Fadeaway: Nike’s latest pivot is bad for brick-and- mortar retail

Published:

Updated:

Need the full story?

Sign up for The Hustle to get the business world's wildest stories delivered daily. This one's on us.

Related Articles

-

-

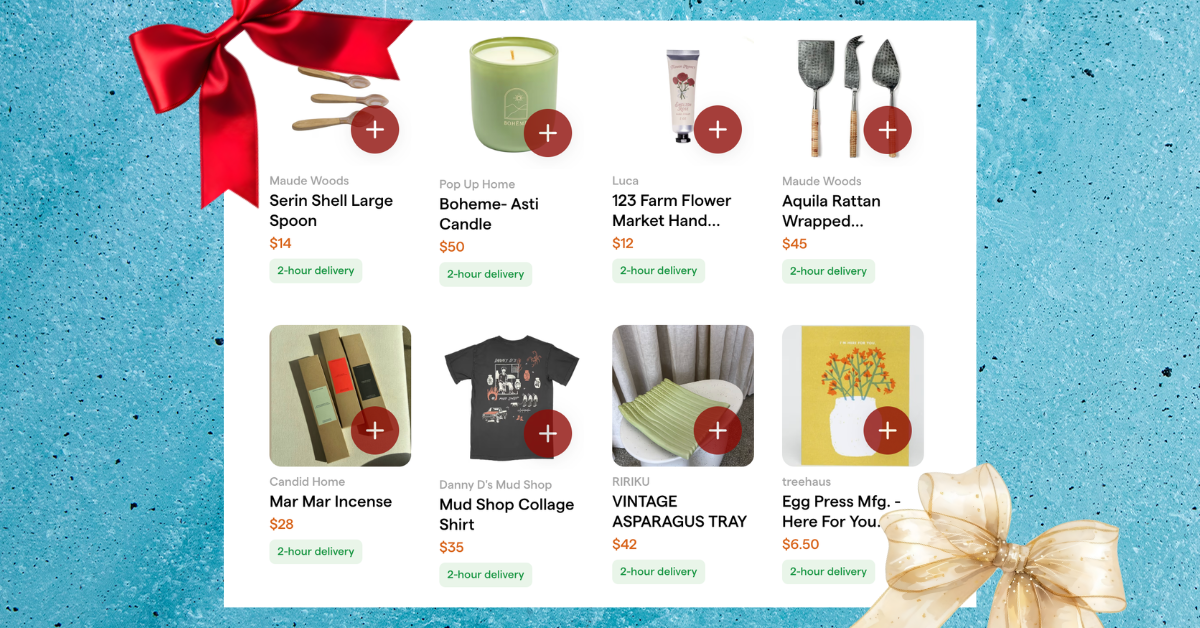

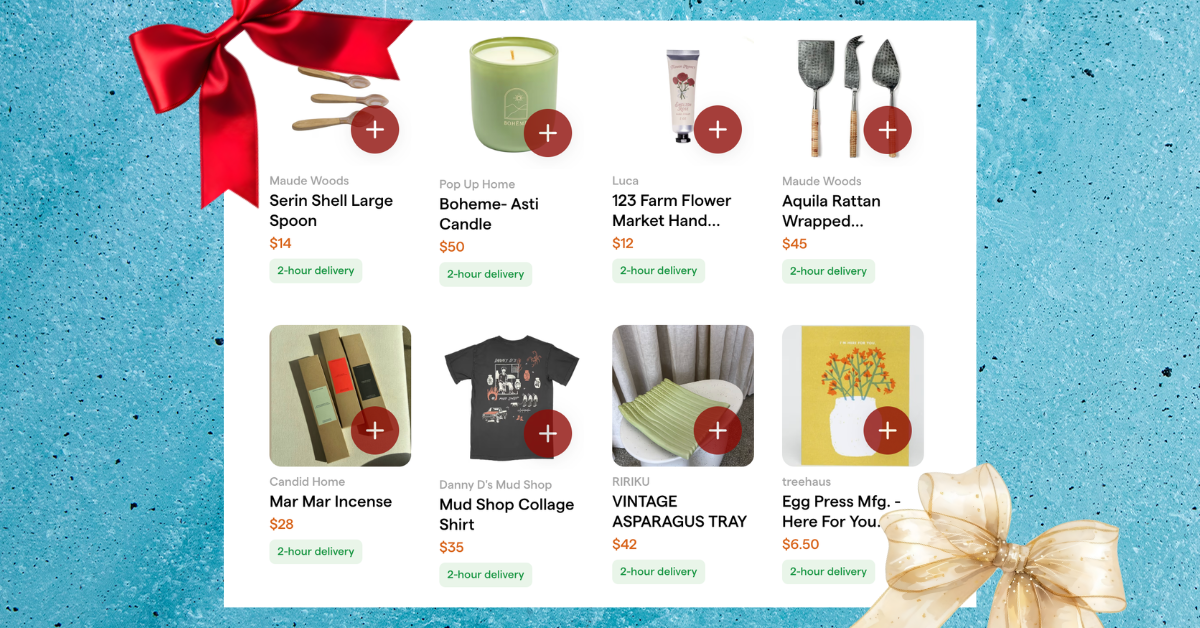

Hate making returns? Hire someone to do it for you

-

In a digital world, people still love a good fountain pen

