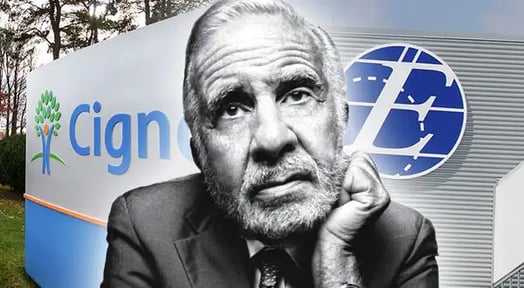

For months, Cigna has been in the process of buying pharmacy benefits manager Express Scripts for $67B… but that was before activist investor Carl Icahn got involved.

The Wall Street Journal made the healthcare industry sick on Wednesday, after reports that Icahn had accumulated a “sizeable” stake in Cigna, and plans to vote against the deal at the approvals meeting in August.

Apparently, Icahn believes Cigna is overpaying for the Express Scripts cash and stock deal ($96.03 a share), and has also expressed his discomfort over competing with Amazon and the Trump administration’s push to cut pharmacy rebates.

It’s an uphill battle…

With only a 5% stake in the company, convincing shareholders who’ve been set on this deal for months may be a tough sell for the superhero investor.

Meanwhile, Cigna’s CEO David Cordani reinforced his confidence in the deal yesterday morning saying, “We strongly believe that the combination (with Express scripts) is in the best interest of our shareholders.”

But investors heard Icahn loud and clear

Express Scripts’ stock fell 6% after the report — because even if it’s a longshot, when Icahn talks, people listen.

We last heard from him when he dismantled the Xerox-Fujifilm merger, believing that the Japanese film company was dramatically undervaluing the copy-pioneer.

The Cigna deal feels like more of a hail mary, but if anyone can make it happen, Icahn.