Ten years ago, Mike Merrill was at a career crossroads. So, the 30-year-old did what any other aspiring entrepreneur would do: He divided himself into 100k shares at $1 apiece and let people on the internet buy a stake in his life.

Since then, he’s sold off 11,823 shares of himself to 805 investors all over the world.

These shareholders — most of whom are complete strangers — get voting power on every major decision Merrill makes: How much sleep he should get each night, who he should date, or whether or not he should get a vasectomy.

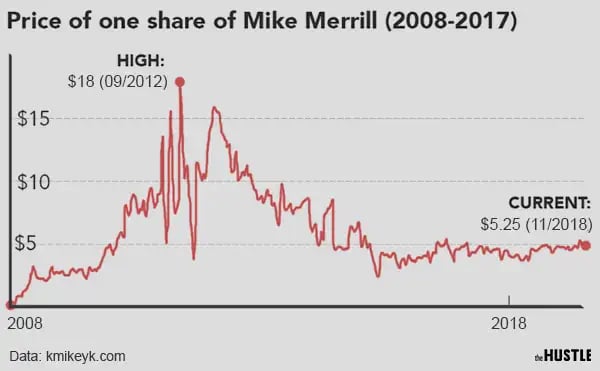

He only releases shares in small batches, and allows the market to determine his worth. Over the course of 9 years, one share of Mike Merrill has fluctuated in price from $0.99 to $18, based on demand. Some early investors (including his own brother) chose to cash out big; others have been in it for the long haul.

In return for selling shares of himself, Merrill gets his own “personal board of advisors,” who mitigate his indecisiveness.

But what’s life like as a “publicly-traded” human? And in an era of digital individualism, why would someone willingly auction off his own agency?

The tale begins in the middle of nowhere…

Or, to be exact, Coldfoot, Alaska (population: 10).

Merrill spent his youth gallivanting around the vast icefields of the tiny Yukon-Koyukuk town, where truckstops and moose were the coming attractions. Homeschooled by his Christian missionary-turned-state trooper father and rescue squad mother, he joined the military. But 3 years in, the self-proclaimed “anti-authoritarian” was discharged.

In the midst of a “little identity crisis,” he followed one of his buddies down to Portland, Oregon and wound up working various non-technical odd jobs in the software space.

One winter night, while bemoaning his life choices, Merrill had a radical thought: What if I let other people control my life instead?

The first thing Merrill had to do was determine his worth as a human.

“At time I had a day job,” he tells The Hustle. “So I calculated my worth based on my free time (nights and weekends) and I figured that time, for the rest of my life, was probably around $100k.”

Merrill decided to divvy himself up into 100k shares, priced at $1 each. Then, much like an actual corporation, he set out to “drum up demand.”

On January 26, 2008, he had his initial public offering — and in the first 10 days, 12 of his friends purchased 929 shares. Though he still retained 99.1% of himself, he made his own shares non-voting and ceded 100% of the decision-making power to his new investors.

He built a website (KmikeyM.com), where people could vote ‘Yes’ or ‘No’ on his major decisions, and the projects he should pursue.

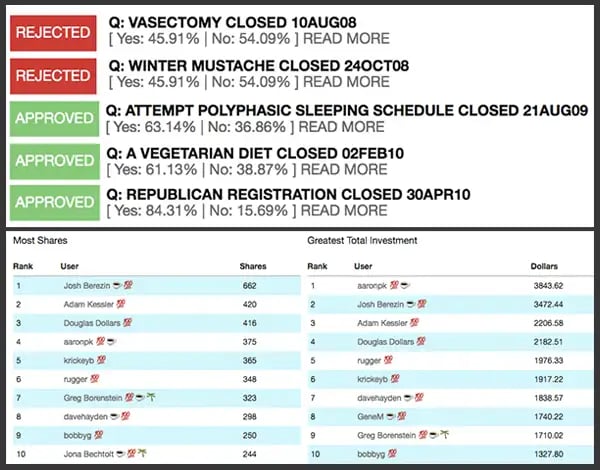

At first, the items Merrill put up for vote were trivial, like whether or not he should invest $79.63 in a Rwandan chicken farming business (approved, with flying colors), or grow a winter mustache (denied). But in very short order, things began to escalate.

Should I get a vasectomy?

At the tail end of his first year on the market, Merrill made plans to move in with his then-girlfriend of 5 years. When his shareholders caught wind of the decision, they were furious.

