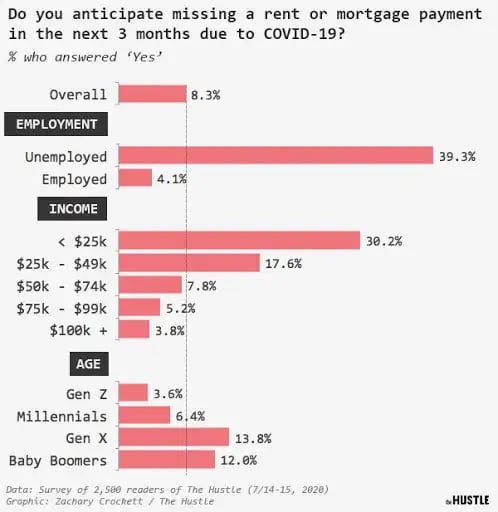

Yesterday, we asked you if you anticipate missing a rent or mortgage payment in the next 3 months due to the economic fallout of COVID-19. ~2.5k of you answered our survey.

The Hustle’s readership skews higher-income than the median American household. A few stats on our respondents:

- Average annual income = $113k (nat. avg. = $63k)

- 69% live in a house; 31% live in an apartment/condo

- 64% pay a mortgage; 36% pay rent

- Average monthly rent/mortgage = $1,844 (nat. avg. = $1,465)

- ~12% are currently unemployed (nat. avg. = 47%)

Caveats aside, let’s take a look at a few findings.

First off, 8.3% of all respondents said they anticipate missing a rent payment in the next 3 months.

To put this figure in context: An apples-to-apples comparison is hard to come by, but one recent survey found 32% of US households had trouble making their housing payments for July. Renters struggled more than homeowners.

More from our findings:

A recent Pew poll found that lower-income Americans (making less than $25k/yr) are facing more food insecurity, and COVID-19-related feelings of depression and hopelessness, than Americans making $100k+/yr. Lower income Americans have also been hit harder by job losses.

Our results mirror that theme: Unemployed and lower-income respondents are up to 5x as likely to say they’ll miss a payment in the next 3 months.

With the extra $600 a week in unemployment benefits set to expire this month, these tensions will likely get worse.

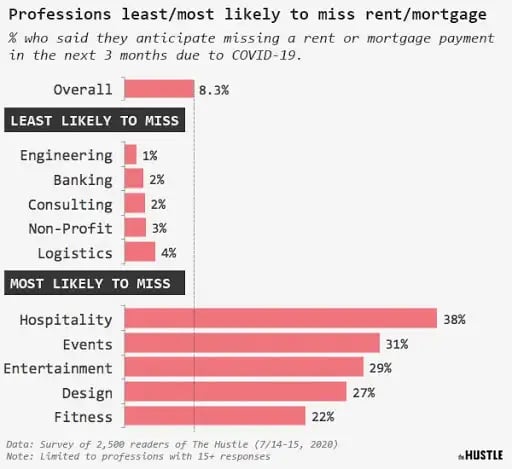

Which industries are feeling the squeeze

Readers who work in fields that have seen fewer widespread layoffs (engineering, banking, management consulting) were far less likely to anticipate missing a rent check.

Workers in harder-hit sectors like hospitality and events don’t have the same optimism, especially with businesses shutting back down in some areas:

- A fitness trainer in Irvine, California told us: “With gyms closing yet again in my county and the relief ending in a few weeks I will be totally screwed… At this point in time the unemployment plus the $600 is more than I can make at work without clients.”

A hair stylist in LA said: “Since reopening a few weeks ago here in Los Angeles, my freelance biz was going well so I have been renting a chair at a new shop, but now salons and barbers are closing again, and I cannot afford to pay rent where I live and where I work.”

If you need help

Many cities and states have limited landlords’ ability to remove tenants for late payments. The National Low Income Housing Association compiled a list of rental-assistance programs that are available around the country.