Board games are starting to look a lot like video games

The board games will stream you now.

Published:

Updated:

Related Articles

-

-

All of the drama, none of the attention span: Bite-sized soap operas are getting big

-

Pirating videos was on the decline; it isn’t anymore

-

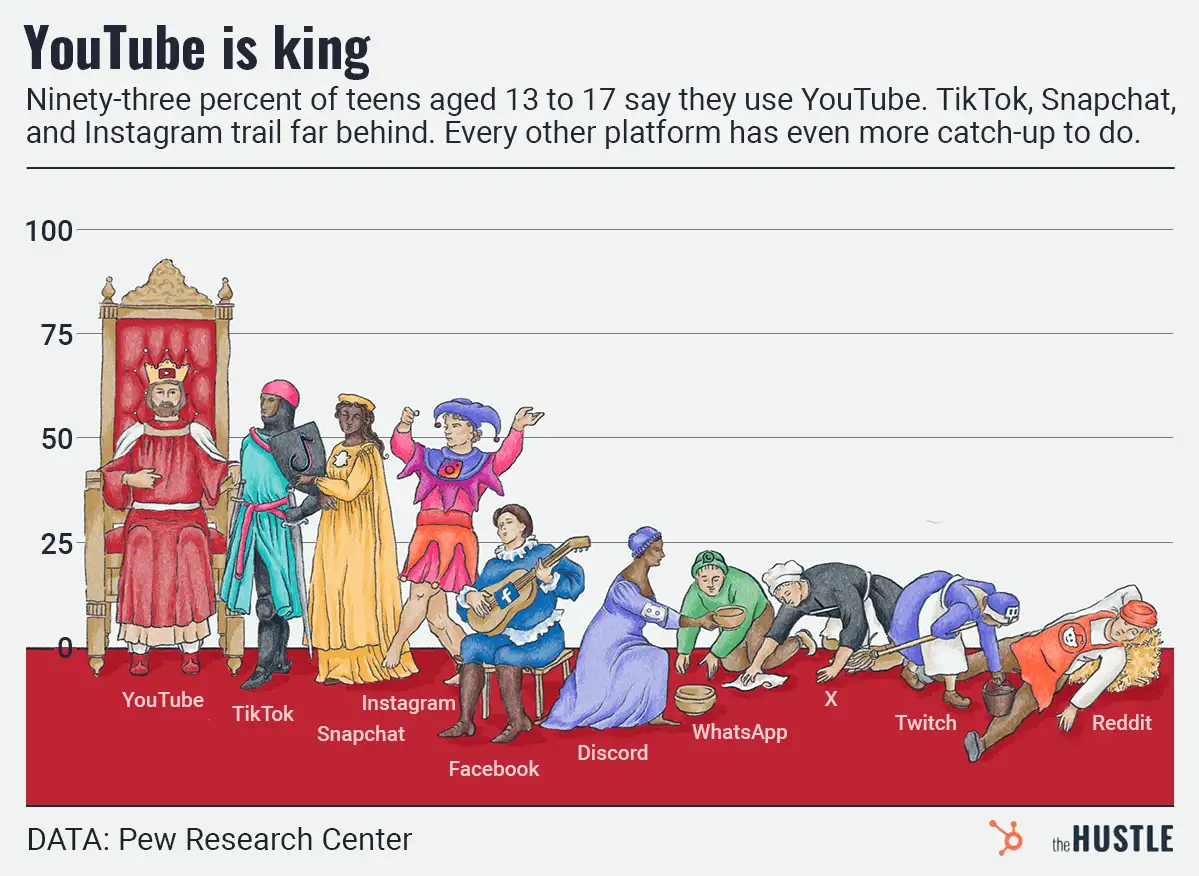

