Take the same item to 4 different pawn shops and you might get offers that vary by hundreds of dollars. Here’s why.

You’re down on luck, your funds are running low, and you’re in dire need of a few hundred bucks in cash — ASAP. The bank won’t help you, and the payday loan place wants a 400% annual interest rate. All you’ve got left is the gold pocket watch your great-uncle Chester gave you.

What do you do? You head to the pawn shop.

Every year, some 30m Americans frequent the country’s 11.8k pawn shops in the hopes of securing a loan in exchange for collateral.

As one pawn shop owner tells The Hustle, “everything that can be pawned will be pawned:” Wedding rings, shotguns, antique horse saddles, prosthetic limbs, and any electronic device imaginable. Collectively, the loans, purchases, and sales pawn shops make on these small items add up to a $6B+ per-year industry.

But not all offers are created equally. If you walk into 5 different pawn shops with that gold watch, you might get offers that differ by 200% or more.

We wondered why that was, so we went looking for an answer. And along the way, we learned a few other things about pawn shops that will make you question whether you should do business with them at all.

How a pawn shop works

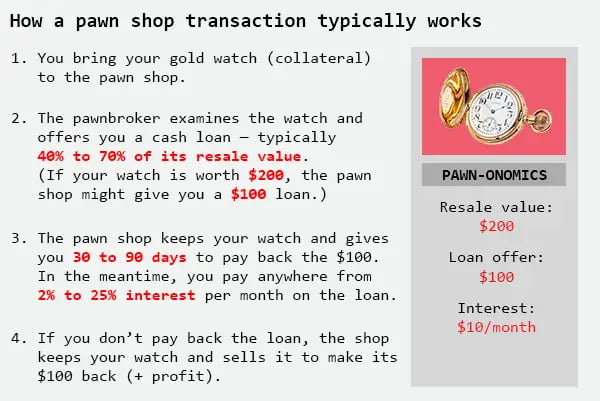

The typical pawn shop transaction goes down like so:

Zachary Crockett / The Hustle

Pawn shops are generally a last resort for people in lower-income brackets.

“The average customer might be living paycheck to paycheck, or maybe he had an unexpected expense emergency come up,” says Jimmy Rodriguez, the owner Max Money Pawn in Houston, Texas. “He needs fast cash, and I’m the most convenient option.”

According to the National Pawnbrokers Association, 7.4% of all US households have frequented a pawn shop. This figure jumps up to 40% among lower-income earners, who often don’t have enough cash on hand to cover a $400 emergency expense.

The average pawn shop loan is just $150 — but even a small loan can rack up considerable interest fees for someone in financial straits.

When Christine Luken, a counselor in Cincinnati, fell on tough times, she took her grandmother’s ring to a pawn shop and was given a $150 loan. “I had to pay $30 a month in interest,” she told the website Student Loan Hero. “I ended up paying interest on it for 24 months, $720 in total. That’s 480% of what I originally borrowed.”

Pawn shop interest rates vary from state to state. In California, the limit is 2.5%/month (30% APR); in Alabama, it’s 25%/month (300% APR) — high enough to be considered predatory, but not quite as bad as a payday or title loan.

In 85% of all cases, customers are able to pay back their loans. But when they don’t, the pawn shop still makes money by selling the collateral.

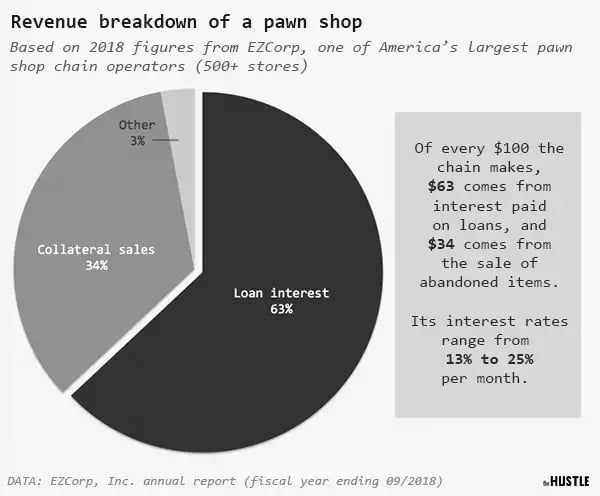

To get a better sense of what a pawn shop’s revenue breakdown looks like, we took a look through the most recent annual report for EZCorp, Inc., one of America’s largest pawn shop chains.

Among its 500+ US shops, 63% of all revenue comes from loans and fees (which range from 13% to 25%), and 34% comes from selling the collateral.

Zachary Crockett / The Hustle

The items that come through a pawn shop’s door can be alarming. We spoke to owners who’ve been offered gold fillings, glass eyes, and even a replica of Noah’s Ark made out of popsicle sticks.

A 20-year veteran of the pawn shop business, Rodriguez has seen his share of weird stuff: NCAA football national championship rings, 19th-century firearms, rare guitars, and $10k watches.

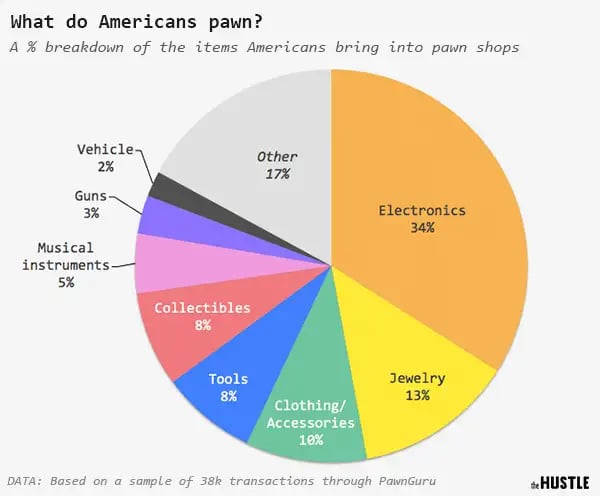

Overall, though, run-of-the-mill electronics and jewelry are the most commonly pawned goods.

