Drive through the labyrinthine roads of Hillsborough, California and you’ll see why it’s America’s 3rd wealthiest town.

Multimillion-dollar estates dot the lush hills — palatial properties with waterfall pools, tennis courts, and wine cellars. Among the structures are famed abodes like the 98-room Carolands Chateau and the Flintstone House. At $4.5m, even the median house here goes for 14x the national average.

The town is home to top tech execs, Fortune 500 CEOs, and titans of foreign industry. But one man reigns supreme: A residential broker named Stanley Lo.

In the local real estate rags, Lo is a misfit in a sea of manicured headshots.

He sports a jet black, Elvis-like pompadour, ostentatious spectacles, and bespoke pinstripe suits. He poses in outrageous positions. He plasters his full-page ads with slogans like “I caught a fish!” and “Wild and scary good!”

But if you take a look at the sales records of all those mansions, you’re likely to see his name.

Over the past 4 decades, Lo has sold nearly $6B worth of houses in the San Francisco Bay Area. Last year alone, his sales volume topped $347m — good enough to rank him in the top 5 broker-owned firms nationwide. In the process, he’s helped reshape the demographics of some of America’s priciest neighborhoods.

Who is this guy? And how did he rise to the top of one of the most competitive real estate markets in the world?

His journey started with $100 and a busboy job

Born in Hong Kong in the 1940s, Lo began life in a state of financial turmoil.

Though Lo’s grandfather was a successful real estate developer, the communist revolution in China had a volatile impact on the country’s hard-nosed capitalists. The family soon moved to Taiwan, where Lo came of age.

In 1968 — at the height of the Vietnam War — Lo secured a US student visa and boarded a plane to study electrical engineering at San Jose State.

“I landed with $100 in my pocket,” he says.

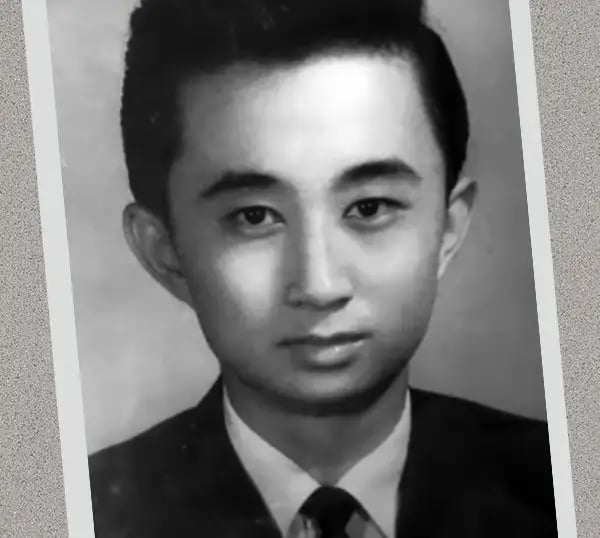

Lo as a young man (Stanley Lo)

To financially support himself, Lo took on any odd job he could get, working as a busboy and a nightclub cleaner — often late into the night. After work, he’d study until 1 or 2 am, get a few hours of sleep, then wake up at 6 and commute from San Francisco to San Jose for classes. He says he ate hot dogs for nearly every meal.

On campus, Lo also somehow found time to network with fellow foreign students, eventually becoming the president of the school’s Chinese Student Association.

During a shift one day at his restaurant job, Lo met a man who told him about a single-family home in the Los Altos Hills (a suburb 40 minutes south of San Francisco) for around $70k — no down-payment required.

At the time, the area was still largely agricultural and had only been incorporated as a town about a decade earlier. But Lo saw an opportunity for growth.

Though he had little capital, Lo struck a deal to purchase the home.

He continued to work, barely covering the mortgage payments. A year later, as the area became more desirable, he refinanced the place and sold it at a hefty profit.

Left: Lo as a student in the 1970s; Right: Speaking at an event for the SJSU Chinese Student Association (Stanley Lo)

While still a student, Lo reinvested the profits in a series of 3 or 4 more houses, flipping each for an increasingly larger profit. By the early 1970s, he was buying distressed development land in undervalued areas and holding it until the market went up, taking advantage of low down payments and deferred interest. In one early deal, he says he bought a property for $220k and flipped it for $400k.

“I just kept loading the bull,” he says. “One house turned [into] two. Two became three, and so on. I saw infinite opportunity. Where others saw a wasteland, I saw a gold mine.”

Lo says he had a few things working for him in these early days:

- Luck: He met the right people at the right time, and got an early entry into what would later become one of the nation’s hottest housing markets.

- A risk-taking mindset: “Not many were willing to gamble at that time; I felt I had nothing to lose.”

- Likability: “I didn’t have much capital early on, so I had to rely on my personality and my intelligence to convince people to work with me.”

After receiving his green card, Lo leveraged these traits into one of the most formidable real estate businesses in California.

The green banker

In 1984, Lo got his broker’s license and launched his own agency, Green Banker — a reference to Chinese symbology that roughly connotes “money pot.”

Lo eschewed the traditional model of hiring a ton of agents, choosing to take on every transaction personally. He oversaw everything himself, from the initial phone call to the staging. “I don’t want to depend on 100 agents,” he says. “If they leave, I’m an empty shell. I only want to depend on myself.”

Early on, he also established himself as a brand.

He dressed like a Vegas showman, with Gucci belts, Prada suits, and fanciful ties that he would often change in and out of 3 times per day, based on what the occasion called for. He cultivated a look that stood out from the faces in the real estate rags.

