930. And those who do go are attending less: In 2018, the average moviegoer paid for only 3.5 tickets, down from 4.9 tickets in 2002.

As a result, the National Association of Theater Owners says the number of cinemas in the US has fallen from 7,477 to 5,869 (-22%) in the past 20 years.

Consumers have cited the high cost of tickets and concessions as a main deterrent to seeing a movie. In turn, theaters have made efforts to lower these prices, ranging from refillable popcorn buckets to annual subscription models.

But at the end of the day, some customers, like Gil (the economist who examined outrageous snack prices), are still willing to pay for the experience — even if it comes with 788% markups.

“I have young kids, so going to the movies is almost a utopia,” he says, “And when I go, I certainly buy popcorn.”