To say it’s been a rough year for tech startups would be an understatement.

WeWork, once worth $47B, filed for bankruptcy. Convoy, the Bezos-backed trucking company valued at $3.8B, shut down. Health startup Olive AI shuttered after peaking at a $4B valuation.

And many other startups followed suit by selling for a fraction of their valuations or closing up shop:

- Hopin, the virtual-events startup once valued at $7.8B, sold its core business for $50m.

- Once valued at $2.5B, scooter startup Bird filed for bankruptcy last month.

- Fintech startup Plastiq, which raised $226m in funding, went bankrupt in May.

Nearly 3.2k private venture-backed startups went under in 2023 after raising a combined $27.2B in funding, according to data compiled by PitchBook for The New York Times.

Funding the future

All the turmoil has made VCs more selective, putting a squeeze on the funding that once flowed so freely in Silicon Valley.

- Between 2012 and 2022, the funding in private US startups multiplied eightfold, hitting $344B.

- In the last year, investments in US tech startups declined 49%.

This makes it even harder for startups to survive, meaning we might see even more closures in 2024.

And when a startup goes under, it’s not just the investors who get burned. Startup founders have long struggled — often in silence — with their mental health; investors predict this funding shortage will only magnify the issue.

It’s not all bad news

Behemoths like Uber and Slack were founded just after the 2008 recession — some experts say tough economic times can actually be good for business.

And with 262k+ tech workers laid off in 2023, there will likely be more talented minds diving into entrepreneurship.

Plus, there are plenty of other reasons it could be a good year for startups, per TechCrunch:

- Interest rates are expected to fall, which could boost valuations and help get VC funding flowing.

- Software is the most common startup product, and more companies will look to spend on software products.

- Big IPOs are coming down the pipeline (like Reddit and Shein).

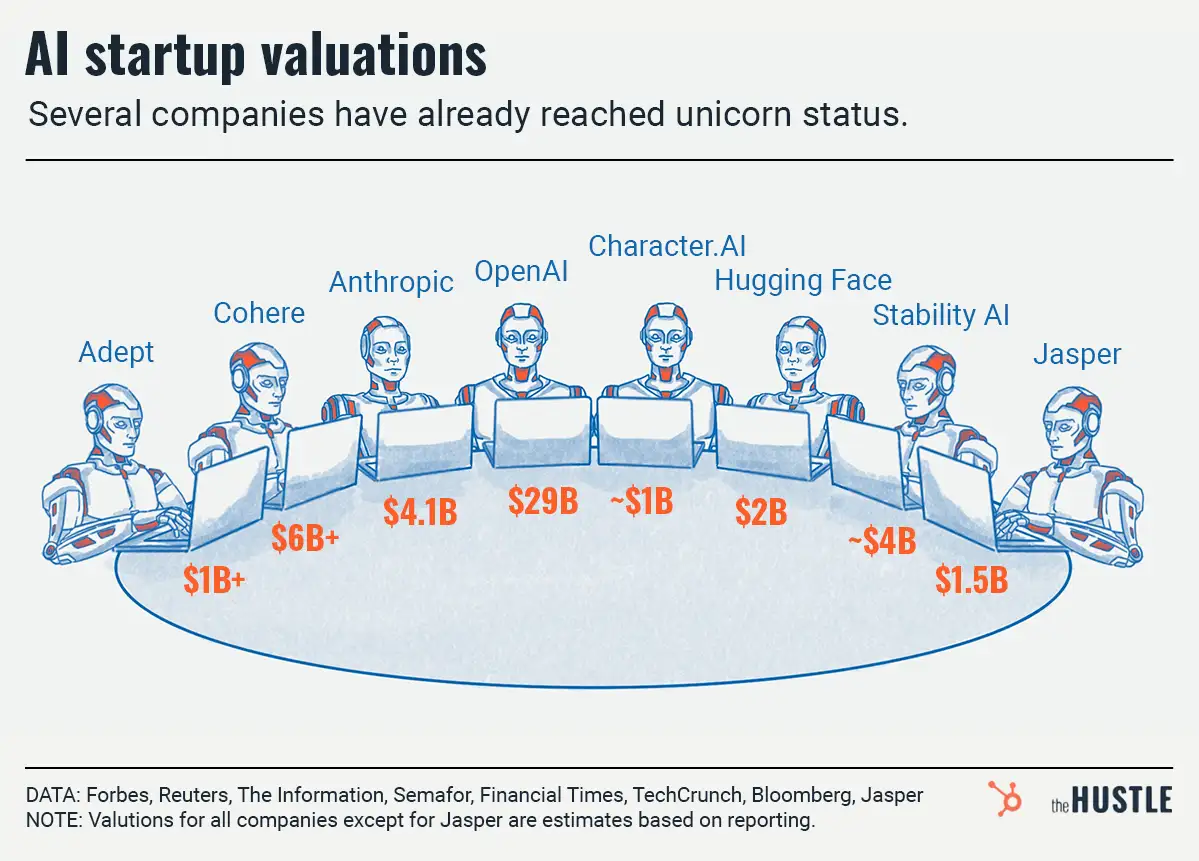

And, of course, there’s AI, which could help businesses be more efficient and profitable.

Startup

.jpg?width=48&height=48&name=IMG_2563%20(1).jpg)