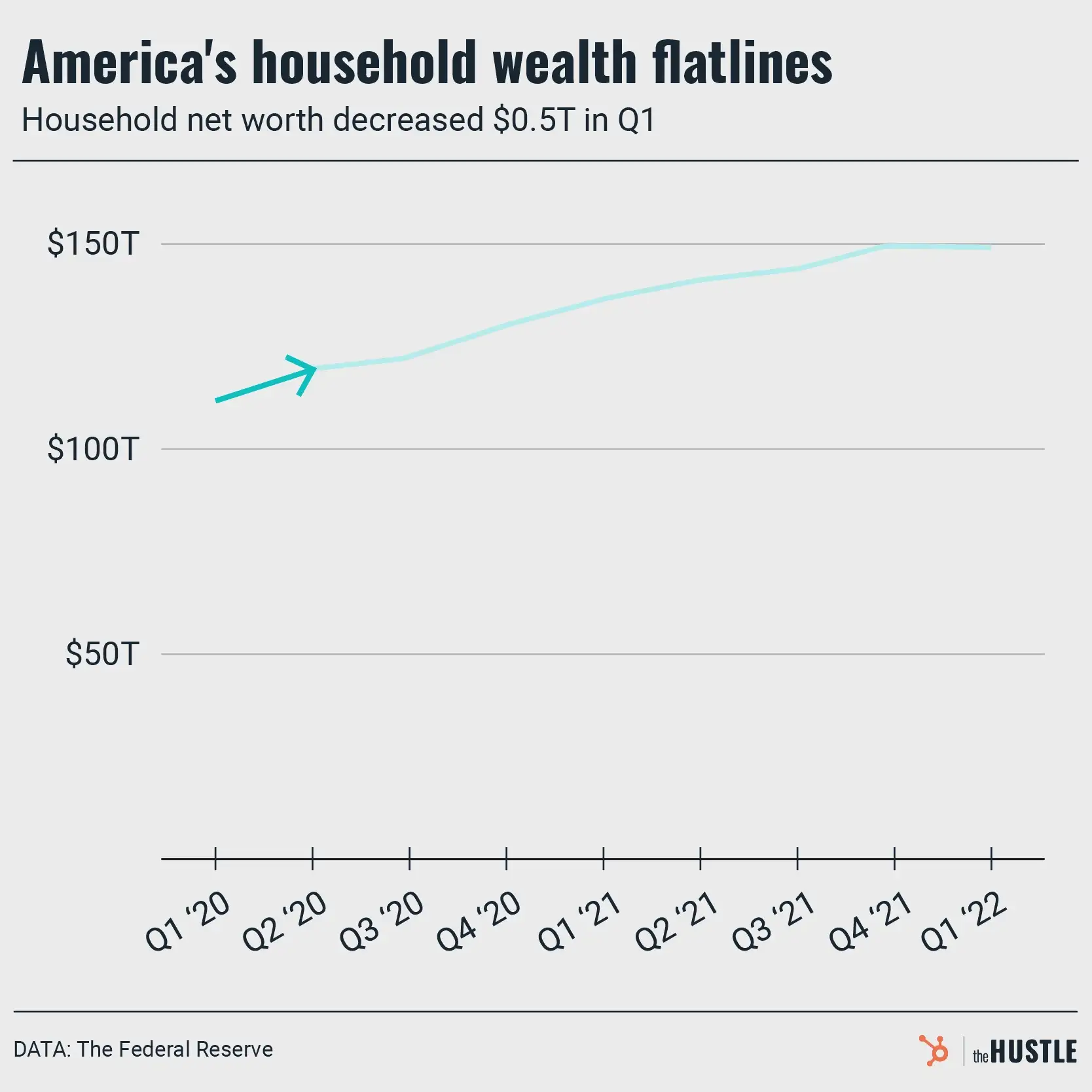

US household net worth dropped in Q1 of 2022, the first dip in two years, per the Federal Reserve. This was largely driven by the stock market’s recent downtown.

What’s that mean?

Overall, household net worth decreased by $540B to $149.3T.

Household net worth is determined by subtracting liabilities from assets.

- Liabilities include debt, which grew 8.3%, slightly more than last quarter.

- Assets include the things you own, like real estate.

Real estate values jumped $1.6T this quarter, but that wasn’t enough to fully offset a $3T drop in the value of corporate equities — AKA stocks — held by households.

The last decline came in Q1 2020…

… at the beginning of the pandemic. But as many homes received stimulus payments, net worth rose to a record $149.8T in Q4 of 2021.

Now, even with stocks down, bank accounts remain $39T above pre-pandemic levels, per Bloomberg.

Meanwhile…

… inflation rose 8.6% YoY in May, the highest increase since 1981. In the past year, fuel prices alone are up 106.7%. In an effort to curb this, the Federal Reserve has raised interest rates.

And according to MarketWatch, it’s the financial health of US households that will determine whether the economy can withstand those hikes.