Thanks to slipping sales, Ford is on a collision course with the investment junkyard

Ford slipped down an investment grade thanks to flagging global sales, and unless it makes “clear progress” a double downgrade is on the road ahead.

Published:

Updated:

Related Articles

-

-

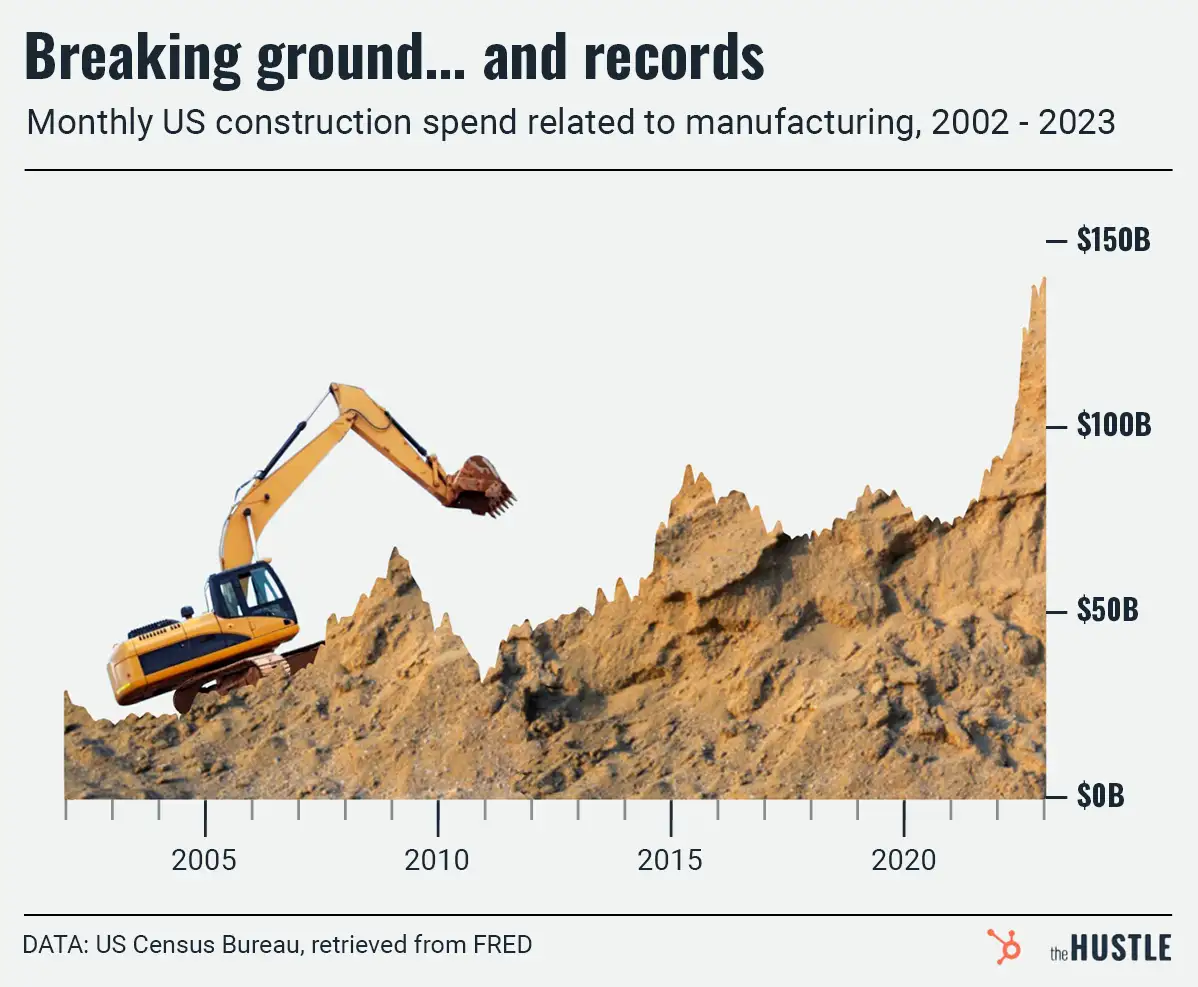

What to know about Tesla slashing prices

-

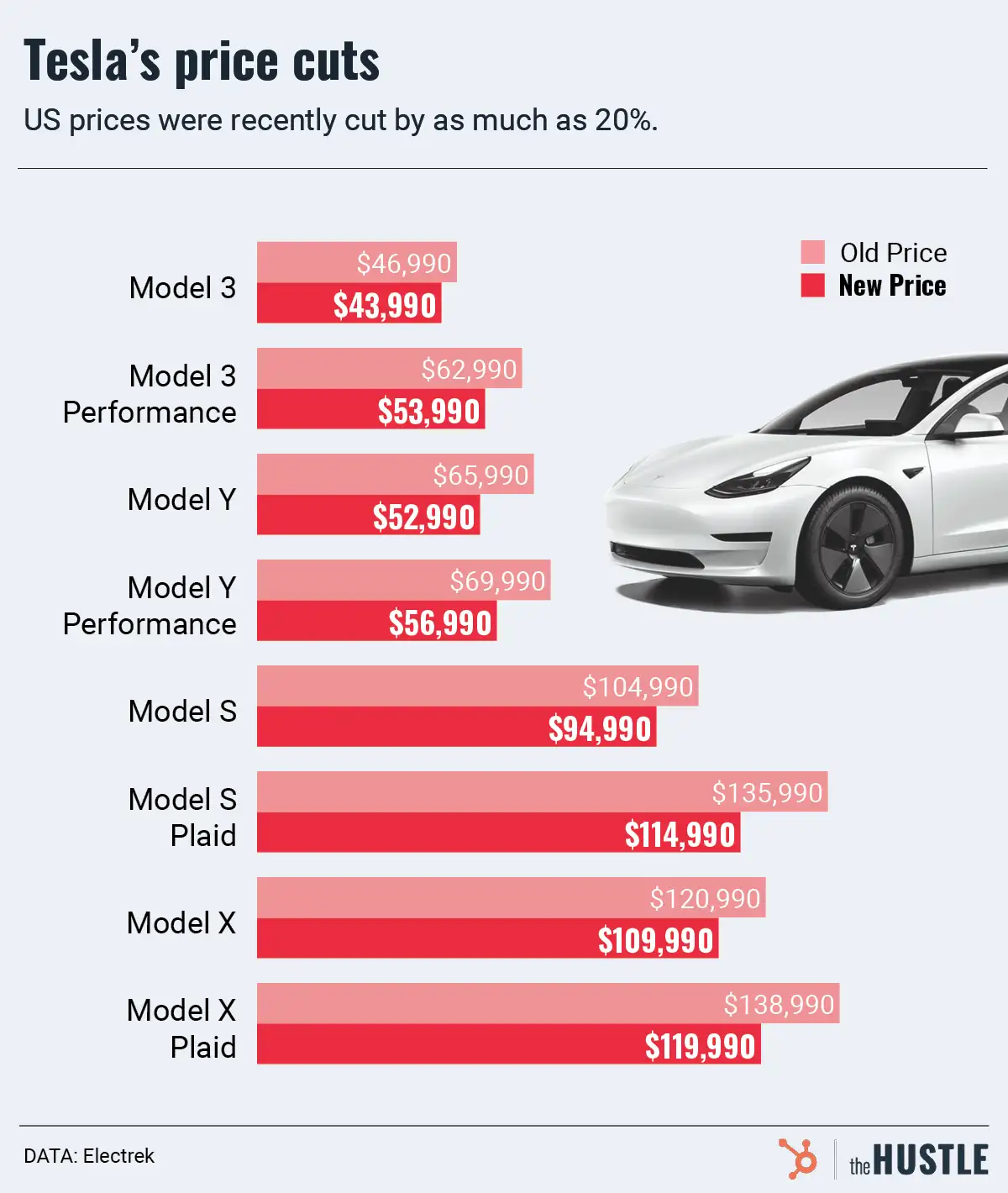

Tesla’s water problem

-

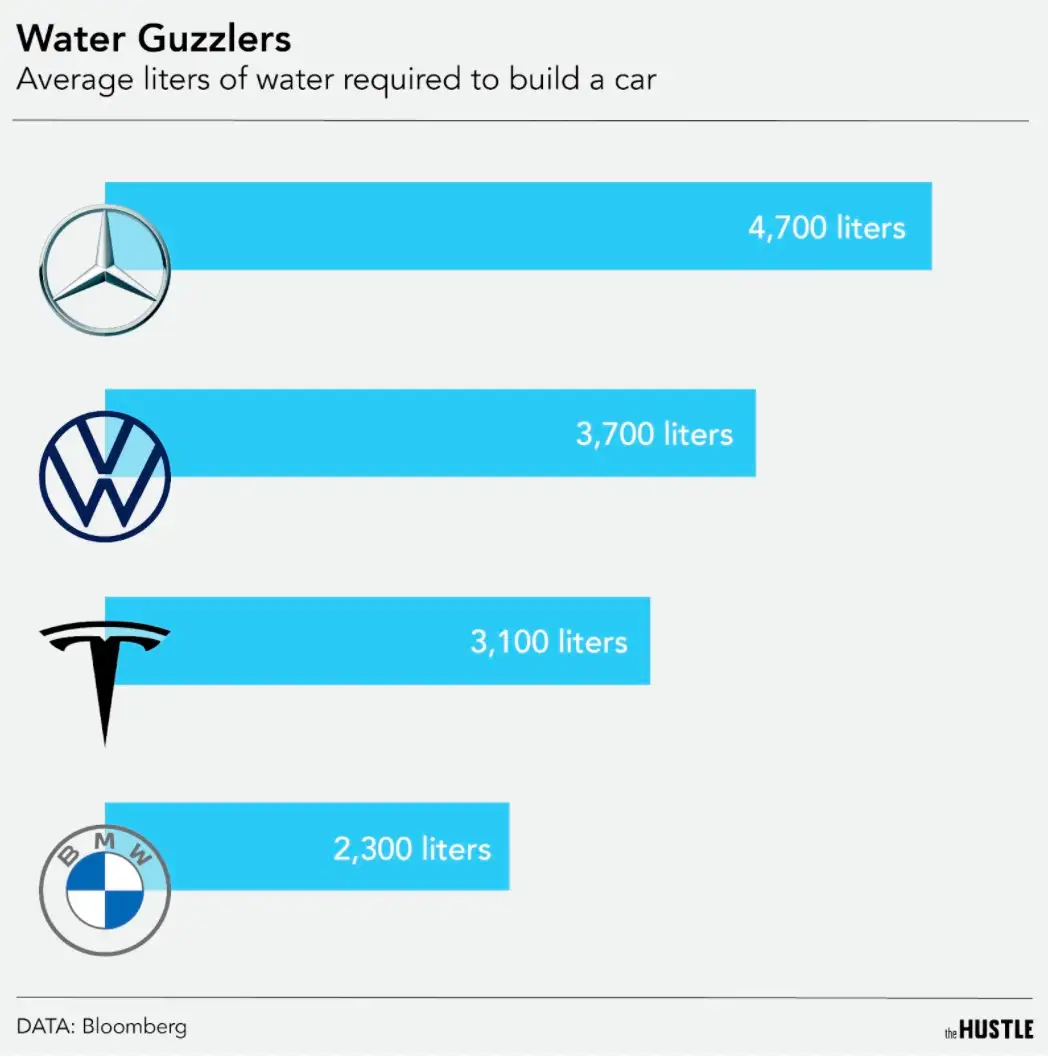

