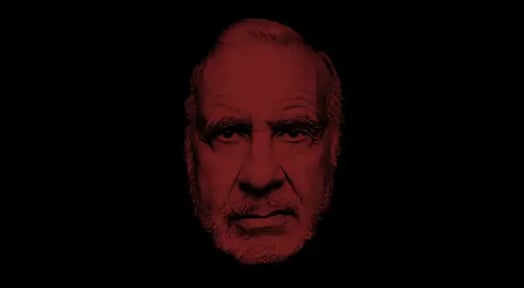

Yesterday, 82-year-old multi-billionaire Carl Icahn announced that his investment firm Icahn Enterprises will sell off nearly all of his Tropicana Entertainment casinos for $1.85B.

And that’s not even his biggest sale this month — last week, Reuters notes, Icahn also sold off auto parts maker Federal-Mogul for $5.4B.

A smart bet

According to the Las Vegas Sun, Icahn Enterprises bought Tropicana Entertainment’s flagship property, the Tropicana Atlantic City hotel and casino, in 2009 for a measly $200m after it was hit hard by the recession and regulators deemed its former owner, William Yung, unqualified to run a casino.

Fast-forward 8 years, and WSJ reports that Tropicana Entertainment is humming along with $898m in revenue for 2017, while Icahn’s capitalizing on a consolidating gambling industry that’s benefiting from more states legalizing casinos.

Bright spot in a tough few years

According to Forbes, Icahn is currently weathering “one of the worst slumps of his career,” with Icahn Enterprises’ losses costing him about $3.6B in net worth since 2015.

Then again, he’s still 43rd on the Bloomberg Billionaires Index with a net worth of $20.6B. So maybe we’ll save our condolences…