“I was getting emails from people saying, ‘We should have a say in such things — it’s going to impact your life!’” he says. “I thought, okay, that’s probably a fair point. And from then on, I let them vote on things in my private life too.”

First up on the table: Whether or not Merrill should get a vasectomy, a procedure that would permanently prevent him from having children (which, in the eyes of shareholders, where an “additional economic burden”). The decision was narrowly denied, with 55% voting ‘No.’

“I thought, ‘Cool, I’m in the clear!” recalls Merrill. “I guess I won’t have to have anything sharp near my nether regions now.”

In the ensuing months, Merrill put a variety of major lifestyle choices up for vote: Whether or not to adopt a polyphasic sleep schedule (approved), become a registered Republican (approved), or convert to a vegetarian diet (approved).

One afternoon in 2009, his story wound up on Hacker News (a popular discussion board run by tech accelerator, Y Combinator), where it caught the eye of a 40 year-old software engineering director from San Francisco named Gordon Shephard. The man was so intrigued that he bought up $6.4k worth of Merrill from other investors, driving the share price up to $11.75

As demand spiked, Merrill’s own brother — an early investor who’d bought at $1 per share — decided to cash out, walking away with enough profit to buy a new dishwasher for his kitchen.

The more Merrill allowed his investors to participate in the most intimate details of his life, the more interest spiked. So, he decided to go all-in.

Who should I date?

When Merrill’s relationship dissipated in 2012, he once again turned to his shareholders for advice — this time, in the romance department.

“Under normal circumstances, no one is going to complain when someone is buying flowers or going out to dinner and a movie,” he wrote in an investor letter. “But as a publicly traded person with a responsibility of productivity to the shareholders, we live under special circumstances. A relationship is likely to affect both [my] productivity and [my] output.”

In a resolution titled “Shareholder Control of Romantic Relationships,” Merrill asked his investors if they’d like to take complete control over his dating process. It was enthusiastically approved, with an 86% vote.

“We’ve all been in a situation where your friend starts dating someone and you’re super opposed to it, but can’t really say anything,” says Merrill. “Friends can’t really give you objective advice — but shareholders? Maybe.”

Merrill went on a variety of dates, updating investors via a private forum at each juncture and ceding to their feedback. Merrill soon fell for a 28-year-old assistant named Marijke Dixon — and after securing his shareholders’ approval, he offered her a three-month “relationship contract.”

These antics soon caught the eye of the press: In 2013, Merrill’s story made the rounds in Wired, The Atlantic, and the Today Show, attracting a massive wave of new investors.

In the span of a month, Merrill’s shareholders quadrupled, from 120 to 500+. Overnight, his share price skyrocketed to $18, giving him a $1.2m market cap.

Suddenly, complete strangers were vying to control his life.

Stranger things

The flood of new shareholders dramatically changed the way Merrill thought about his experiment.

“At first, people wanted to invest in Mike Merrill,” he says, “Then, people became more interested in the concept and the novelty than my life. It was a weird, alienating feeling, but also exciting — it was starting to take on a life of its own.”

With a mix of strangers and friends (his original investors), Merrill realized he had to mitigate the possibility of “insider trading:” His buddies, who he hung out with on a daily basis, knew more about his life than other investors. To compensate, he began publicly posting more updates and information about his life.

According to Merrill, strangers made better investors than friends. “I found them to be more objective,” he says. “When people know you too well, they vote for what they think you want, which isn’t necessarily what’s in your best interest.”

Shareholders frequently, and unanimously, vote for Merrill to take risks, like leaving his desk job of 10 years, reorganizing his finances, and moving into a tiny cabin.

By and large, they are more inclined to say “Yes” than “No:’ Of 134 total voting measures to date, 93 (69%) have been approved, and only 41 (31%) have been denied.

“They push me to do things I probably otherwise wouldn’t do,” he says. “And usually, it ends up working out for the best.”

Merrill’s market

Like all markets, Merrill’s share price is contingent upon demand, which fluctuates wildly with bursts of publicity. In recent years, attention has stagnated, and his shares — once as high as $18 — currently sit at $5.24.

For his investors, many of whom got in at $1 per share, it’s still a solid return.

Merrill, on the other hand, has not profited from his endeavor. Over the course of his decade-long experiment, he’s kept the money from his share sales in a bank account, untouched.

Today, he still posts life decisions for his shareholders to vote on, though the gravity of what’s at stake has gradually dwindled: (a recent motion to purchase a fanny pack was denied).

“I have a powerful decision-making engine of people who can give me feedback or advice about anything,” he says. “And honestly, who wouldn’t want that?”