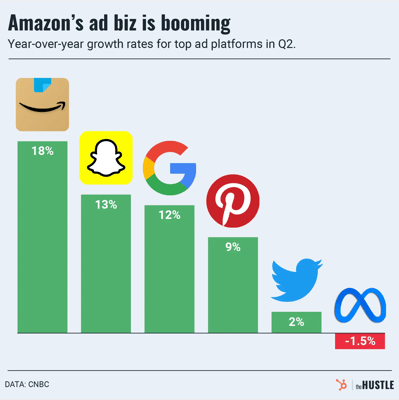

Amazon’s ad biz is growing faster than its rivals

Amazon’s digital ads are appealing to brands, resulting in faster growth than its rival.

Published:

Updated:

Related Articles

-

-

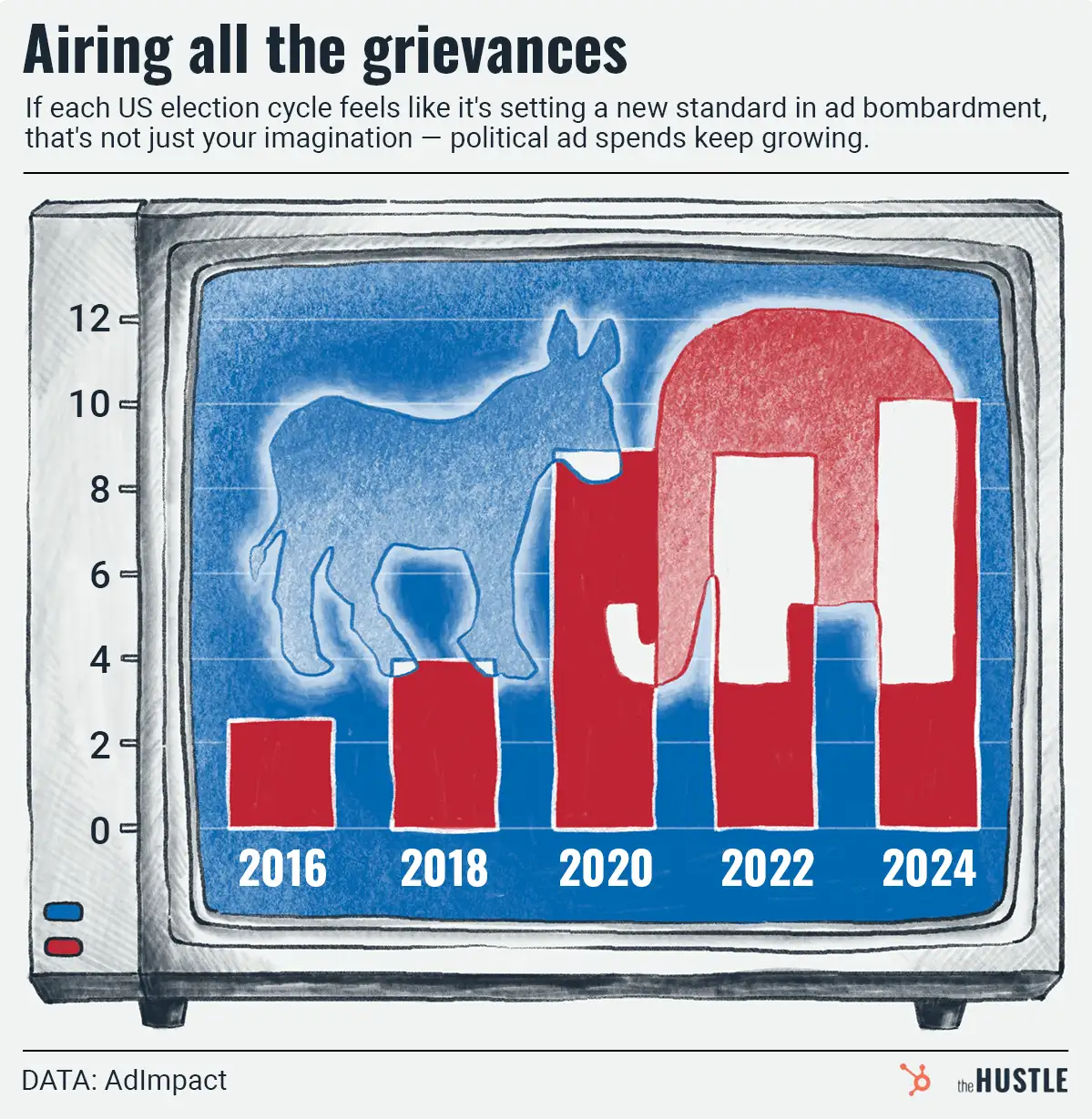

The local TV business approves this message

-

No, we do not want Amazon Music Unlimited

-

Is the ‘Big One’ about to drop on Amazon?

