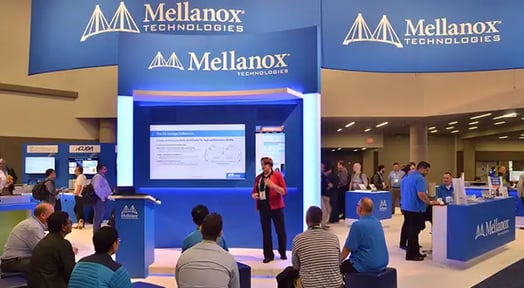

The California-based chip-making giant Nvidia purchased an Israeli computer hardware manufacturing company called Mellanox for $6.9B, the biggest acquisition in Nvidia’s history.

Intel and Microsoft had also expressed interest in Mellanox, which makes Ethernet switches and adapters that enable computers to connect to one another in large networks. But it was Nvidia — which has had a roller-coaster of a year — that ultimately won the bidding war.

A crypto-powered roller coaster

Nvidia first rose to prominence in the crowded technology industry by making graphical processing units (GPUs) to power video games.

Then 5 years ago cryptocurrencies and AI took off, and all of a sudden Nvidia had tons of new customers for its high-octane graphics chips. The company’s stock took off: Between 2016 and 2018, Nvidia’s stock value increased more than 9x.

But then crypto crashed — and it pulled Nvidia down with it.

Nvidia needs a win

After the value of cryptocurrencies fell sharply last year, demand for powerful GPUs slumped, forcing Nvidia’s stock to crash 50% in just a few months.

For competitors like Microsoft and Intel, Mellanox was more of a “nice to have” acquisition target. For Nvidia, on the other hand, the Mellanox acquisition is a survival strategy — a way to diverse revenue in a future with fewer chips.

The $6.9B price tag was a 14% premium on Mellanox’s closing price last Friday — and a 50% premium on the company’s value before Intel announced that it was interested last January.