Aston Martin’s London Stock Exchange debut was… not what James Bond was hoping for

Published:

Updated:

Need the full story?

Sign up for The Hustle to get the business world's wildest stories delivered daily. This one's on us.

Related Articles

-

-

Luxury brands seek a miracle inside their (ostentatious, overpriced) bag of tricks

-

Cold plunges are going corporate

-

Soho House brings exclusivity to the masses

-

On the rocks, please: Luxury ice is in

-

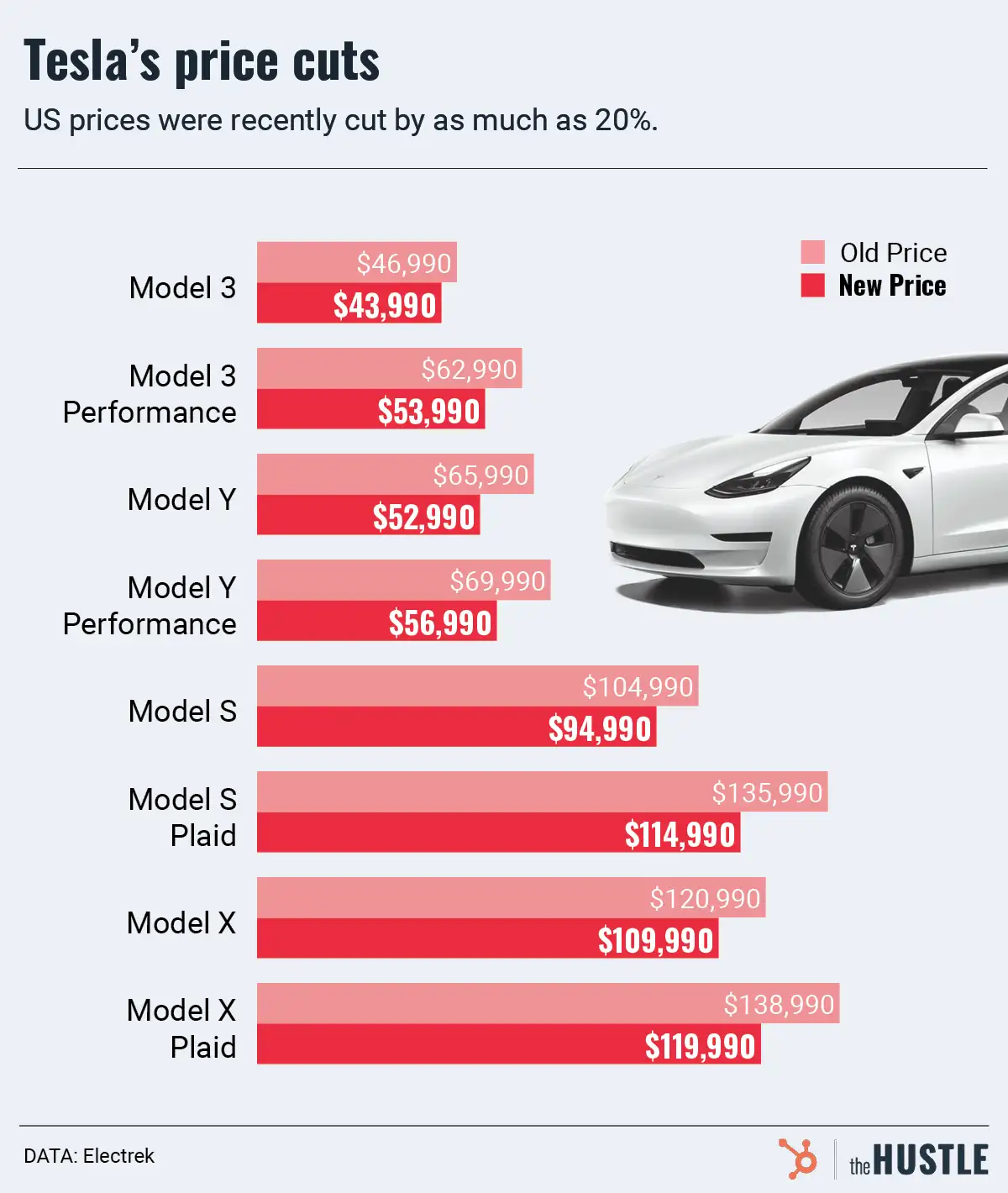

What to know about Tesla slashing prices

-

The ice bath business is on fire

-

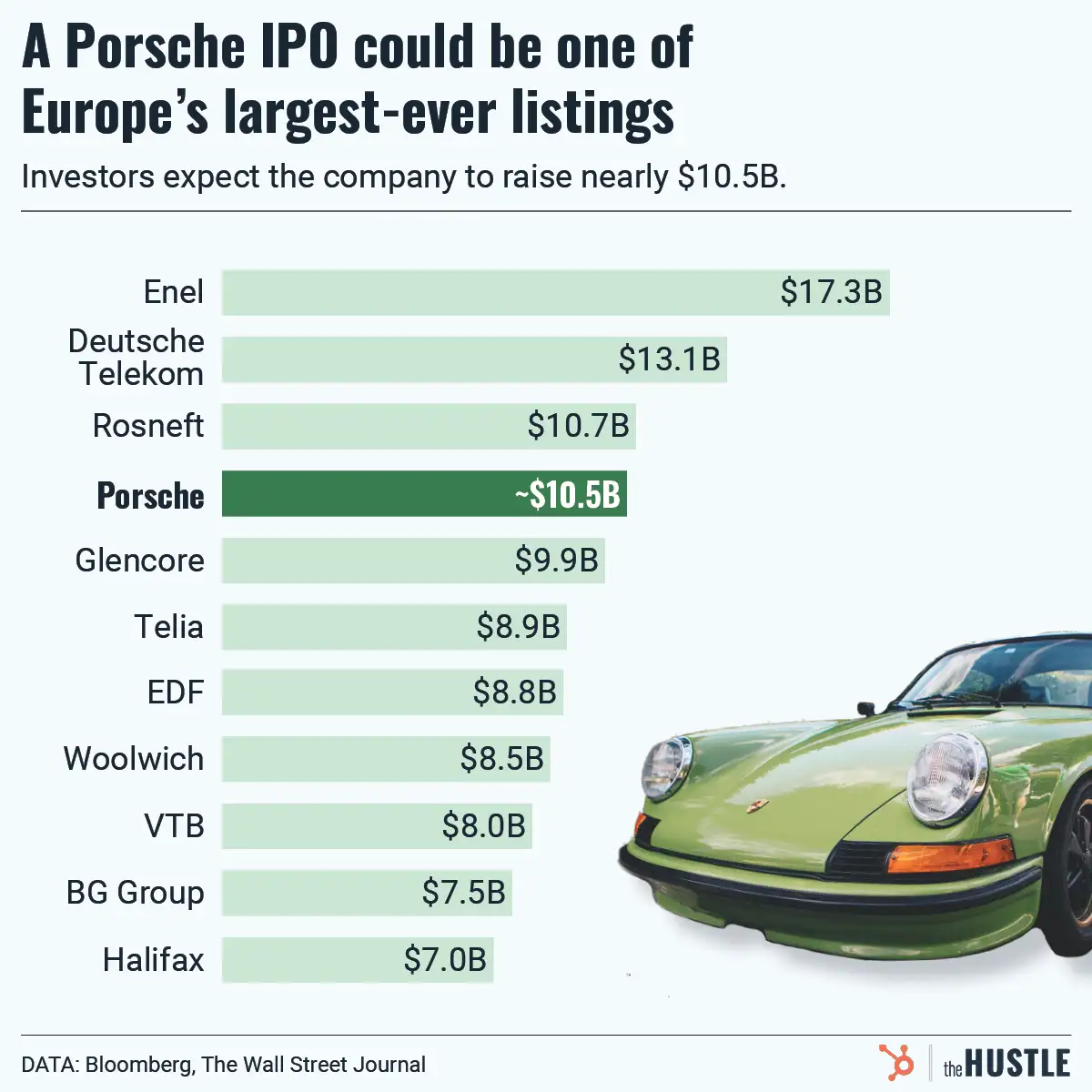

Porsche plans to go public

-

Crystals are a $1B+ industry. Who’s buying?

-

President Biden is laying down the law for EVs