Teenagers are obsessed with YouTube — and so is everyone else

-

Disney will buy Comcast out of Hulu as streaming looks more like regular old TV

-

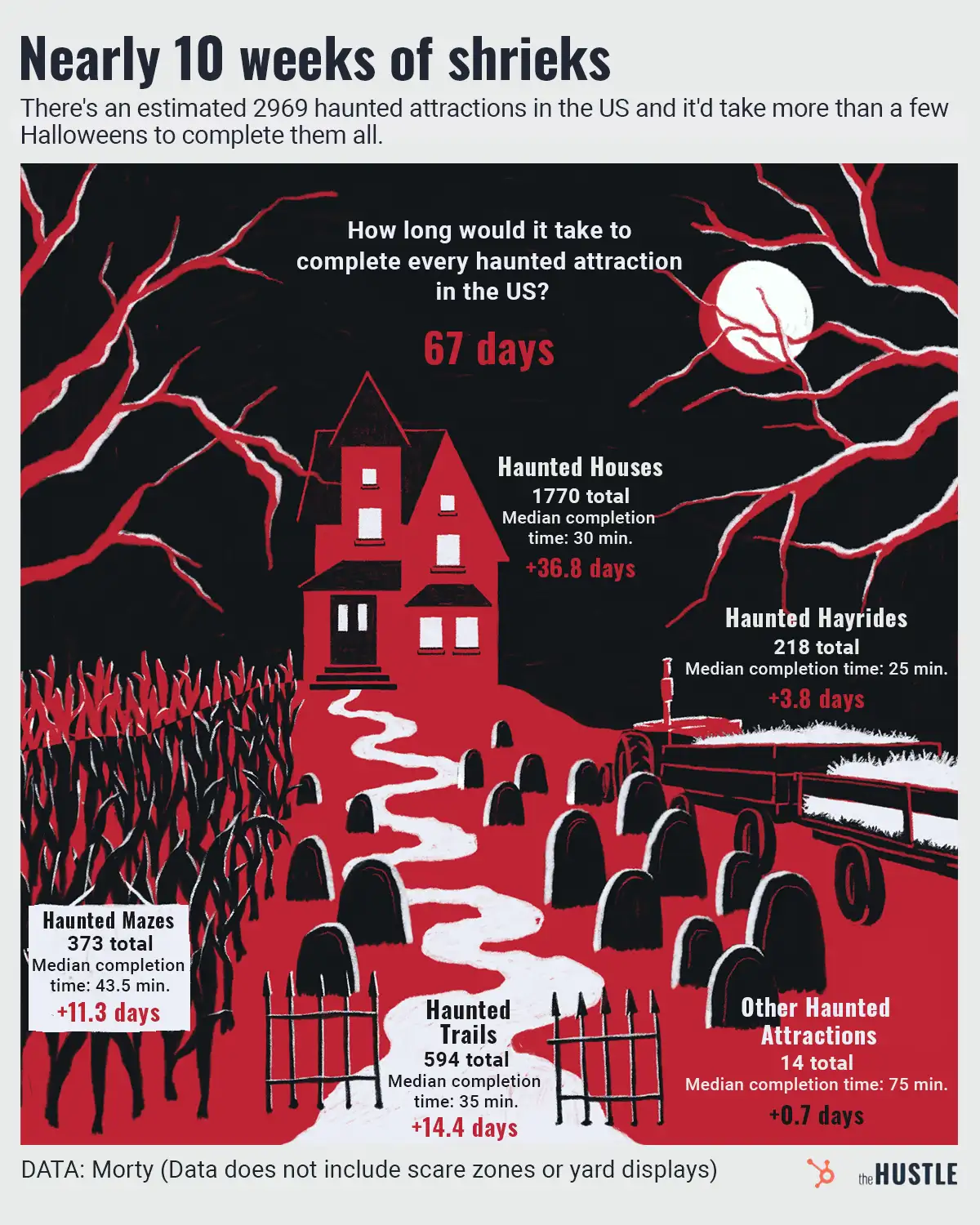

How to find the best haunt this Halloween

-

Las Vegas’ giant $2.3B sphere is officially open

-

Uh, why is Tom Brady in the office? How celebrity-brand partnerships are evolving