-

This TV could be your new best friend — but, like, a terrible friend who gossips about you constantly

-

Bowling balls, nipple clamps, rubber chickens: Essential or not, you can get ‘em on Amazon

-

Amazon labels its ‘frequently returned’ items

-

Amazon’s Virginia bummer

-

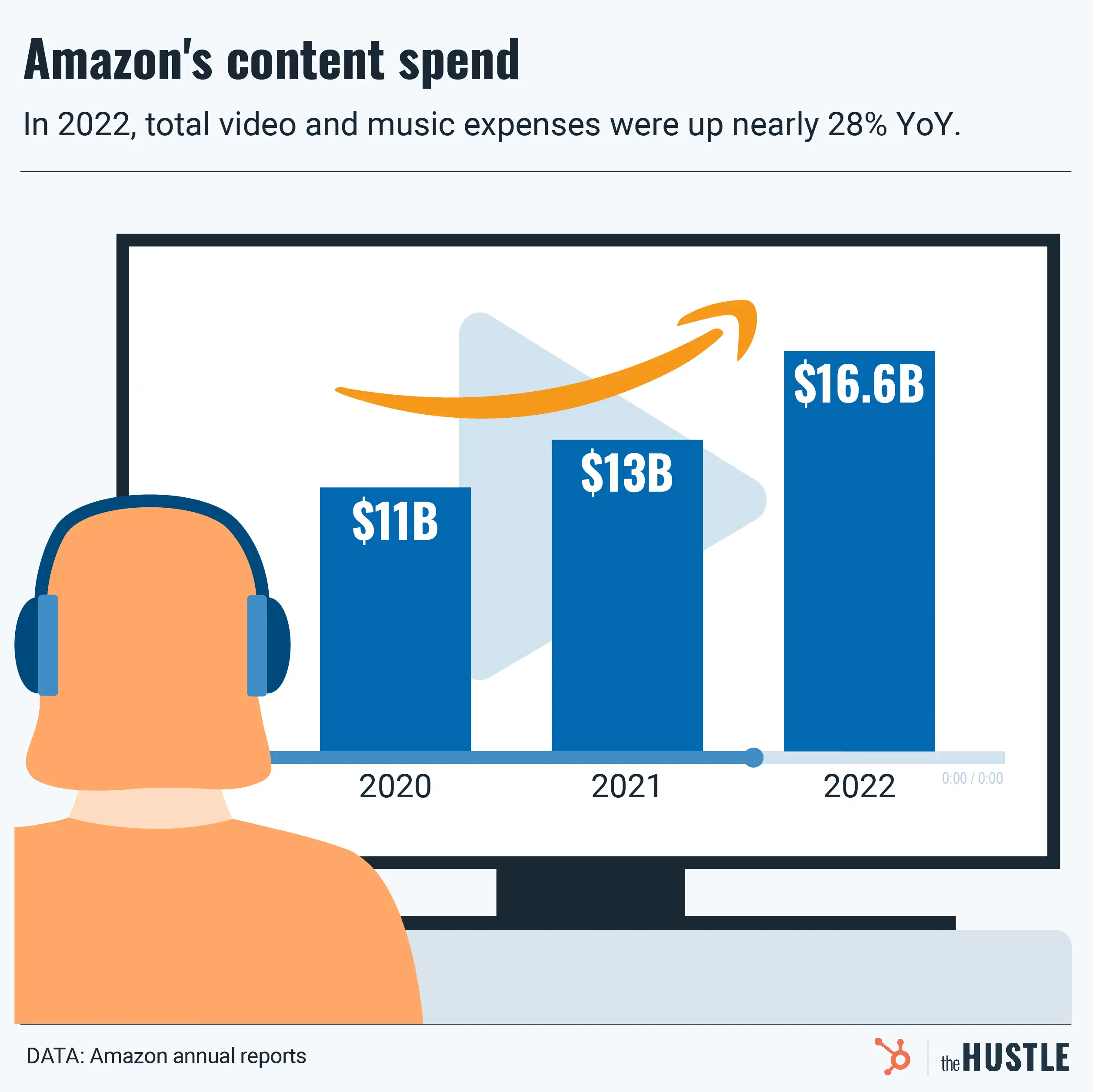

Amazon says its media moves are working

-

RIP, AmazonSmile