Key report takeaways:

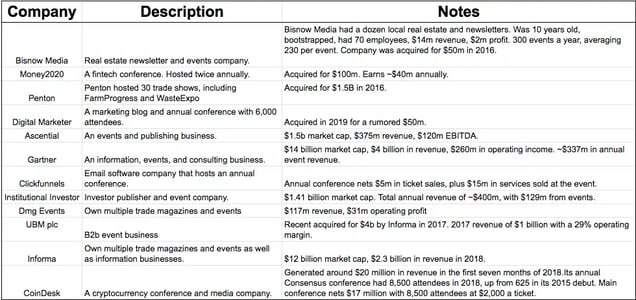

- While an often forgotten business, there are hundreds of business tradeshows that have huge revenue numbers and profit margins (30% to 50%) that rival even the biggest software startups.

- There is an opportunity to create new tradeshows in the construction space as well as direct to consumer product niches.

- The three businesses that are profiled in this report are Informa, Gartner, and Ascential, companies that you may not have heard of but they quietly make hundreds of millions in profit (and we show how).

Keep your funding announcements and unicorn status for yourself.

I’m interested in simple businesses that do one thing: mint cash.

One of my favorite examples is the event industry, a relatively boring sector that can make massive amounts of profits.

You may not know this, but The Hustle has a small events business. In fact, we started as an event company and that business has financed many of our (now) bigger initiatives.

But for this case study, I focused on big events — ones that earn hundreds of millions of dollars in revenue with relatively little upfront capital.

Regardless of the category, the event industry is big. Look at Live Nation, the $10B-a-year concert promoter. Or Coachella, one of the world’s biggest revenue-producing festivals, which makes $100m a year in profit. Or even the UFC, which makes $5m to $10m in ticket sales per fight.

But for each of these sexy events, there are hundreds of unsexy trade shows, exhibitions, and business conferences that quietly spit off hundreds of millions of dollars in profit and earn more than all of the examples above.

Below, I break down 3 different event companies. I explain how much money they make and how they do it.

At the end of this report, I’ll show you what opportunities I’ve discovered after dozens of hours of research, including reading event companies’ annual reports, speaking with industry experts, and comparing notes from my own experience in the space.

5 Reasons Why You Should Care About Tradeshows

While events may not make headlines, if you’re looking to build a steady and profitable business, trade shows are a great option.

Here are a few advantages they offer:

- Steady annuity over a long period: Many of the companies mentioned in this report have consistently grown annual revenue over many decades. Some of them launched in the 1800’s. Once a trade show is established, many attendees will attend for years, creating a steady, long term flow of profits.

- Predictable: Contrary to what most people think, the majority of trade show revenue comes from exhibitors, not ticket sales. Additionally, most vendors sign up and pay 6-12 months in advance, making revenue predictable.

- Few upfront costs: Most events can start with little money upfront. When timed correctly, prepaid exhibitor and sponsor revenue can pay for costs like venue, vendors, and marketing. This is a tactic I personally know about as The Hustle made hundreds of thousands of dollars at our first two events with relatively little money up front (less than $10k).

- Boring but growing: Because events are not considered sexy businesses, many entrepreneurs and talented employees have not seriously considered working in the event industry. This is starting to change. Jason Lemkin — who sold his software company, EchoSign, to Adobe — now runs Saastr, a $10m+ trade show for software founders. Same with the founders of Money2020, whose business we explore more below. They previously sold businesses to Google for $250m.

- Unlimited breadth: The key to a big event business is picking the right niche. Million-dollar events have been built around the oddest and seemingly small niches. One event which we mention makes $30m a year in the “home and gift” category. Go figure.

Informa: The $12B Event Behemoth That You’ve Never Heard of

Launched in 1732 as a weekly shipping magazine, Informa has transformed into a 7,500-person conglomerate that owns dozens of trade publications and events. The company did $2.3B in revenue in 2018.

The company uses a three-prong strategy of trade shows and conferences, marketing services, and subscription revenue to make money in dozens of different niches, from health-care to construction.

Inside the numbers

Based on this earnings deck, Informa’s 2018 revenue was $3.09B. Global exhibitions revenue was $761m (575 pounds), so exhibitions compose 25% of company revenue.

Exhibitions revenue breakdown (source):

- 69% is exhibitor

- 10% is attendee

- 21% is advertising + sponsorship.

The company hosted ~1,200 events in 2018, averaging $1m in revenue per event. Of course, this is misleading as some events can make tens of millions of dollars while others are small, low-earning meetups, which we’ll address later.

Another important number is 2,000,000: the number of attendees Informa had in 2018. Using this, we can see that they make the following off each attendee:

- Exhibitor: $414 per attendee

- Attendee ticket sales: $60 per attendee

- Advertising: $7.80 per attendee

- Sponsorship: $4.80 per attendee

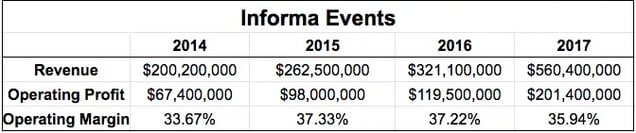

Not bad — but check out Informa’s margins. Like the other event companies I looked at, they are massive. Informa’s events ran at a 36% margin in 2017 and have been consistent through the years.

