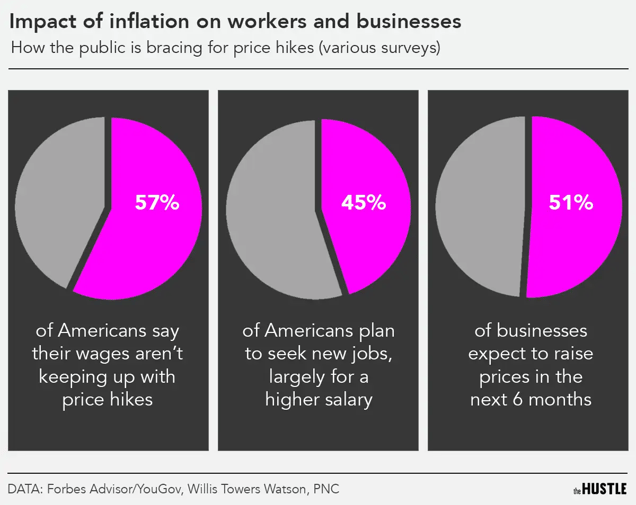

As America continues to reckon with inflation, neither businesses nor everyday people feel good about their financial situations.

Zachary Crockett / The Hustle

It all means that conditions are ripe for a perplexing phenomenon.

“This is the complete dynamic that you need… to develop inflationary psychology,” Richard Curtin, an economist at the University of Michigan, told The Hustle.

Inflationary psychology is when:

- Consumers speed up purchases or seek higher salaries because they believe prices will rise in the future

- Businesses raise prices in anticipation that costs will go up in the future..

But to really understand this phenomenon, we have to step back to the roots of America’s current inflation problem.

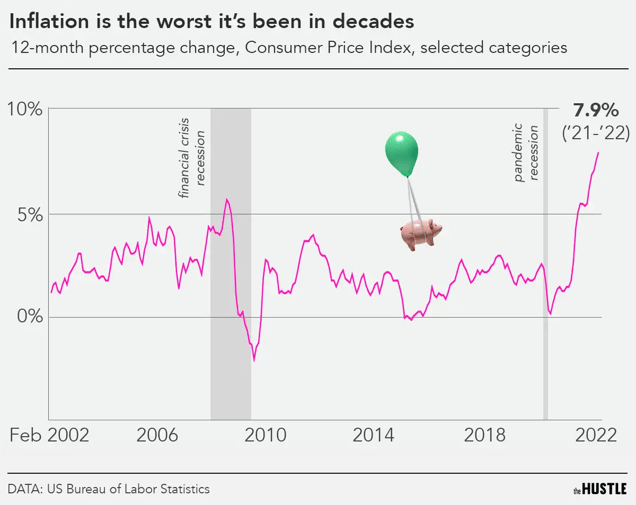

In February 2022, prices across all American goods were up 7.9% compared to February 2021. The average American is expected to need an additional ~$5k this year to live the same life they did last year.

Zachary Crockett / The Hustle

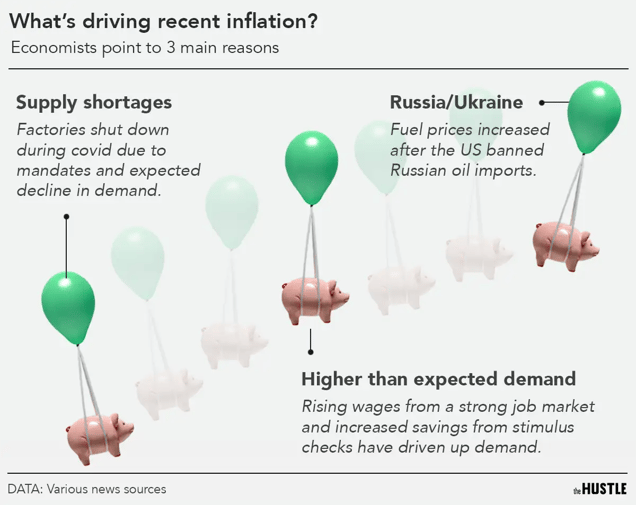

Economists have pointed to 3 root causes for this recent inflation.

- Supply shortages from covid: Many factories shut down during the pandemic because of covid precautions and an expected loss of demand.

- Higher than expected demand: Demand has been high because of rising wages from a strong job market, increased savings from government stimulus checks, and pent-up spending that was curtailed in the earlier stages of the pandemic.

- Russia’s war against Ukraine: Fuel prices have increased after the US banned Russian oil imports, and food prices may rise with a reduction in Ukrainian wheat and fertilizers.