Zachary Crockett / The Hustle (data via PawnGuru)

When working out what kind of loan to offer a customer, a pawnbroker like Rodriguez will assess the resale value of the item and how easy it will be to sell in case the owner doesn’t come back for it.

But making these judgments — especially with more unique items — can be highly subjective. And as a result, pawn shops will often give you dramatically different loan offers.

The massive variance in pawn shop offers

To better illustrate just how much pawn shop offers can vary, we decided to run a little experiment with the help of PawnGuru, a platform where consumers post items online for pawn shops to bid on.

PawnGuru began by gathering 4 items:

- A 1-carat diamond (resale value: $2.5k)

- A 2005 Kawasaki 205R motorcycle ($2k)

- A Louis Vuitton handbag ($535)

- A 500GB PlayStation 4 ($175)

They took these items to 4 pawn shops in Houston and asked to trade them in for a loan. Here’s what the offers looked like:

Zachary Crockett / The Hustle (data via PawnGuru)

At one shop, they were offered a $1.4k loan for the diamond; at another shop just down the road, the offer was $200. That’s a 600% variance.

The motorcycle (75% variance), handbag (33%), and PS4 (46%) got offers in closer proximity — but even a difference of $25 to $100 in loan amount could mean a world of difference for someone living from paycheck to paycheck.

We were intrigued by this, so we decided to dig a bit deeper.

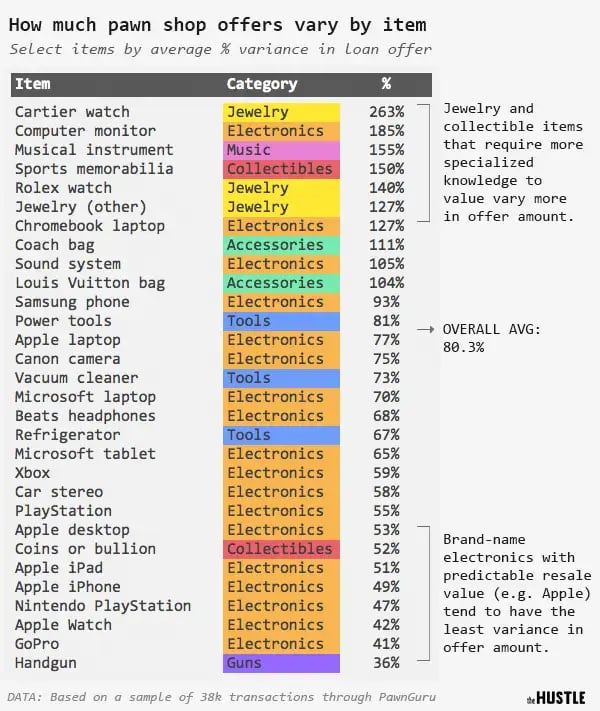

Using a sample of 38k transactions on the PawnGuru platform, we were able to see the average difference between the highest and lowest loan offers by item.

Zachary Crockett / The Hustle (data via PawnGuru)

Watch values vary wildly — especially those on the higher-end. With a 263% variance, the average Cartier watch might get offers ranging from $3k to $825 depending on what pawn shop you visit. Musical instruments (155%) and sports memorabilia (150%), both items with higher sentimental/subjective value, also vary widely in offer amount.

Brand-name electronics like the Apple iPad (51%) are easier to price and get more consistent offers.

So… why is there so much variance?

How is it that an item could possibly get 2 offers that are hundreds of dollars apart? Is one pawn shop just greedier than the other?

According to PawnGuru’s founder, Jordan Birnholtz, it boils down to one of 3 things: Margins, capital, and specialization:

- Pawn shops have wildly different profit margin goals.

- Pawn shops operate with wildly different levels of liquidity.

- Pawn shops specialize in different types of items.

Pawn shops base a loan offer, in part, on the money it will make if it has to sell the item — but shops are all over the board with their profit margin targets, and there isn’t a standard in the industry. At a large chain like EZCorp, the gross margin on sales is around 38%; at a small store, it might be closer to 50%.

The biggest factor, though, is that pawn shops have different specialties.

A shop with specialized knowledge in firearms might not give an informed offer on a Cartier watch, just as a shop run by a master jeweler might not know what he’s looking at when a 1950s Fender Stratocaster comes through the door. Birnholtz says that ~20% of the pawn shops in his network won’t take harder-to-price designer clothes.

Main Street Pawn Shop, in Pontiac, Michigan, is crammed with stuff ranging from saxophones to plaster clowns (Photo: Nikki Kahn/The Washington Post via Getty Images)

Doling out a loan on a piece of collateral like a guitar or a vintage comic book is a calculated risk, but it’s mitigated by the fact that the overwhelming majority of pawned items are reclaimed.

Ultimately, it’s in the best interest of a pawnbroker to find a loan that works for his customer, then work to make sure they get the item back.

Rodriguez, the shop owner in Houston, says that 60% of his revenue comes from repeat customers who might bring in the same item 5 or 10 times per year and pay $15 interest on it each time. This is a better outcome than selling the item in his store, which might take weeks and occupy precious floor space.

But the argument for getting a pawned item back into the hands of its owner isn’t always purely about dollars and cents.

“If I know an item means something special to a customer, I’ll work to get it back to them,” says Rodriguez. “Especially if it’s, like, a wedding ring.”

Ecommerce And Retail