-

A growing hunger for scents good enough to eat

-

Atlanta funded a grocery store — and more are on the way

-

Blind boxes are set to take over Christmas

-

Goodwill got a glow-up

-

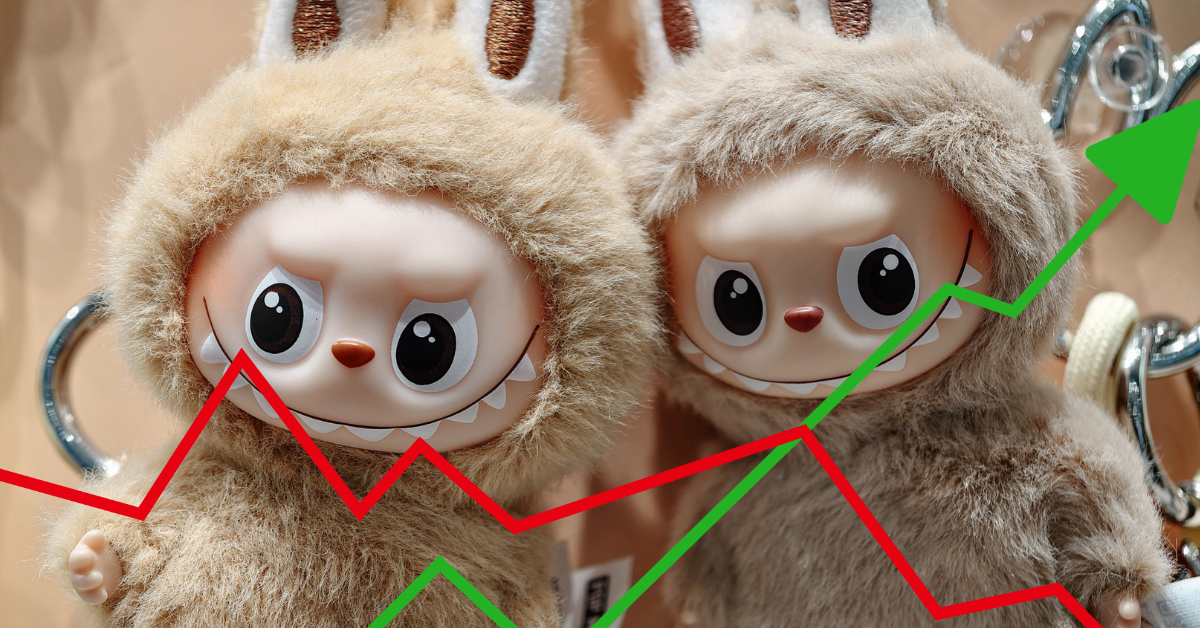

Now you can bet on Labubus and sneakers

-

Beauty brands for dogs have arrived — Is anyone surprised?

-

Move over, Spirit Halloween. Enter, Urban Air Adventure Park