On a scale of 1 to 10, how well do you feel the economy is doing? If you answered anywhere between 1 and 10, yep, you’re correct.

The year in economic data was a roller coaster ride — and a Rorschach test. You could find reasons to say the sky was falling; you could find reasons to say things were better than ever.

The narratives behind year-end economic headlines tend to lean toward the latter’s rosier outlook:

- The Congressional Budget Office is confident the US economy remains on track to avoid a recession next year.

- The Federal Reserve has held interest rates steady as inflation normalizes.

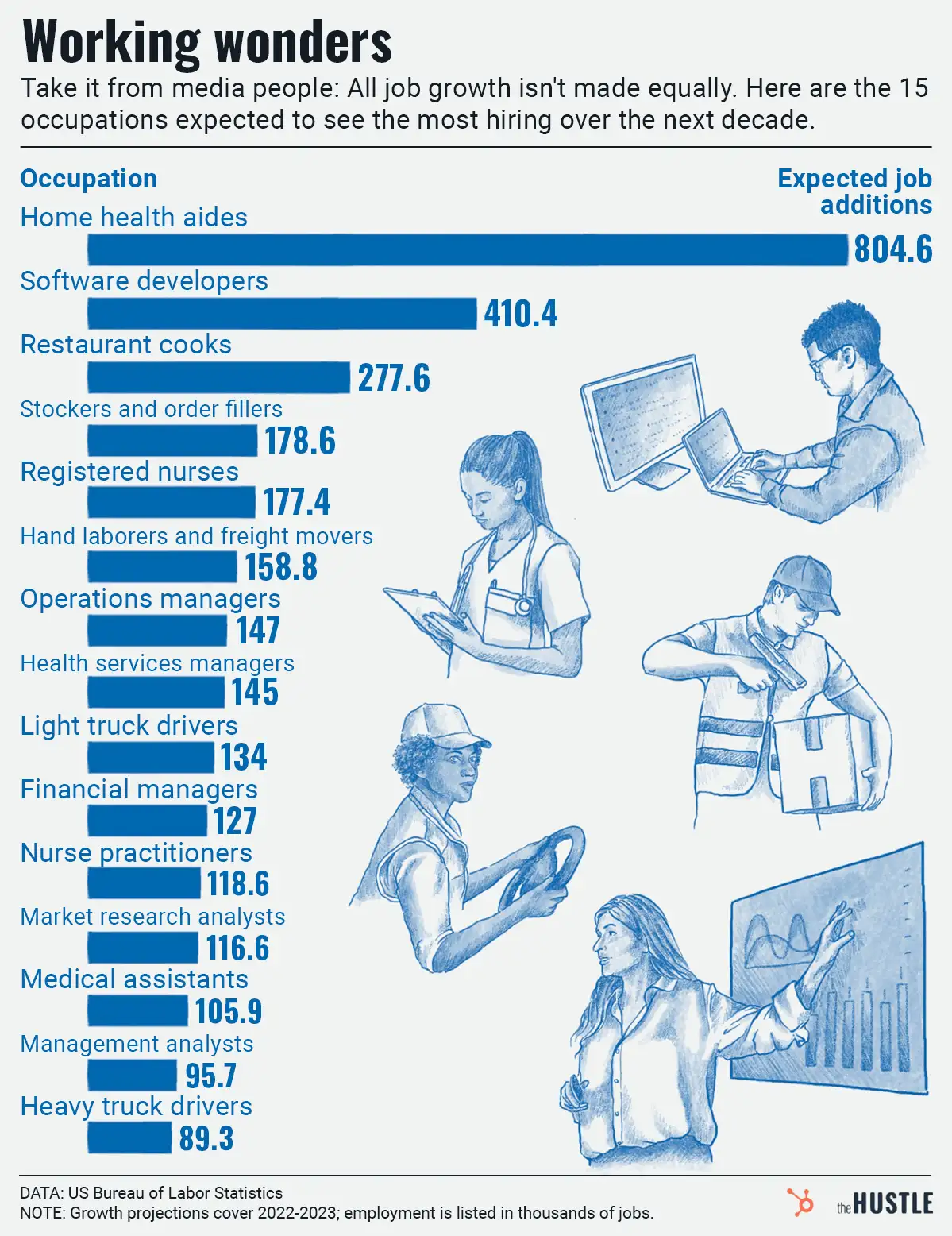

- Employers added 199k jobs in November, with the unemployment rate at just 3.7%.

That’s all great, right?

For now, yeah. But broad economic uncertainty still reigned supreme in 2023.

For every good number, many people were left waiting for a different shoe to drop. Case in point, here’s the flip side of the numbers above:

- The CBO sees unemployment rising to 4.7% by the end of next year.

- The New York Fed president called the idea of lowering rates “premature.”

- A survey of execs found 38% expecting more layoffs in 2024, with 50%+ anticipating, at minimum, hiring freezes.

So, which set is correct?

Both, ultimately. This duality is how “vibecession” — generally meaning pessimism about the economy, no matter how the economy’s actually performing — rose to prominence this year.

Just look at University of Michigan’s Consumer Sentiment Index, a popular gauge of those public economic vibes:

- The measure started at a modest 64.9 in January.

- … but things soured by May, when it bottomed out at 59.0.

- … then it took off again, peaking at 71.5 in July.

- … just to tumble back down to 61.3 in November.

- … only to rebound once more in December, up to 69.4.

The fact that we’ve ended on a high note says a lot. Lest we forget, 2023 was the biggest-ever year for US bank failures, as banks with $548.7B in combined assets folded.

Recency bias can be a beautiful thing, it turns out: Since most of that damage was done in the year’s first half, everyone’s apparently feeling fine about all that bank drama now.

It’s all in the (very recent) past, right?… Right?

Economy