Detroit-based StockX — a “stock market for shoes” — raised $110m at a $1B valuation, according to The New York Times.

As one analyst told the NYT: “The internet and eBay made reselling into a cottage industry. Platforms like StockX made it into a business.”

A tool for investors

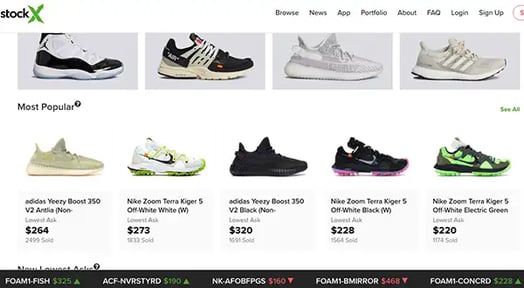

StockX’s marketplace is a resale platform for rare shoes — many of which have never been worn — and other merchandise.

Sneaker connoisseurs consider shoes as investments, and StockX is proving their point.

The shoes — as well as other available items like streetwear and watches — are assigned stock tickers. Bidding customers see recent sale prices, volatility, and a 52-week high and low.

Legacy brands could get involved

StockX is one of several shoe marketplaces: Rival resale sites like GOAT Group, Stadium Goods and Bump have also received millions in funding.

Insiders expect brands may eventually intervene to find a way for themselves to better benefit from resale.

But for now, the marketplaces are cashing in. So are sneakerheads — some of whom make $250K annually (off $1 million in shoe sales) and even employ assistants.