To put this in perspective, the S&P 500 averages around 10% in operating margins.

So, why do people attend Informa’s events?

According to Informa, people come because their events are “face-to-face platforms for sales and product promotion.” In other words, to get more customers.

More specifically, Informa says that their “global exhibitions organize transaction-oriented events that allow international buyers and sellers to meet face-to-face, build relationships, trade and conduct business.”

An example: Each year Informa hosts a trade show in Dubai called Arab Health. In 2017, tens of thousands of attendees came. Those attendees worked in the health-care industry, ranging from doctors to insurance providers. They came to learn about the latest in health-care tech, see new products, and hear from speakers who are authorities in the industry.

For attendees, Arab Health is free. Informa makes its money from exhibitors. In this example, the trade show had over 4,200 exhibitors, each paying thousands of dollars to have a booth.

To simplify, most trade shows are just like an online publisher. Attract high-quality and highly targeted eyeballs of company leaders who make decisions, and then monetize via advertising and sponsorship. If you’re a vendor selling into that market, you can’t ask for a better situation.

Gartner: How IT Conferences Make Billions

Gartner made nearly $4B in revenue last year with ~$260m in operating income through its research, events, and consulting businesses.

Gartner’s business model deserves its own deep dive. But to oversimplify, the company sells research reports that help large companies decide which technology and software they should purchase.

Gartner creates research for multiple niches and hosts dozens of events each year for its subscribers. At these events, attendees learn about the latest tech and research trends and network with Gartner analysts, peers, and industry leaders.

The events, which mostly cater to tech leaders at companies with revenue north of $250m, cover topics like cloud strategies, big data analytics, supply chain management, and IT sourcing.

Ticket costs range from $1,000 to $10,000, and it appears that the majority of speakers are Gartner analysts.

In other words, Gartner’s events are niche. But there’s big money to be made by catering to senior people who work at trendy tech companies.

Inside the numbers

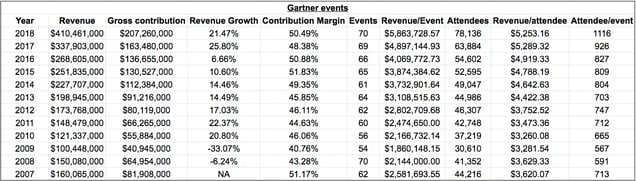

In 2017, Gartner’s event business had revenue of $337,903,000. The company hosted 69 conferences that year, averaging almost $4,897,144.93 per event.

Gartner had ~65,000 people attend their events in 2017. That’s ~$5,300 in revenue per attendee, including a combination of ticket sales and exhibitor revenue, with an average event size of 926 attendees.

In my opinion, the most impressive part of Gartner’s business is its steady growth and consistent profits. The company launched in 1979 and has grown consistently over the years, only launching a handful of new shows a year and keeping margins consistent in the 50% range.

Gartner is most famous for its Magic Quadrant, which is its self-created standards for how the company evaluates software. The best position is the top right of the quadrant, which, according to Gartner, says you’re a leader in the industry with great vision and the ability to execute.

As expected, this quadrant creates huge amounts of fomo. Because of this, software vendors pay huge fees to exhibit at Gartner’s events in order to stay relevant and in the company’s good graces.

Ascential: A $60m-Per-Conference Company

Ascential is a publicly traded British business-to-business publisher and event company with a $1.5B market cap. Like Informa, the company owns multiple publications for different industries and uses events in a significant way to monetize its audience.

Their most famous event is Cannes Lions, a festival where thousands of advertising and technology executives flock to to discuss the latest in the media world. The company bills that event as the “world’s biggest get-together of people interested in creativity.”

Inside the numbers

In 2017, Ascential made $375m in revenue with an adjusted EBIDTA of $119.5m.

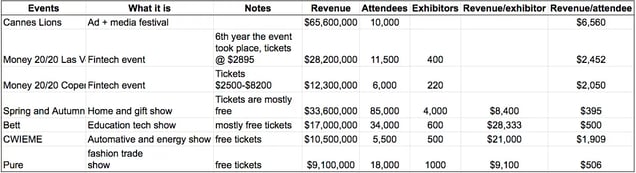

Instead of breaking down Ascential’s entire event business, I will look at some of its individual events. Unlike the other companies, Ascential breaks down the revenue per event, which is worth examining.

It appears as though Ascential’s strategy is to offer two types of events: one with free or cheap tickets and one with high-priced tickets.

High-price ticket events include Money20/20, a fintech trade show with arms on several continents, and Cannes Lions, which includes an advertising awards show and networking event for ad buyers.