-

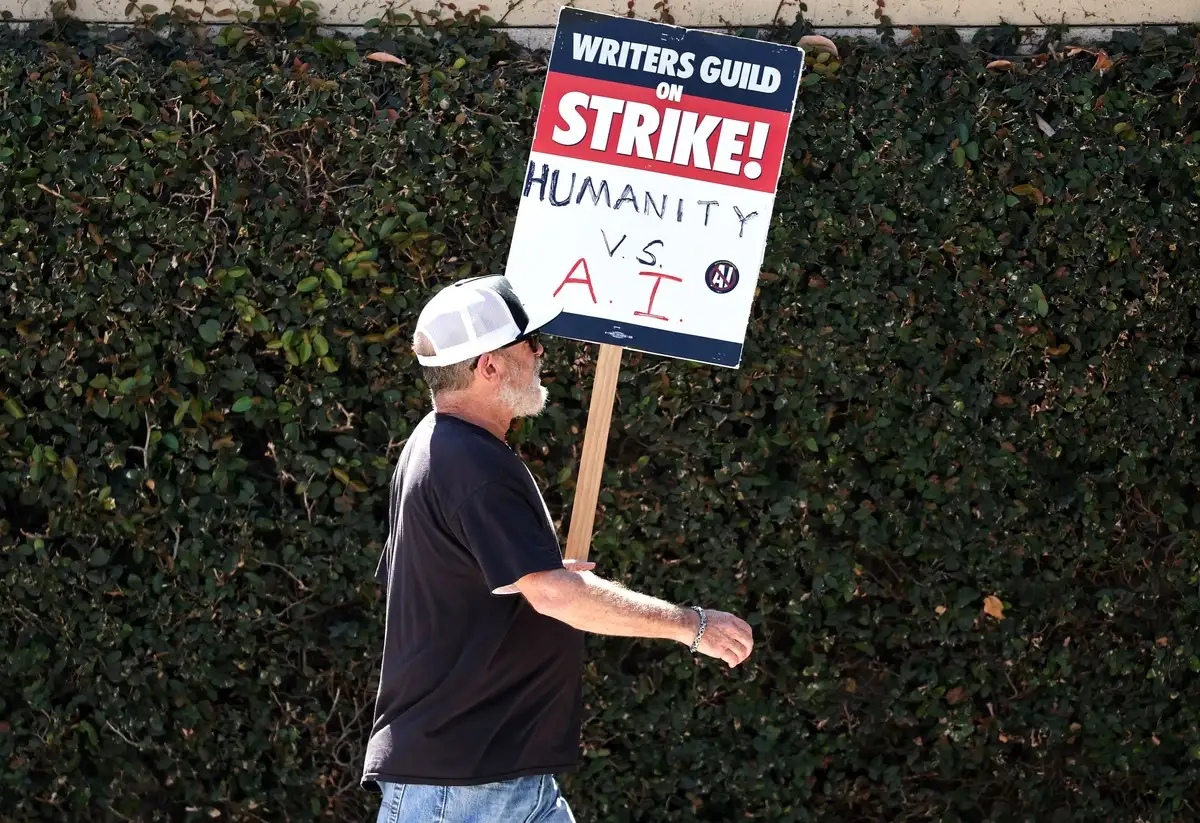

‘AI is not a writer:’ Why the writers’ strike deal matters beyond Hollywood

-

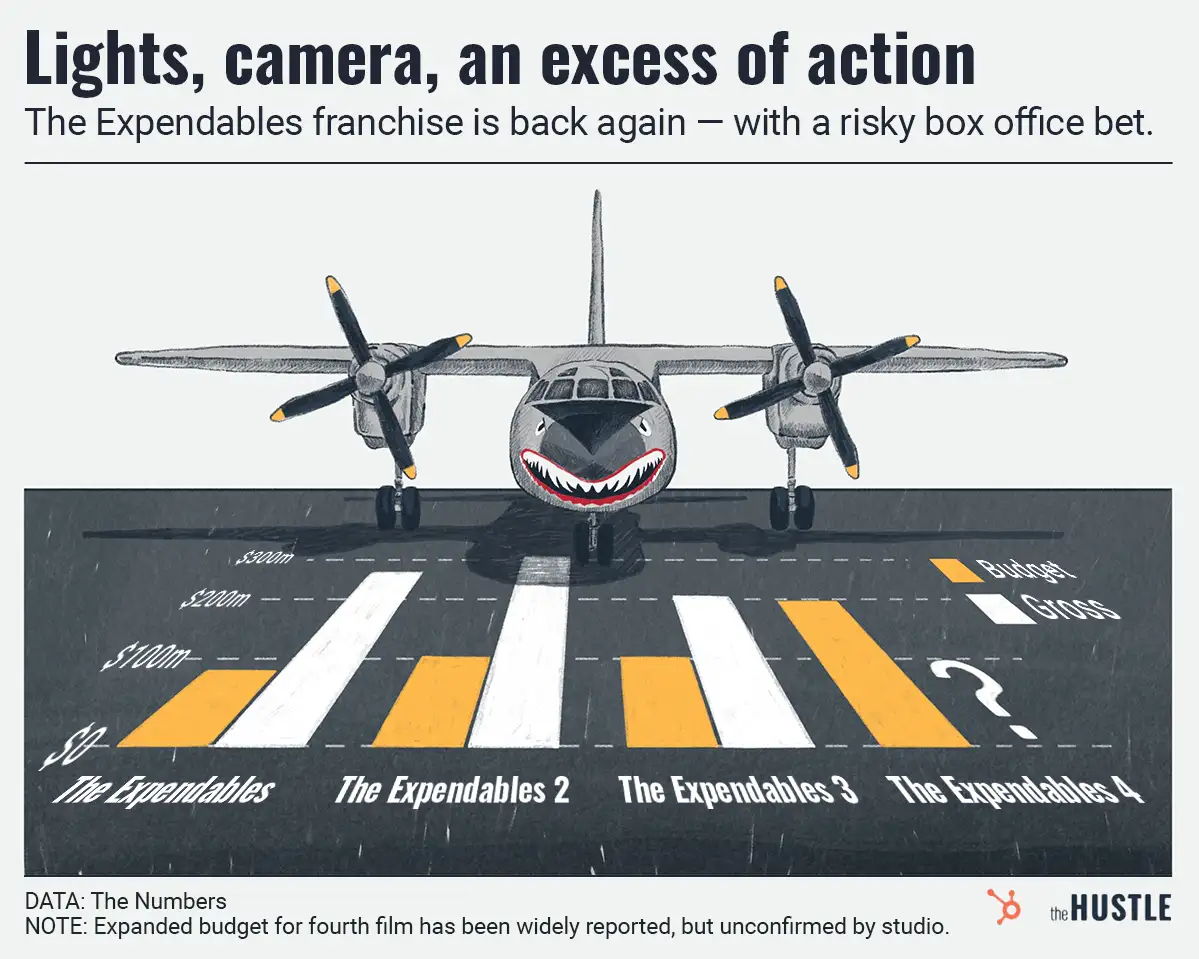

When a $789m film franchise turns risky