Lo developed a look that matched his buoyant personality (Zachary Crockett / The Hustle)

Lo drove a variety of cars — from luxury vehicles, to trucks, to Toyotas — to avoid intimidating clients, often cranking out American oldies from the likes of Elvis Presley and Chubby Checker.

He bought his own printing press and spent several million dollars per year pumping out thousands of full-color pamphlets and fliers plastered with his visage.

But as a newcomer, competition was stiff — especially as a Chinese immigrant broker in a largely white market.

“I’d get all kinds of bad words, bad-mouthing, and rumors from other agents,” he says. But Lo brushed it off as a part of real estate’s zero-sum game: “Either I died, or they died,” he adds, “and it wasn’t going to be me.”

Lo continued to buy distressed homes during the recession in the early ‘80s and resold them for a profit to newly minted millionaires during the ‘90s tech boom. During this time, his work ethic and his ability to match local sellers and buyers earned him recognition as one of the Bay Area’s top brokers by sales volume.

But much of Lo’s success came from leveraging his culture — the very thing that alienated him — into an asset.

The foreign investor real estate boom

Lo focused the bulk of his efforts on one suburb in particular: Hillsborough, California.

Sandwiched in the hills midway between Palo Alto and San Francisco, the town was almost exclusively occupied by wealthy white residents, who settled there for its excellent schools, quietude, and palatial estates on large lots.

Lo — who speaks Mandarin, Cantonese, and Taiwanese — saw an opportunity to market the area to overseas Asian buyers who had cash to burn.

Zachary Crockett / The Hustle

In 1979, China went through a free-market reform that saw unparalleled economic growth, development, and wealth creation.

The country was ripe with a new class of millionaires and billionaires looking for foreign investments, and new US immigration policies were set up to court them: Under the EB-5 visa program, foreign residents could obtain an expedited green card if they invested $500k-$1m in a US venture.

There were several reasons US real estate appealed to wealthy Chinese citizens:

- China’s constitution barred private land ownership: All urban land was state-owned, and could only be leased in 70-year installments.

- They could get more for their money: $12m could get them a 2k-sq.-ft. condo in Hong Kong, or a 15k-sq.-ft. mansion in the US.

- They could send their children to good public schools in a “safe haven” away from China’s turbulent socio-political climate.

Between 2000 and 2015 — and especially in the wake of the ‘07-’08 financial crisis — Chinese homebuyers poured billions of dollars into California real estate.

“They were crazy to come to the US,” says Lo. “The weather, economy, freedom: They saw it as the world’s golden kingdom.” Through Chinese-centric marketing and word-of-mouth, he sold hundreds of 7- and 8-figure Hillsborough mansions.

Often, these deals were all-cash. Lo would show clients the homes via virtual tours, or photo brochures, and they would purchase them sight unseen.

“People knew that if they wanted to come to the Bay Area, I was the guy,” he says. “They knew I could speak their language and understand their culture.”

Several of Hillsborough’s homes; the castle-like Chiltern Estate, up top, sold for nearly $29m in 2014 (Zillow)

These foreign buyers soon grew to represent ~30% of Lo’s clientele. But he also continued to aggressively target local US-based buyers, establishing himself in the local community by purchasing a Jewish deli near Hillsborough.

In the last few years, Lo says foreign buyers have significantly declined — largely due to the Chinese government’s clampdown on external investments and more stringent US immigration policies.

But this dip hasn’t had much of an impact on Lo’s sales figures: Since 1984, he’s sold 6k+ houses worth nearly $6B collectively.

In 2019, he topped $347.2m in closed deals, making him the No. 1 agent-owned brokerage in California (and No. 5 in the US) by sales volume. By the same metric, he has been the No. 1-ranked agent in Northern California for the last 9 years, and the No. 1 agent in Hillsborough since 1986.

Today, the town of Hillsborough is ~35% Asian, and is the 3rd wealthiest town in the US. Lo has played a role in buying, selling, or developing 2,200 of its 3,912 homes.

Selling mansions in the age of COVID-19

As a top agent in one of the nation’s hottest real estate markets, Lo has seen it all: a dotcom boom and bust, a housing market crash, a second tech golden age — and now, a national pandemic.

But he says business is booming.

Zachary Crockett / The Hustle

In the face of widespread unemployment, the housing market has largely been on a “sugar high” — especially in Silicon Valley, where a limited housing supply has kept prices stable.

Lo says one recent luxury listing courted 16 offers and sold in 5 days for $1m over the asking price. Houses in the $3m to $6m range, he adds, are selling like hot cakes.

“People still have a lot of money here,” he says. “It’s a desirable location with a supply shortage. It’s very competitive — more than last year, even.”

The 76-year-old agent claims to work 18-hour days and says the secret to his energy is that he considers his work to also be his play.

Though he has his own mansion in Hillsborough, he takes frequent trips to Las Vegas, where he owns a second home — a 25k-sq.-ft. residence near the estates of casino tycoon Sheldon Adelson, and UFC president Dana White. Though he’s earned millions by taking risks in real estate, he doesn’t gamble, or even invest in stocks. “If I can’t touch it, I don’t invest in it,” he says.

He’s spent his life looking for gold in the rough — morphing undesirable lots into elegant compounds, and selling the very American Dream he once pined for working late nights at restaurants and nightclubs.

“There is joy,” he says, “in watching something develop from nothing.”