We’ve got a massive semiconductor worker shortage

-

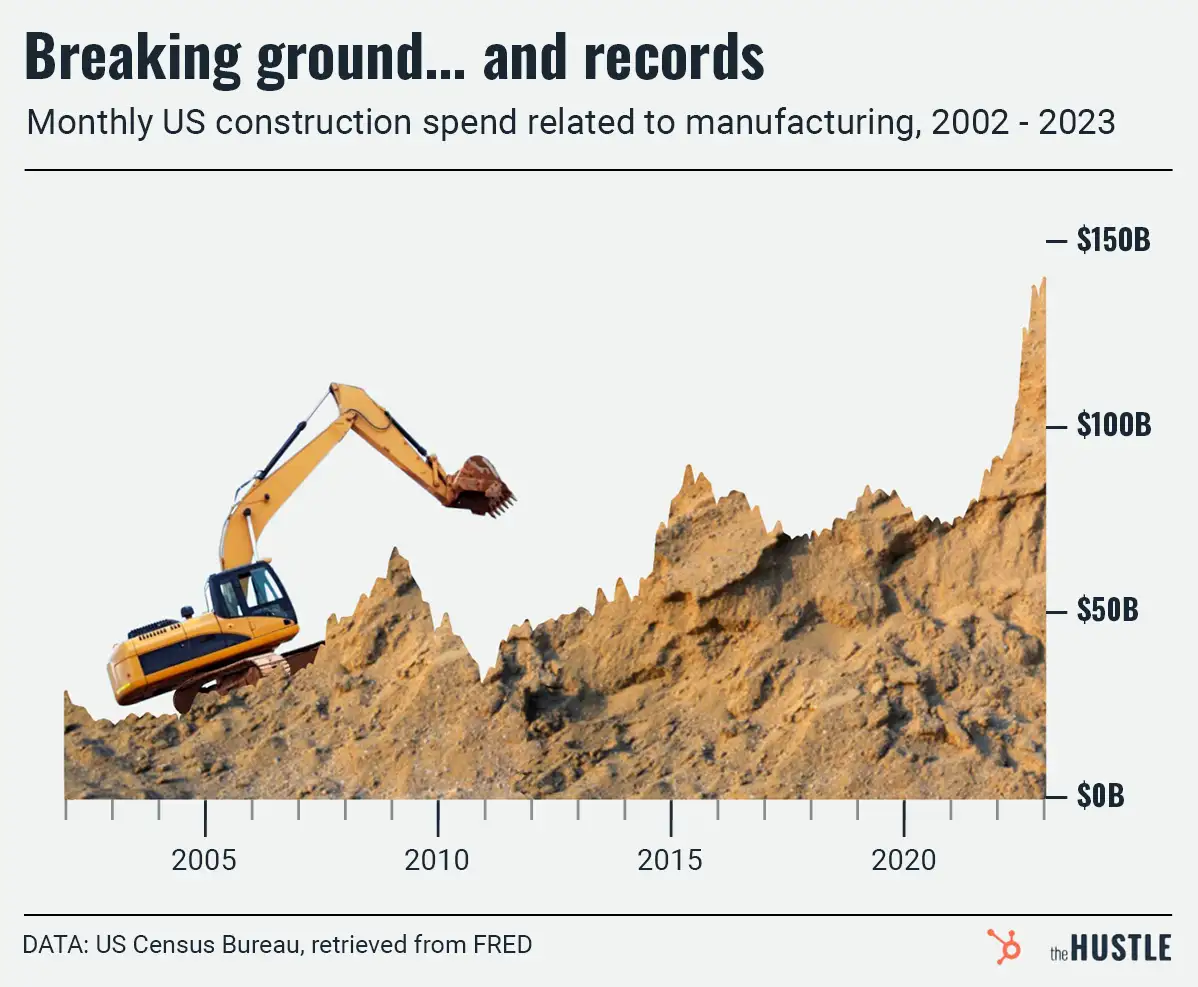

Intel’s $20B pivot could save the company, and help solve the chip shortage

-

President Biden is laying down the law for EVs

-

Digits: Icelandic workers, an art critic’s epic smackdown, and Toyota’s tiny win

-

How will Big Auto’s EV push affect car dealers?

-

Digits: Electric pickups, a $260m ‘floating’ park, and a DVD SPAC

-

Just-in-time auto manufacturing is having a rough time