A solution is easy to identify, but difficult to execute: shoring up supply chains, controlling demand (potentially through raising interest rates), and negotiating an end to the crisis in Ukraine.

Zachary Crockett / The Hustle

Now, here’s where inflationary psychology comes in.

A new problem could arise if average people and businesses expect inflation to continue far into the future, regardless of whether steps have been taken to reduce the original causes of inflation.

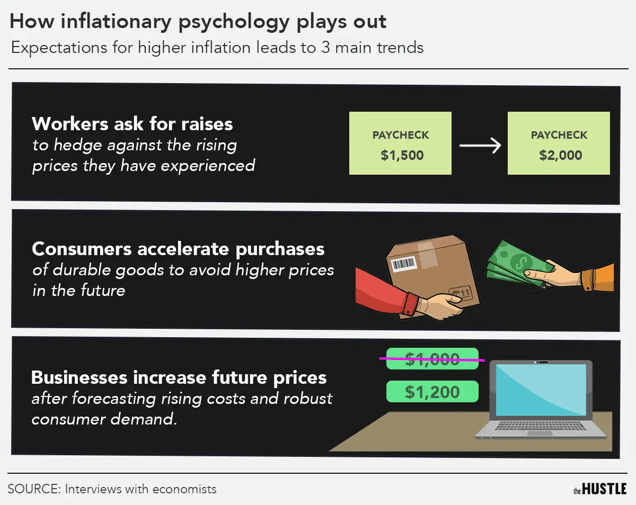

Expectations for high inflation lead to 3 trends:

- Workers ask for raises to hedge against the rising prices they have experienced.

- Consumers accelerate purchases of goods to avoid higher prices in the future. Research has shown that households are 8% more likely to buy durable goods (cars, refrigerators, etc.) when they expect a bump in inflation.

- Businesses increase future prices after forecasting rising costs and robust consumer demand.

In other words, the perceived need for a higher salary and for higher prices to withstand future inflation leads to higher prices and higher salaries. And inflation keeps churning on.

This cycle is kind of like a game of musical chairs.

Businesses and people know inflation will end at some point, but they want to obtain the best possible outcome before it’s over. So they race around the circle faster and faster, asking for increasing wages and sending costs higher and higher.

The deeper inflationary psychology takes hold, the harder it is to shake off and the longer the cycle continues.

Zachary Crockett / The Hustle

In his 1971 State of the Union, Richard Nixon noted that inflationary psychology had “gripped our nation so tightly for so long.”

Nixon tried to stop inflationary psychology by instituting wage and price controls, but his plan failed. His successor, Gerald Ford, organized the Whip Inflation Now campaign, urging disciplined spending habits and personal savings. That didn’t work, either.

This cycle of inflation, which started in 1965, didn’t end until the early ’80s, when then-Federal Reserve Chair Paul Volcker increased interest rates from ~10% to ~20%, crashing the economy into a recession in the process.

“Every administration thought they had power to end inflation but they really didn’t,” Curtin said. “And I think now you can see that same sense of overconfidence in the ability of the government to control inflation.”

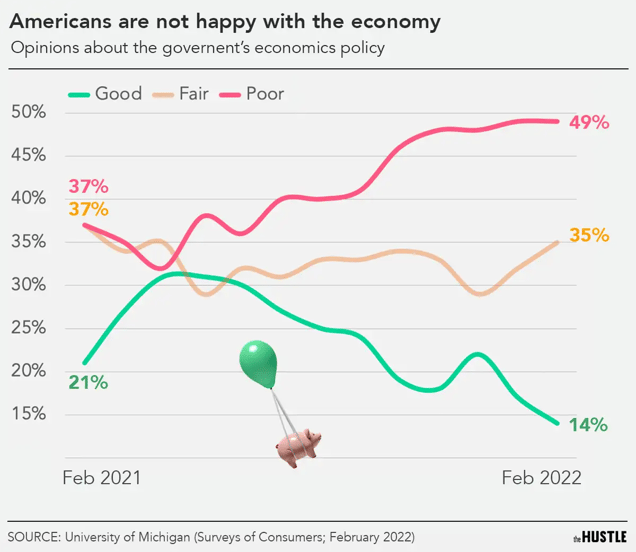

In a February consumer survey, Curtin found mixed signs for whether inflationary psychology was starting to take hold.

- The good news: ~10% of respondents were buying goods now out of fear of price increases, mostly for houses. In the 1970s, the rate was ~50%.

- The bad news: 49% of respondents unfavorably assessed the federal government’s economic policies. That share was up from 37% in February 2021.

Zachary Crockett / The Hustle

The lack of confidence means many Americans fear the government isn’t doing the right thing to stop inflation.

And the great fear of inflationary psychology is that perception can turn into reality.