Tickets for these events range from $2,000 to $10,000 and make up a large portion of the company’s revenue. Companies often buy dozens — and sometimes 100s — of tickets.

For Cannes Lions, it’s not uncommon for an agency to purchase 100 to 200 tickets and spend millions hosting events at the trade shows. Because of this, Ascential makes tens of millions of dollars per event with only 5,000 to 10,000 attendees.

For the free or cheap events, the name of the game is attendee volume, which guarantees big revenue from exhibitors. For example, at the Spring and Autumn Fair, tickets are free.

Like an online publication, Ascential works hard to make sure that the right people are in attendance and that there are enough of them. To monetize, the company deploys its sales team to sell as many booths as possible.

Conference Growth Opportunities

The most profitable trade shows are incredibly focused on a single niche.

To keep with the online publishing analogy, the most successful trade shows are not Buzzfeed, which relies on viral stories to attract the biggest advertising dollars.

The most successful conferences are narrow and deep, not wide and shallow. To make north of $1m per event, you only need 500 to 1,000 people and the right niche.

China

The US is by far the largest market for exhibitions, but nearly every company report I read said that China offers the greatest opportunity for expansion. Informa alone has a half-dozen events in China already, including Sign China, Furniture China, and Beauty China. However, they, along with other companies, said that expanding China is their biggest opportunity.

Construction

The building and construction industry is a large untapped market, many analysts and event companies said. This niche is a highly fragmented market, and the four largest commercial organizers account for just 9% of the US market. A new b2b media startup, Industry Dive, is beginning to move into the construction space so it will be interesting to see how that space evolves.

D2C everything

Direct-to-consumer businesses are new startups that sell online to customers rather than stores. Think Away Travel or Dollar Shave Club. A new trade show for retail, ShopTalk, was recently launched and is already a huge success. However, there’s room for trade shows for specific d2c niches.

Twp examples:

- Bedroom and bath accessories: Companies like Casper, Tuft and Needle, Parachute, Harry’s and many others have built large businesses for peoples’ rooms.

- Pet supplies: Nearly 1/3rd of Americans own a pet. Chewy recently exited for billions of dollars, and other pet tech, food, and marketplaces have raised billions.

Things to look out for and to keep in mind

Some industries are hard to create events for. For example, people who have tried to create conferences in the fashion industry, or other fast-moving industries, have found it hard to get a foothold. However, there are a few commonalities that I found among the winning trade show businesses.

Where digital doesn’t work

Online advertising is a wonderful tool for acquiring new customers for many businesses. However, digital isn’t applicable to every industry. For example, when Boeing needs to buy millions of dollars worth of cable, the company probably isn’t swayed by an online ad. Its people want to see the products in person and meet the creator.

The best trade show businesses will exploit this. They cater to businesses that buy huge quantities of product and want to see those products in person. If an exhibitor can meet 3-5 potential customers and one of those customers spends $100k+ with the exhibitor, a trade show can easily justify a $10k booth.

Plan a year in advance

Both Informa and Ascential went into 2019 with the majority of exhibitor and sponsorship revenue booked for the rest of the year. This makes revenue predictable, which is great, but it also shows how vendors need a long runway before an event happens.

Make it expensable

We made this mistake before. In the early years of our conference business, the majority of attendees were small business owners and freelancers. Because of this, we didn’t earn much revenue from tickets. Even worse, sponsors didn’t want to spend a lot as the attendees were not big companies.

So, from our experience as well as everything I’ve researched, the cost of big trade shows must be expensable and the targeted companies should be large. One of the companies I analyzed said it aims to create trade shows for industries where the target companies earn at least $200m in revenue.

Utility vs. entertainment

Many media companies, which are looking for alternative revenue streams as the competition for digital ads has heated up, are starting to diversify by creating events. But event revenue often isn’t significant when the events are viewed as entertainment rather than utility. While entertainment-based events can make money, they’re an easier sell when people need them to do their jobs better.

An example is Vice’s Creator’s Project, an art show for creators. This event is mostly entertainment, making it tough to justify high ticket and exhibitor prices. By comparison, an event that’s geared for computer part-sellers will do much better, as high ticket prices can be more easily justified due to the potential for a high ROI.

Networking vs. content

Most trade show websites have the speakers as the main selling point. After talking to many event organizers, the reason is simple: to attract the right attendees. At events like Coachella, the value is in the content.

At trade shows, the key to building a big business is making the show about networking, selling, and the possibility of landing revenue-generating contacts. The speakers do a wonderful job of attracting the right attendees. But make no mistake, the big money is in networking.

———-

There you have it friend, the trade show business.

This industry is significantly bigger than most people think. And as I dug deep, I was shocked to see how many companies were quietly making billions. Hopefully this report will inspire some of you to start trade show businesses or apply trade show business best practices to your company.

I would love your feedback on this report. Let me know in the comments what you’re interested in seeing in the next report, what industries interest you, and any other feedback.

Also, feel free to ask questions in the comments and I’ll be sure to answer them!

Nohome