Shortly after Kristy Shen and her partner, Bryce Leung, turned 31, they quit their computer programming jobs and retired.

The couple had grown disillusioned with the “Boomers’ dream”: Get a job, be a loyal employee for decades, buy a house, retire at 65.

Instead, they devoted themselves to a bare-bones lifestyle, saved 80% of their annual income, and amassed a portfolio worth $1m — enough to leave behind the 9-to-5 life and live frugally off the dividends.

Millennials are often hounded for their poor financial management. Some 66% of 21- to 32 year-olds have no savings, and one-third don’t actively think about retirement.

But a growing subculture of young folks like Chen are hellbent on achieving financial independence by their early 30s.

They call themselves the ‘FIRE’ community

Subscribers to the FIRE movement (short for “Financial Independence, Retire Early”) don’t feel like waiting around for the early bird special.

Early retirement is not a new concept. It’s been kicked around since the 1950s and gained momentum during the ’90s tech boom, when books like Your Money or Your Life and The Complete Tightwad Gazette promoted self-reliance, frugality, and smart investing as a path to financial liberation.

In the past decade, FIRE has found a new home on the internet, fueled by gurus like Mr. Money Mustache and Mad Fientist, who run wildly popular blogs with posts like “Safety Is an Expensive Illusion” and “Luxury Is Just Another Weakness.”

Mad Fientist (left), and Mr. Money Mustache (right) retired in their 30s and now run financial independence blogs with millions of monthly readers (via MadFientist.com)

One of the movement’s central breeding grounds, the r/FinancialIndependence subreddit, has swelled from 100k to 900k subscribers over the past 5 years. Its members tirelessly debate everything from the cost of having children to the merits of living in a van.

Many of these fast-track retirees are tech workers under the age of 30 with healthy salaries — but the forums are also populated with nurses, teachers, fast-food employees, and janitors.

They follow financial guidelines like the “4% rule” (the ideal annual withdrawal rate from a retirement account without dipping into savings) and the “FI Number” (an individual’s dollar amount needed to retire).

There are several variations of FIRE, but adherents fall into two main camps, based on how militant they are about being frugal:

- LeanFIRE: An approach that calls for extreme minimalism and living on the bare minimum in order to save and retire faster.

- FatFIRE: An approach that still aims to save and be frugal, but allows for a bit more indulgence.

Some insist on more extreme measures.

Mr. Money Mustache (real name Peter Adeney), retired at the age of 30 with $600k in savings and lives a spartan life in Colorado, with expenses that total just $24k per year for a family of 3.

The New Yorker calls him the type of guy who “uses a woodworker’s vice to squeeze more juice out of limes.”

The Hustle

FIRE is an innately privileged concept: For many Americans, thriftiness is a necessity, not a choice — especially in the wake of the pandemic.

But FIRE enthusiasts claim that anyone can follow the movement’s unofficial formula: Dramatically minimize spending. Maximize earnings. Save enough to live off of dividends.

The young, rich, and frugal

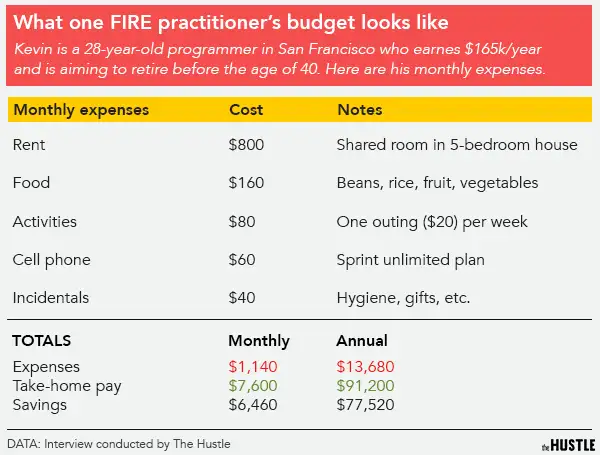

Kevin*, a 28-year-old FIRE devotee living in San Francisco, is among those who go to extreme lengths to cut down on monthly expenses.

A self-described “shitty coder” at a large cloud computing company, Kevin reels in a pretax salary of $165k per year — enough to afford him a “decent lifestyle” in one of the most expensive cities in America.

Instead, Kevin lives far below his means:

- He rents a shared room in a 5-bedroom house for $800 per month

- He sleeps on an inflatable camping mat

- He eats beans and rice 5 nights per week

- He relegates himself to $20 per week for social activities

- He uses his company’s gym to work out for free

- He gets around the city on a bicycle or electric scooter

He also chronicles every purchase in an Excel spreadsheet: $3.47 for a pack of floss; $8.81 for a new bike tube; $14 for a Mother’s Day gift (“Mom gets I’m on a budget,” he says).

Here’s a breakdown of his typical expenses:

The Hustle

Over the past 4 years, Kevin has saved an average of 85% of his annual income, which he funnels into various investment accounts — a Vanguard VTSAX, an IRA, and a 401(k).

By saving ~$78k per year and averaging an 8% return, he’s accumulated $380k in savings — about half of his retirement goal.

“When I hit $800k, I’ll retire and I’ll relocate to a cheaper city — maybe Minneapolis — and just live on the interest,” he says. “Prince was born there, so it can’t be too bad.”

Like many FIRE followers, Kevin doesn’t plan to stop working once he’s “retired.” He wants to pursue his true passion (playing the cello), volunteer at an inner-city programming camp, and code pro bono for nonprofits.

“For most of us, the goal of financial independence isn’t to just check out and quit life,” he says. “We just want the freedom to work on what we choose. When you take money out of the equation, you can spend your time doing more important things for yourself and society.”

Why the rush?

Simeon*, a 25-year-old tech recruiter in Boston making $130k per year, saves 63% of her income by subsisting on $5 Little Caesars pizzas and shopping at Goodwill.

“I haven’t bought a new T-shirt since, like, college,” she says.

Like Kevin, Simeon plans to achieve financial independence by her mid-30s — but she’s driven by a deeper motive.

“My parents will probably never be able to retire,” she says. “My dad lost his job in the recession, and my mom is a social worker. I’ve seen them kind of struggle to get by all my life, and I think that stress is part of what makes me want to escape the traditional system.”

The Hustle

The extreme frugality of some FIRE millennials seems to driven, at least in part, by distrust in the economy.

Many in the movement were reared into a harsh job market in the wake of the 2008 financial crisis, and have since faced a pandemic, a daunting housing market, and mounting student debt crisis.

All the while, they’ve been inundated with tales of impossibly young tech clairvoyants minting billions in their early 20s.

They want to escape the “shackles” of the traditional workplace and create economies of their own choosing, on their own time.

Freedom, more than security, is the golden goose.

Diana*, a 31-year-old engineer in Seattle, acknowledges that there are big roadblocks to achieving financial independence — getting an education, having kids, buying a home — and that adhering to a FIRE lifestyle requires a lot of give and take.

But for her, and many others, the sacrifices are worth it.

“You have to question the very core of what you want in life,” she says. “I choose freedom.”

* Some names in this story have been changed by request.